- United States

- /

- Pharma

- /

- NYSE:ZTS

Zoetis (ZTS) Valuation in Focus Following Q3 Growth and New Cat Therapy Approval

Reviewed by Simply Wall St

Zoetis, Inc. reported its third quarter earnings along with a revenue guidance update for 2025, giving investors a transparent view of operational stability. The company’s recent product approval in Europe further underscores its focus on innovation.

See our latest analysis for Zoetis.

While Zoetis delivered year-over-year growth in both revenue and net income, plus expanded its European product lineup, recent share price momentum tells a different story. The stock closed at $120.24 after a steep pullback, with a 1-year total shareholder return of -31.1% weighed down by a string of double-digit declines in the past month and quarter. Despite solid business fundamentals, market sentiment has clearly turned cautious in the short term. At the same time, innovation and steady guidance lay foundations for future recovery.

If you’re watching animal health for signals, it’s also worth considering other opportunities in the sector. For a broader perspective, check out See the full list for free..

With the stock trading at a significant discount to analyst targets despite steady financial growth, investors face a key question: is Zoetis undervalued with recovery potential, or is the market accurately pricing in its future growth?

Most Popular Narrative: 35.9% Undervalued

Zoetis’s most widely-followed narrative points to a fair value far above its latest close. This suggests analysts expect the market is missing a rebound. The calculation brings together bold assumptions, with much riding on growth in new and existing markets to justify the valuation gap.

Ongoing innovation and accelerated R&D output, with expectations for a major new product approval in a key market every year over the next few years, positions Zoetis to expand addressable markets, launch higher-margin products, and protect market share, positively impacting organic revenue growth and net margins.

Want to know what really fuels this bullish view? It’s not just steady growth. The biggest surprise lies in the aggressive earnings and margin projections that underpin this price target. Think Zoetis is just another animal health stock? You haven’t seen the numbers analysts are betting on for the next few years. Read on to uncover what could make the current market price look like a bargain.

Result: Fair Value of $187.70 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained competitive pressure and regulatory uncertainty could challenge Zoetis’s projected growth. This may put future earnings and its bullish narrative at risk.

Find out about the key risks to this Zoetis narrative.

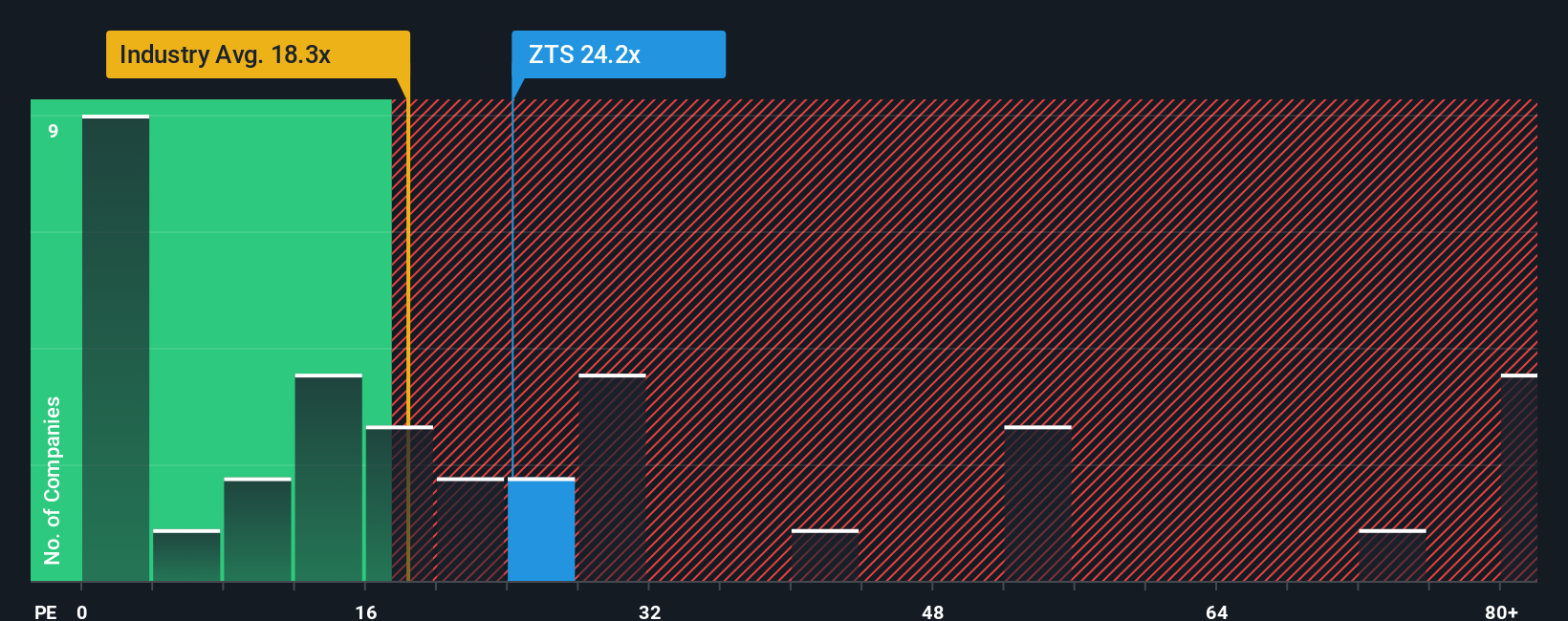

Another View: What Multiples Tell Us

Looking at Zoetis through the lens of its price-to-earnings ratio, the stock trades at 20 times earnings. This is higher than the US pharmaceuticals industry average of 17.9x, yet below the peer group average of 21.8x. The market’s "fair ratio" is 22.8x, which hints at possible upside. However, premium multiples can reflect either strong business quality or increased valuation risk. Is the company’s above-average price justified, or is it a warning signal?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Zoetis Narrative

If you see the story differently or want to test your own view, dive into the numbers and build a personalized perspective in just a few minutes. Do it your way

A great starting point for your Zoetis research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors know that focusing on a single stock could mean missing out on powerful themes shaping tomorrow’s winners. Don’t let valuable opportunities pass you by. Use these screens to stay ahead of the crowd:

- Spot the income potential in companies with resilient business models and attractive yields with these 16 dividend stocks with yields > 3%.

- Capitalize on disruptive trends with these 24 AI penny stocks featuring leaders at the forefront of artificial intelligence advancements.

- Seize opportunities where the market has yet to recognize real value by checking out these 875 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zoetis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ZTS

Zoetis

Engages in the discovery, development, manufacture, and commercialization of animal health medicines, vaccines, diagnostic products and services, biodevices, genetic tests, and precision animal health products in the United States and internationally.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives