- United States

- /

- Health Care REITs

- /

- NasdaqGS:DHC

Is DHC’s Rising Revenue Enough to Offset Mounting Losses and Financial Pressures?

Reviewed by Sasha Jovanovic

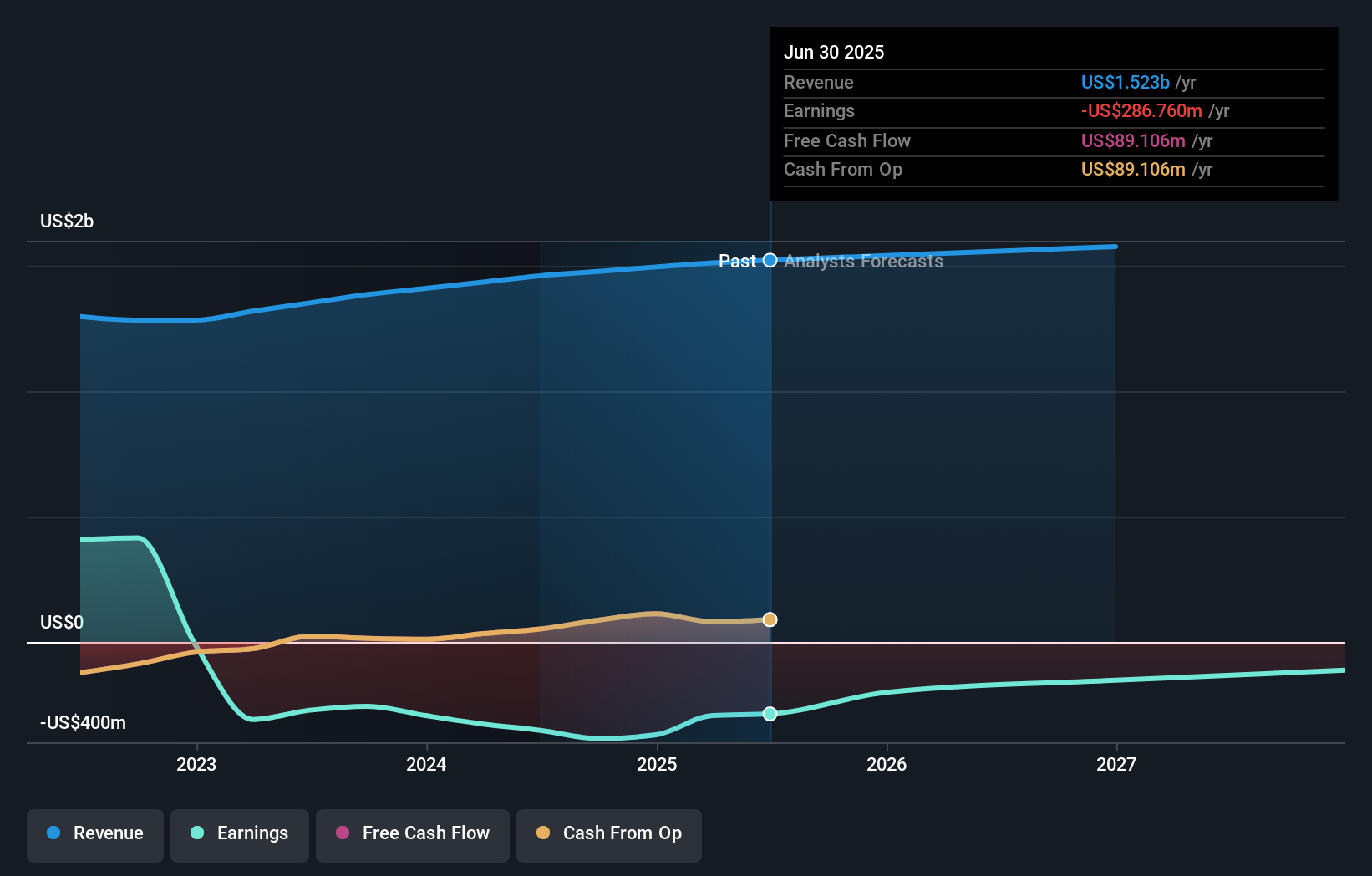

- Diversified Healthcare Trust recently reported its third quarter and nine-month 2025 earnings, with quarterly revenue of US$388.71 million and a net loss of US$164.04 million, compared to US$373.64 million revenue and a net loss of US$98.69 million a year ago.

- While revenue increased year-over-year for both the quarter and nine-month periods, the company also reported an increase in net loss, highlighting ongoing operational and financial pressures.

- We will examine how the wider net loss despite higher revenue shapes Diversified Healthcare Trust’s current investment narrative.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

Diversified Healthcare Trust Investment Narrative Recap

To be a shareholder in Diversified Healthcare Trust, you need to believe that long-term demographic trends and upgrades to its senior housing communities will help drive meaningful improvement in occupancy and profit margins, even as short-term earnings remain pressured. The recent quarterly report does not significantly change the near-term catalyst of rising senior housing demand, but the enlarged net loss continues to spotlight debt servicing and refinancing risk as the most important immediate concern for the business.

Among recent announcements, the completion of a US$375 million senior secured notes offering in late September stands out for its relevance to the current earnings results. This debt refinancing was designed to manage upcoming maturities, stabilize interest expenses, and potentially ease near-term liquidity pressure, which ties directly into how DHC must juggle higher losses with the need to sustain investment in its income-producing assets.

In contrast, while refinancing activity buys DHC time, investors should be aware that a persistently high leverage ratio could...

Read the full narrative on Diversified Healthcare Trust (it's free!)

Diversified Healthcare Trust is projected to reach $1.6 billion in revenue and $381.0 million in earnings by 2028. This outlook is based on analysts' assumptions of 2.4% annual revenue growth and an earnings increase of $667.8 million from the current earnings of -$286.8 million.

Uncover how Diversified Healthcare Trust's forecasts yield a $4.25 fair value, a 7% downside to its current price.

Exploring Other Perspectives

The Simply Wall St Community’s fair value estimates for Diversified Healthcare Trust span a wide range from US$1.95 to US$4.25, based on two independent views. While such diversity shows that opinions can differ sharply, remember debt servicing costs remain an immediate risk for the company’s outlook, so it pays to compare several viewpoints.

Explore 2 other fair value estimates on Diversified Healthcare Trust - why the stock might be worth less than half the current price!

Build Your Own Diversified Healthcare Trust Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Diversified Healthcare Trust research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Diversified Healthcare Trust research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Diversified Healthcare Trust's overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DHC

Diversified Healthcare Trust

DHC is a real estate investment trust focused on owning high-quality healthcare properties located throughout the United States.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives