Stock Analysis

- United States

- /

- Real Estate

- /

- NasdaqGS:RDFN

Redfin (NASDAQ:RDFN shareholders incur further losses as stock declines 11% this week, taking three-year losses to 87%

Redfin Corporation (NASDAQ:RDFN) shareholders will doubtless be very grateful to see the share price up 37% in the last month. But that is meagre solace in the face of the shocking decline over three years. To wit, the share price sky-dived 87% in that time. So it sure is nice to see a bit of an improvement. The thing to think about is whether the business has really turned around. We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

After losing 11% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

Check out our latest analysis for Redfin

Redfin isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally hope to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last three years, Redfin saw its revenue grow by 4.1% per year, compound. Given it's losing money in pursuit of growth, we are not really impressed with that. Nonetheless, it's fair to say the rapidly declining share price (down 23%, compound, over three years) suggests the market is very disappointed with this level of growth. We generally don't try to 'catch the falling knife'. Of course, revenue growth is nice but generally speaking the lower the profits, the riskier the business - and this business isn't making steady profits.

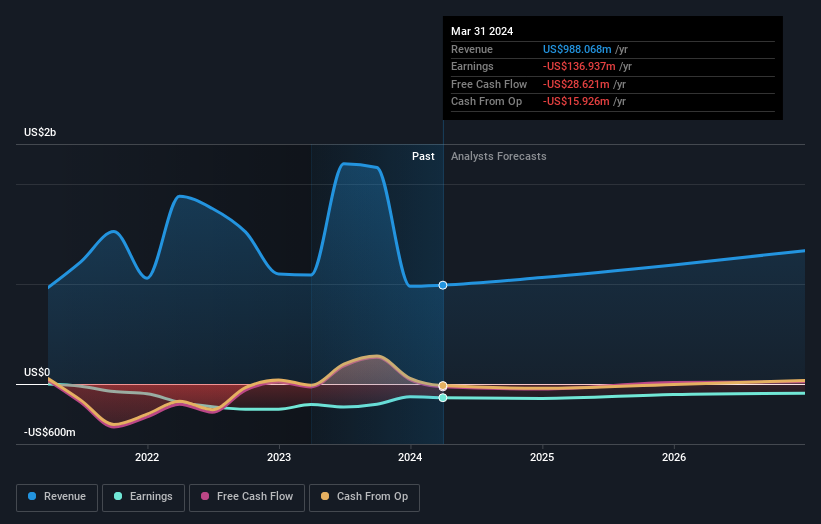

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. This free report showing analyst forecasts should help you form a view on Redfin

A Different Perspective

Investors in Redfin had a tough year, with a total loss of 32%, against a market gain of about 28%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 10% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand Redfin better, we need to consider many other factors. For instance, we've identified 4 warning signs for Redfin (1 is concerning) that you should be aware of.

Redfin is not the only stock insiders are buying. So take a peek at this free list of small cap companies at attractive valuations which insiders have been buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Redfin is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:RDFN

Redfin

Operates as a residential real estate brokerage company in the United States and Canada.

Fair value with concerning outlook.