- United States

- /

- Life Sciences

- /

- NYSE:WAT

Why Waters (WAT) Is Up 5.1% After Raising 2025 Guidance and Unveiling New Detector

Reviewed by Sasha Jovanovic

- In November 2025, Waters Corporation raised its full-year 2025 guidance for both sales growth and earnings while introducing a new Charged Aerosol Detector designed to address key analytical challenges in quality control and development labs, with shipments expected by April 2026.

- This combination of boosted earnings outlook and innovative product rollout signals strengthened business confidence and highlights Waters' focus on expanding its industry solutions.

- We'll explore how Waters' raised full-year earnings guidance shapes the updated investment narrative and potential growth trajectory.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Waters Investment Narrative Recap

Waters shareholders are often attracted to its strong positioning in laboratory analysis, recurring revenue streams, and new product launches aimed at growing segments like pharma and quality control. The company's decision to raise 2025 earnings guidance and sales outlook reinforces management’s confidence, yet these updates do not materially reduce the biggest short-term risk: execution challenges tied to the integration of BD's Biosciences and Diagnostic Solutions, which remains a key swing factor for earnings and synergy realization.

The recent launch of Waters’ new Charged Aerosol Detector, designed to address analytical gaps in quality control labs, ties directly into its near-term growth catalysts by meeting rising customer demand for integrated detection and boosting innovation credibility, even as successful integration of the BD assets will ultimately have greater financial impact if synergies are achieved as targeted.

However, in contrast to upbeat guidance and expanding solutions, investors should be mindful of major integration risks that could ...

Read the full narrative on Waters (it's free!)

Waters’ outlook anticipates $3.7 billion in revenue and $946.3 million in earnings by 2028. This is based on an annual revenue growth rate of 6.4% and a $284.9 million earnings increase from the current $661.4 million.

Uncover how Waters' forecasts yield a $382.87 fair value, in line with its current price.

Exploring Other Perspectives

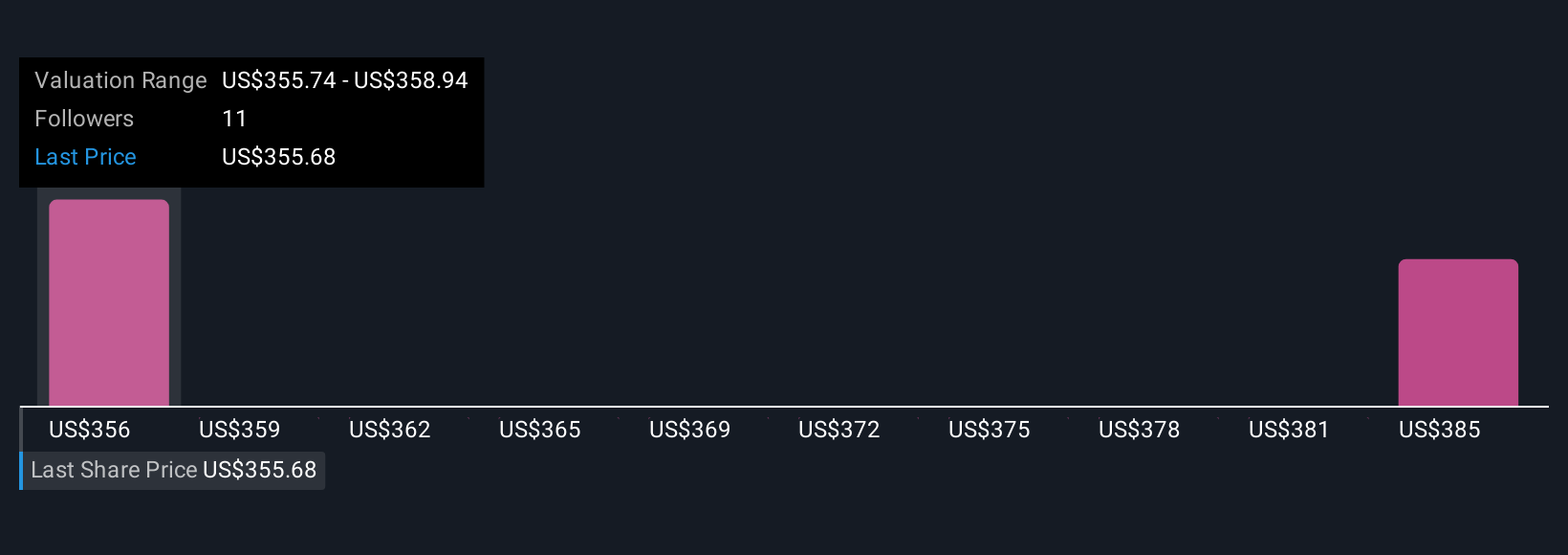

Two Simply Wall St Community members estimate fair value for Waters between US$362.04 and US$382.87 per share. Meeting ambitious cost and revenue synergy targets tied to BD integration could heavily influence whether the company's earnings growth aligns with these valuations, so take time to review multiple outlooks.

Explore 2 other fair value estimates on Waters - why the stock might be worth 6% less than the current price!

Build Your Own Waters Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Waters research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Waters research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Waters' overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Waters might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WAT

Waters

Provides analytical workflow solutions in Asia, the Americas, and Europe.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives