- United States

- /

- Specialized REITs

- /

- NasdaqGS:EQIX

Equinix (EQIX) Valuation in Focus After High-Profile Leadership Appointments and Board Refresh

Reviewed by Simply Wall St

Equinix (EQIX) has made headlines with recent leadership changes. The company named Douglas Merrill as Chief Information Security Officer and brought Rebecca Kujawa onto its Board. Investors are watching how these moves could impact the company’s direction.

See our latest analysis for Equinix.

Recent boardroom moves have set the stage for change at Equinix, but the share price story has been a bit more turbulent. While the company has maintained growth initiatives and rewarded shareholders with a steady dividend, Equinix’s share price is down 12.7% year-to-date, and the total shareholder return over the past year sits at -8.5%. Still, the longer view is more encouraging. With a 32.8% total return over three years, this suggests that momentum could swing back if new leadership delivers on strategy.

If you’re keeping an eye on bold leadership changes like these, it might be a good time to broaden your search and discover fast growing stocks with high insider ownership

With shares trading nearly 17% below analyst price targets and a robust track record over the longer term, investors now face a key question: Is Equinix undervalued at current levels, or is all future growth already reflected in the price?

Most Popular Narrative: 14.6% Undervalued

The current narrative sets Equinix’s fair value at $965.56 compared to a last close price of $824.75, pointing to a notable disconnect and sparking debate on whether recent digital infrastructure gains are fully priced in.

Equinix's aggressive capital allocation toward global data center and interconnection capacity, anchored in large, high-demand metros and emerging markets, positions the company to capture accelerating enterprise AI, cloud adoption, and digital transformation demand. This drives robust long-term revenue growth. Strong, broad-based customer bookings momentum, including increasing deployment sizes and higher-density workloads (especially in AI and hybrid/multi-cloud), points to rising occupancy, higher pricing power, and durable recurring revenue streams.

Want to know what’s fueling this bullish outlook? The central narrative builds its case on electrifying expansion bets and record-setting demand for next-generation workloads. However, the true game-changer is hidden in the numbers. Are you ready to see which financial forecasts are tipping the scales for this ambitious valuation?

Result: Fair Value of $965.56 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks such as rising capital costs and shifting demand for data center services could quickly challenge the positive growth outlook for Equinix.

Find out about the key risks to this Equinix narrative.

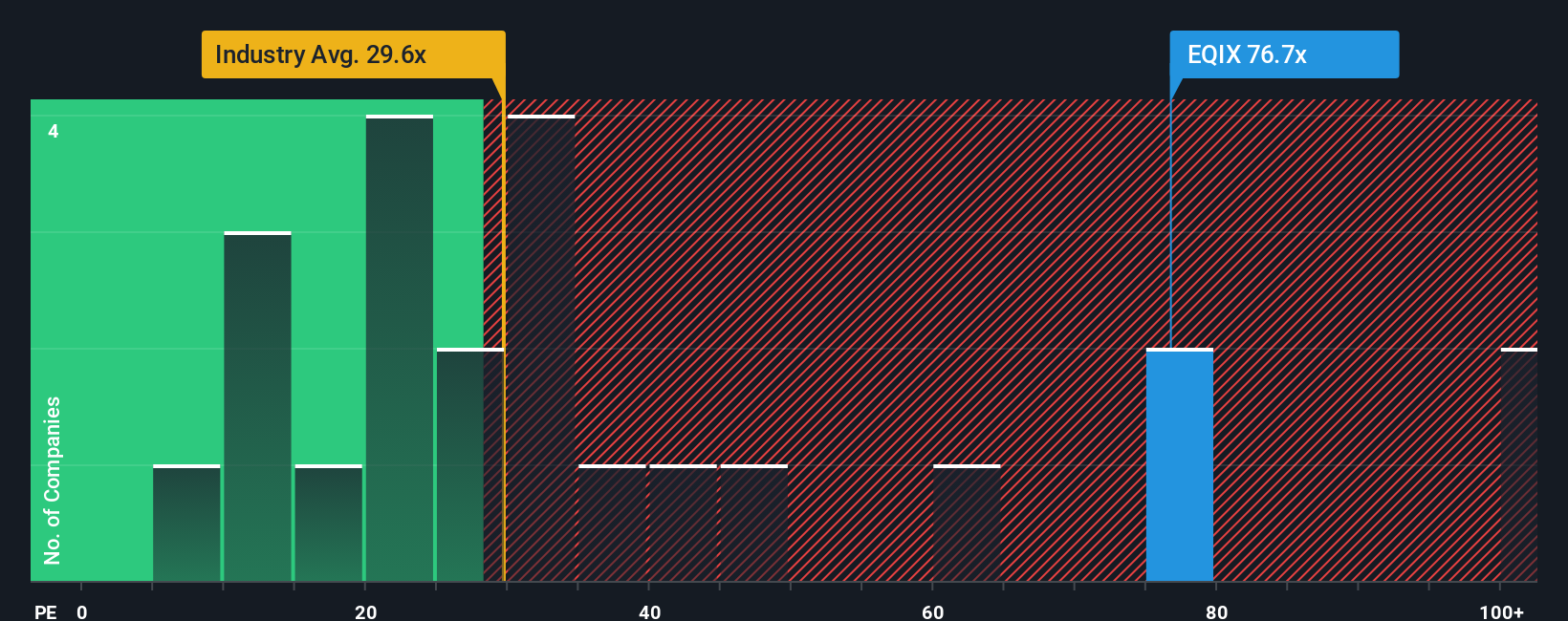

Another View: What Multiples Suggest

Looking through the lens of price-to-earnings, the story changes. Equinix currently trades at 75.6x earnings, which is much higher than both its US industry peers at 26.4x and the fair ratio of 35.9x. This premium signals significant valuation risk if market sentiment shifts. Will investors continue to pay up, or will multiples revert to the mean?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Equinix Narrative

If you see things differently or want to dig deeper into the numbers, you can create your own Equinix story in just a few minutes. Do it your way.

A great starting point for your Equinix research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Stay ahead of the curve and spot smart opportunities tailored to your investing style. Don’t miss out; savvy moves now can set you up for future wins.

- Unlock the potential of early-stage growth with these 3592 penny stocks with strong financials offering impressive financial strength and untapped upside ignored by mainstream investors.

- Tap into unstoppable trends by checking out these 24 AI penny stocks powering breakthroughs across artificial intelligence, automation, and digital infrastructure.

- Boost your portfolio’s resilience and income with these 16 dividend stocks with yields > 3% providing consistent cash flow and solid long-term fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Equinix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EQIX

Equinix

Equinix, Inc. (Nasdaq: EQIX) shortens the path to boundless connectivity anywhere in the world.

Established dividend payer with acceptable track record.

Similar Companies

Market Insights

Community Narratives