- United States

- /

- Life Sciences

- /

- NYSE:STVN

Stevanato Group (NYSE:STVN): Valuation Insights Following Strong Q3 Earnings and 2025 Revenue Guidance

Reviewed by Simply Wall St

Stevanato Group (NYSE:STVN) just posted its third-quarter results, showing higher sales and stronger net income compared to last year. The company also reaffirmed its full-year revenue outlook for 2025.

See our latest analysis for Stevanato Group.

Stevanato Group’s latest earnings announcement, with healthy sales and net income growth, has drawn new attention to the stock. After steady gains earlier this year, recent momentum has cooled, with a modest 1.99% 90-day share price return. Yet the one-year total shareholder return sits at a solid 10.96%. Over three years, shareholders have seen an impressive 57.6% total return, reflecting the company’s resilience and long-term potential even as short-term trading turns cautious.

Wondering what other companies might be showing strength following earnings? It’s a great time to cast a wider net and discover fast growing stocks with high insider ownership

With strong earnings and a healthy upside to analyst price targets, investors may wonder if Stevanato Group is still undervalued after recent gains or if the market has already factored in the company’s next leg of growth.

Most Popular Narrative: 15.8% Undervalued

Stevanato Group’s widely followed narrative suggests fair value is well above yesterday’s closing price, reflecting optimism that future growth justifies a higher valuation. The stage is set for robust growth if current trends continue.

Secular shifts toward self-administration and personalized medicine are accelerating demand for specialized, integrated drug delivery devices (such as auto-injectors, pen injectors, and dual/chamber syringes). These are areas where Stevanato is expanding capacity and capability, suggesting greater future revenue mix from higher-margin solutions and sustained margin expansion.

Want to peek behind the math that powers this fair value? The narrative bets big on faster earnings expansion and margin transformation, hinting at ambitious forecasts that could surprise even industry insiders. Which bold assumptions propel the stock past analyst targets? Find out what makes this narrative so bullish on Stevanato's future.

Result: Fair Value of $28.62 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent high capital expenditures or unexpected setbacks at new sites could pressure margins and raise questions about Stevanato's ability to deliver on growth forecasts.

Find out about the key risks to this Stevanato Group narrative.

Another View: What Do Market Ratios Suggest?

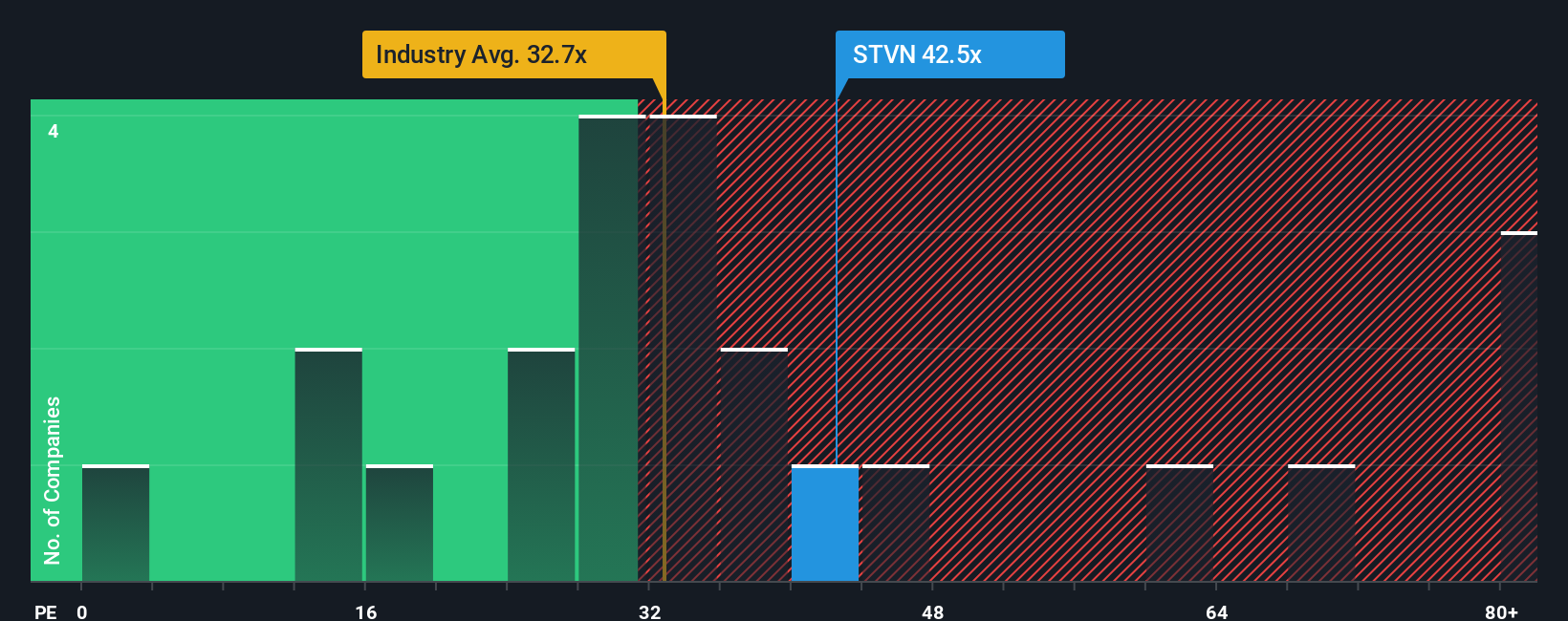

Looking at its price-to-earnings ratio, Stevanato Group trades at 40.4x, which is higher than both the North American Life Sciences industry average of 36.4x and the stock's fair ratio of 24.4x. This means the market is pricing in a lot of future growth, raising the stakes for any disappointment. Is this optimism warranted, or does it signal higher valuation risk than most investors realize?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Stevanato Group Narrative

Prefer to dig into the numbers yourself or want to craft a different story? It only takes a few minutes to create your own perspective, so why not jump in and Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Stevanato Group.

Looking for more investment ideas?

Smart investors always look beyond the obvious. Don’t settle for just one opportunity when you could be uncovering tomorrow’s standouts in the hottest corners of the market.

- Uncover strong long-term income potential by targeting higher yields with these 16 dividend stocks with yields > 3%, screening out companies offering robust returns above 3%.

- Ride the wave of innovation by tapping into growth stories at the intersection of healthcare and technology using these 32 healthcare AI stocks.

- Catch tomorrow’s breakout successes early by targeting these 3588 penny stocks with strong financials with impressive fundamentals before the crowd.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:STVN

Stevanato Group

Engages in the design, production, and distribution of products and processes to provide solutions for biopharma and healthcare industries in Europe, the Middle East, Africa, North America, South America, and the Asia Pacific.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives