- United States

- /

- Life Sciences

- /

- NYSE:TMO

Thermo Fisher Scientific (TMO): Evaluating Valuation After $5 Billion Share Buyback Announcement

Reviewed by Simply Wall St

Thermo Fisher Scientific (TMO) just announced a major new share repurchase plan, with board approval to buy back up to $5 billion of stock and no set end date. For investors, this is an important glimpse into management’s capital allocation plans and confidence.

See our latest analysis for Thermo Fisher Scientific.

This announcement follows a string of corporate updates from Thermo Fisher Scientific over the past few weeks. These include a new quarterly dividend payout and the debut of their advanced Helios MX1 semiconductor analysis system. With the share price climbing more than 23% over the last 90 days, momentum appears to be building, and its 4% total return over the past year highlights steady, if not spectacular, long-term performance.

Curious what else is gaining traction in the healthcare space? Explore opportunities with our handpicked See the full list for free.

But with shares now trading just about 7% below analyst price targets and nearly 6% below some intrinsic valuation models, the real question for investors is whether there is still meaningful upside or if the market has already anticipated future growth.

Most Popular Narrative: 6.7% Undervalued

Thermo Fisher Scientific's widely followed narrative places its fair value at $613.58, notably higher than the recent closing price of $572.41. This perspective draws strength from robust growth expectations and the company’s expanding market reach.

Strong momentum in high-impact innovation, as seen in next-generation analytical tools like the Orbitrap mass spectrometers and AI integration into drug development workflows, positions Thermo Fisher to capture incremental share as genomics and precision medicine proliferate. This is expected to structurally boost future revenues and margins.

Want to know what bold quantitative assumptions back this valuation? The narrative hinges on powerful expansion signals and a future profit trajectory that could shake up the sector. Which of Thermo Fisher's business moves are driving these upgraded earnings models? Tap in for the narrative that spells out the surprising financial roadmap behind today’s fair value target.

Result: Fair Value of $613.58 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in China or further government funding cuts could undermine Thermo Fisher’s growth trajectory and challenge even the most optimistic forecasts.

Find out about the key risks to this Thermo Fisher Scientific narrative.

Another View: Multiples Tell a Subtler Story

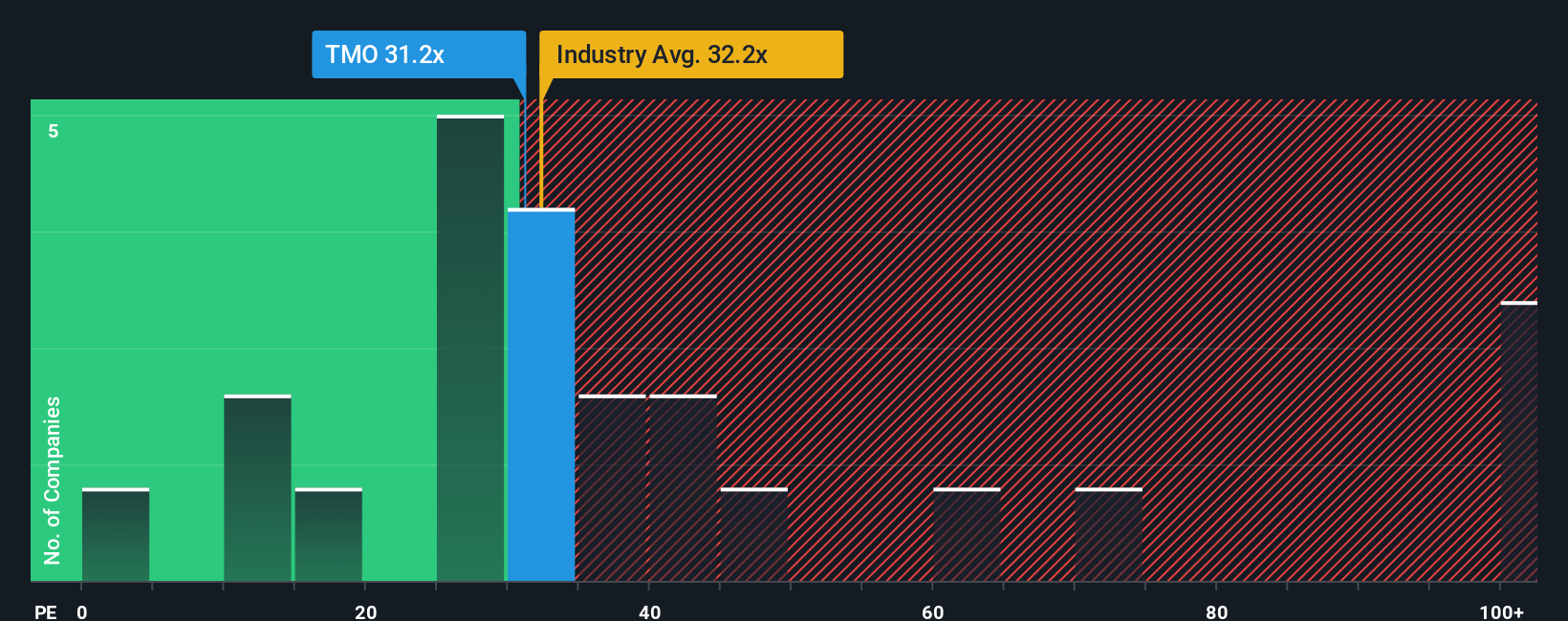

While the dominant narrative highlights fair value using projected earnings and growth, our take based on current market ratios suggests a more nuanced picture. Thermo Fisher trades at a price-to-earnings ratio of 32.7x, which looks reasonable against industry peers at 36.2x, but stands above the fair ratio of 29.8x. This implies some valuation risk if expectations do not play out perfectly. Are investors right to price in a premium, or is there a disconnect waiting to close?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Thermo Fisher Scientific Narrative

If you see Thermo Fisher's story unfolding differently, or want to put your own research to the test, you can craft your own narrative from scratch in just a few minutes. Do it your way

A great starting point for your Thermo Fisher Scientific research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

There are smart opportunities waiting beyond Thermo Fisher Scientific. Seize your edge by tracking innovators and untapped markets that could supercharge your investment strategy.

- Capitalize on tomorrow’s breakthroughs by backing these 25 AI penny stocks fueling progress in artificial intelligence, data analytics, and automation.

- Supercharge your quest for growth with these 28 quantum computing stocks at the forefront of computing, communications, and industry disruption.

- Power up your portfolio’s income with these 16 dividend stocks with yields > 3% offering attractive yields and steady fundamentals from industry-respected companies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Thermo Fisher Scientific might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TMO

Thermo Fisher Scientific

Provides life sciences solutions, analytical instruments, specialty diagnostics, and laboratory products and biopharma services in the North America, Europe, Asia-Pacific, and internationally.

Proven track record and fair value.

Similar Companies

Market Insights

Community Narratives