- United States

- /

- Real Estate

- /

- NasdaqGM:EXPI

eXp World Holdings (EXPI): A Fresh Look at Valuation After Surprising Q3 Profit and Dividend Announcement

Reviewed by Simply Wall St

eXp World Holdings (EXPI) set the tone for investors by flipping to a net profit in the third quarter, after reporting a loss during the same period last year. The company also exceeded revenue and earnings expectations.

See our latest analysis for eXp World Holdings.

The latest earnings beat and renewed dividend helped spark a fresh surge in eXp World Holdings’ stock, driving an impressive 11% share price jump in a single trading day. Even with this rally, momentum has only just begun to rebound after recent pressures, as shown by a 1-year total shareholder return of -21%. There has been a noticeable pick-up over the last 90 days. The market seems to be warming up to eXp’s profitability turnaround and commitment to rewarding shareholders, even as the longer-term picture remains a work in progress.

If this rebound has you thinking about what other fast-recovering opportunities might be out there, now is a great time to discover fast growing stocks with high insider ownership.

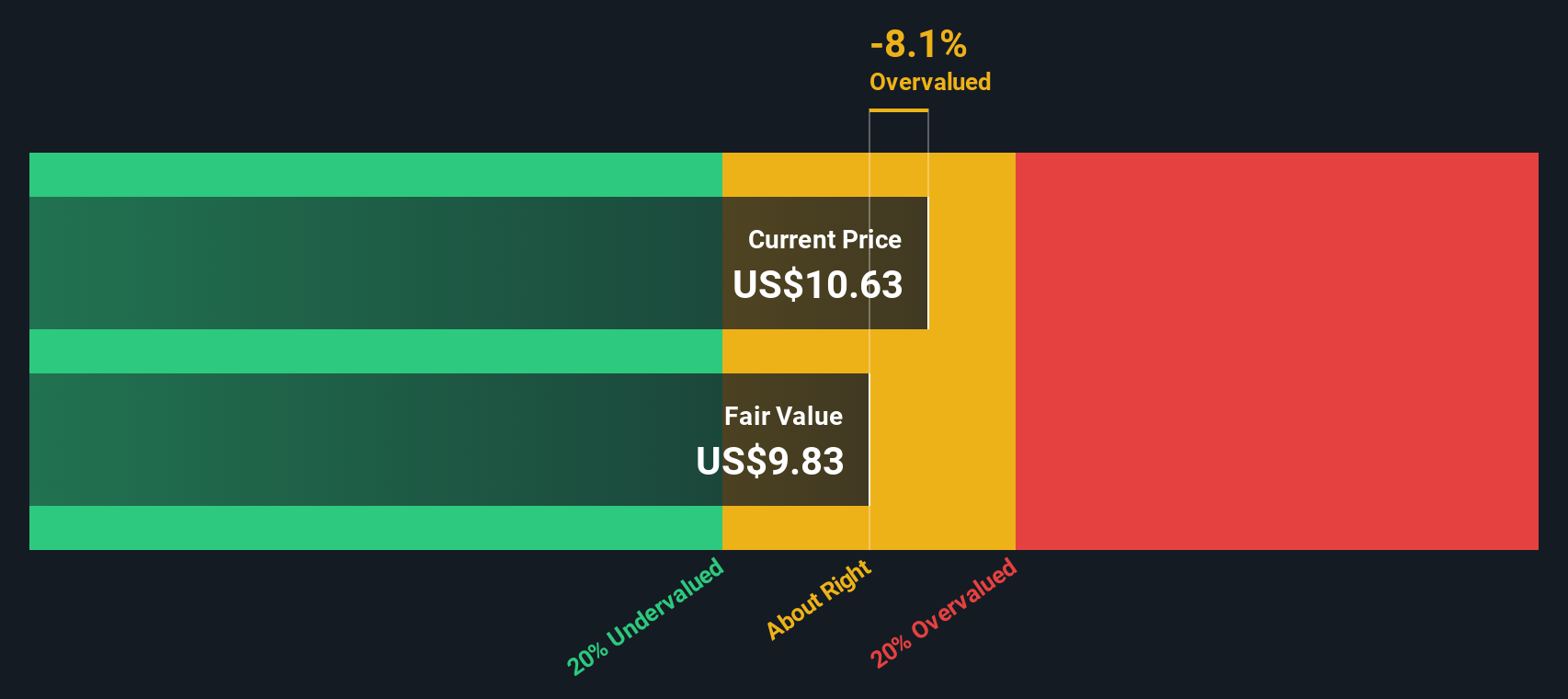

With shares rebounding after a sharp selloff and eXp World Holdings delivering a surprise return to profitability, the big question is whether there is still upside for new investors or if the market has already priced in the company’s future growth potential.

Most Popular Narrative: 10% Undervalued

At $10.80 per share, eXp World Holdings still trades below the most closely watched narrative’s fair value of $12.00, keeping bargain hunters interested. Underpinning this perspective are ambitious forecasts for the cloud brokerage’s reach and tech-fueled transformation.

Accelerating global expansion supported by a scalable cloud-based platform is allowing eXp to rapidly launch into new markets (Peru, Turkey, Ecuador, Japan, South Korea) and capture productive agents quickly, which increases potential transaction fees and top-line revenue in tandem with the ongoing digitalization of commerce and work.

What is fueling such a bold price target? This narrative leans heavily on expectations of rising revenues, the rebound from negative margins, and a sky-high future profit multiple. Which assumptions really drive the bullish case? Dive in to uncover how aggressive forecasts and daring financial projections are shaping the current valuation story.

Result: Fair Value of $12.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifts in demographic trends or sustained housing affordability challenges could dampen demand. This may undermine eXp World Holdings’ agent growth and future earnings potential.

Find out about the key risks to this eXp World Holdings narrative.

Another View: Discounted Cash Flow Challenges

While the market is focused on analyst price targets and future earnings projections, the SWS DCF model presents a less optimistic perspective. According to our DCF estimates, eXp World Holdings appears overvalued at $10.80 compared to a fair value of $7.47. Is the market pricing in more than the fundamentals support, or is it simply looking further ahead?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out eXp World Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 874 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own eXp World Holdings Narrative

If you are keen to challenge these assumptions or dig deeper into the numbers, you can craft your own perspective in just a few minutes with Do it your way.

A great starting point for your eXp World Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Standout Opportunities?

Smart investors never stop at just one idea. Open the door to even more high-potential investments that could accelerate your portfolio’s growth and keep you ahead of the market.

- Tap into the latest breakthroughs in healthcare technology by joining innovators already profiting from these 32 healthcare AI stocks.

- Amplify your passive income strategy with these 16 dividend stocks with yields > 3%, featuring top companies offering impressive yields and robust fundamentals.

- Ride the next digital revolution and boost your portfolio with an exciting lineup from these 82 cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:EXPI

eXp World Holdings

Provides cloud-based real estate brokerage services for residential homeowners and homebuyers.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives