- United States

- /

- Life Sciences

- /

- NYSE:WAT

Assessing Waters (WAT)'s Valuation After Recent 32% Share Price Surge

Reviewed by Simply Wall St

See our latest analysis for Waters.

After a year of uneven total shareholder returns, Waters’ recent momentum stands out. The stock’s 31.99% three-month share price gain signals shifting sentiment and growing optimism, even as its 12-month total return remains modestly negative.

If this surge has you searching for the next potential winner, now’s a great time to broaden your focus and uncover fast growing stocks with high insider ownership.

With shares closing in on analyst targets and still trading at a slight premium to intrinsic value, investors now face a classic dilemma: is Waters undervalued after its rally, or has the future already been priced in?

Most Popular Narrative: 3.1% Undervalued

Waters’ most followed narrative places fair value above the last closing price, suggesting analysts see even more upside despite the recent surge.

The planned combination with BD's Biosciences and Diagnostic Solutions business is expected to accelerate entry into biologics, precision medicine, and cell/gene therapy markets. These are segments with expanding analytical needs, unlocking new addressable markets and providing a multi-year revenue synergy opportunity, directly impacting future revenues and EPS growth.

Want to decode why analysts are betting on a premium for Waters? The answer is not just growth or guidance, but a series of bold, quantitative calls for revenue, profits, and future multiples. Curious which positive assumptions really drive this price target? Find out what lies beneath the headline numbers that could change the narrative for good.

Result: Fair Value of $382.87 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution risks related to Waters’ major acquisitions or ongoing weakness in key markets could quickly challenge analysts’ optimism about sustained profit growth.

Find out about the key risks to this Waters narrative.

Another View: What Do Market Ratios Say?

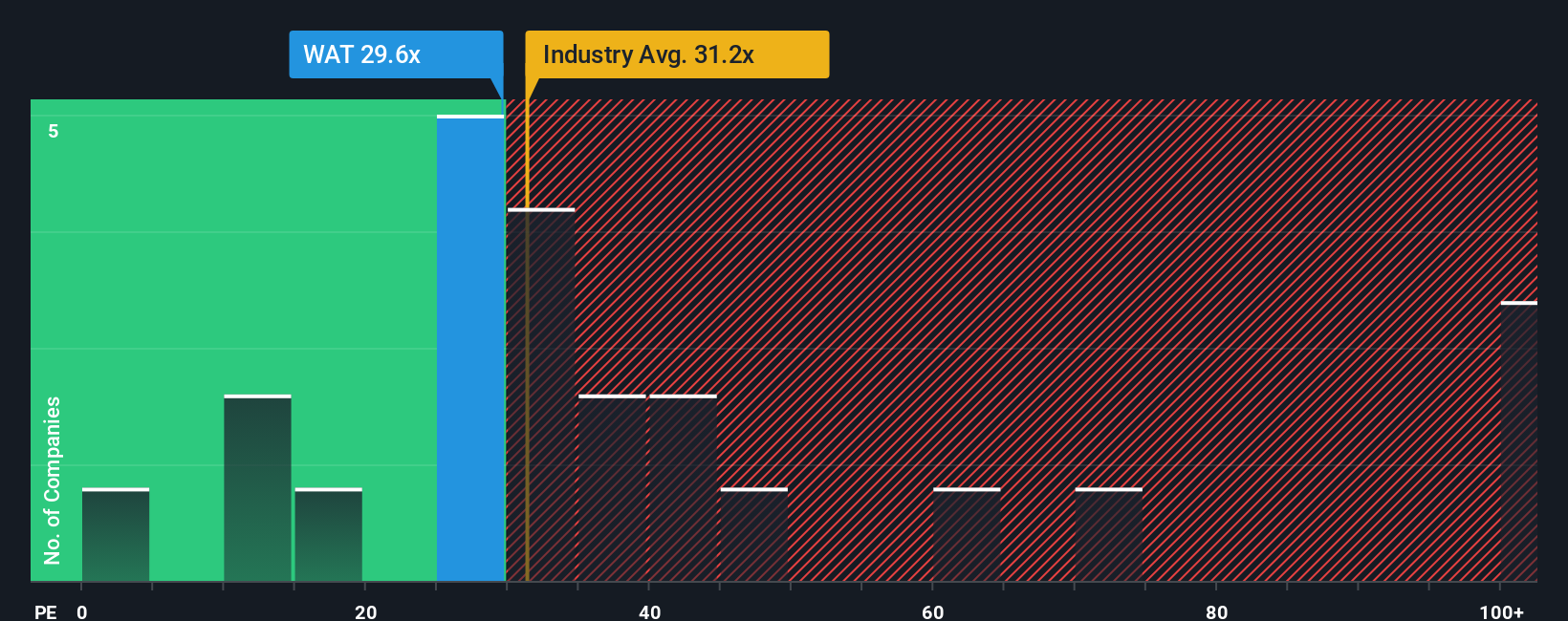

Looking at Waters using the price-to-earnings ratio, shares trade at 34.1x, which is pricier than both the peer average of 30.7x and the estimated market “fair ratio” of 24.5x. This gap suggests investors are paying a premium for growth and certainty. However, is that justified if sentiment turns?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Waters Narrative

If you see a different angle or want to dig into the numbers yourself, you can put together your own take on Waters in just a few minutes. Do it your way.

A great starting point for your Waters research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investing Opportunities?

Don’t let momentum pass you by. Simply Wall Street’s screeners reveal hidden gems and fresh ways to boost your portfolio that you might be missing.

- Unlock steady income and see how these 17 dividend stocks with yields > 3% are consistently delivering yields above 3% in today’s market.

- Tap into tech-driven breakthroughs by evaluating which companies top the charts as these 24 AI penny stocks, positioning themselves at the frontier of artificial intelligence.

- Ride the cryptocurrency wave and spot tomorrow’s standout companies among these 82 cryptocurrency and blockchain stocks transforming blockchain and digital assets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Waters might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WAT

Waters

Provides analytical workflow solutions in Asia, the Americas, and Europe.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives