- United States

- /

- Life Sciences

- /

- NYSE:STVN

How Investors Are Reacting To Stevanato Group (STVN) Strong Q3 Results and Biopharma-Driven Growth

Reviewed by Sasha Jovanovic

- Stevanato Group reported third-quarter 2025 earnings showing revenue of €303.17 million and net income of €36.06 million, with strong growth driven by its high-value Biopharmaceutical and Diagnostic Solutions segment. The company confirmed its 2025 revenue guidance of €1.16 billion to €1.19 billion and highlighted ongoing capacity expansion to support increasing demand for injectable biologics and ready-to-use drug containment products.

- An interesting insight is that, despite challenges in its Engineering segment, Stevanato Group continues to invest in US and Italian facilities, positioning itself to benefit from industry trends like pharmaceutical onshoring and regulatory-driven demand for innovative containment and delivery solutions.

- We'll examine how the sustained demand for high-value drug containment solutions impacts Stevanato Group's investment narrative and future outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Stevanato Group Investment Narrative Recap

To own shares in Stevanato Group, you must be confident in continued demand for high-value drug containment and delivery solutions, especially as biologics gain market share. The latest earnings and revenue guidance reinforce the importance of scaling new manufacturing sites as the short-term catalyst, while persistent underperformance in the Engineering segment remains the most immediate risk; this earnings update does not materially alter either point.

The company’s reaffirmation of its 2025 revenue guidance (€1.16 billion to €1.19 billion) directly aligns with its expansion projects in the US and Italy, supporting the thesis that capacity increases are crucial for meeting robust biopharma and diagnostic demand. However, whether stronger Biopharmaceutical and Diagnostic Solutions growth will offset the Engineering segment's weakness over coming quarters is still a key question.

But despite these growth ambitions, investors should also be alert to the ongoing drag from Engineering segment volatility, which means…

Read the full narrative on Stevanato Group (it's free!)

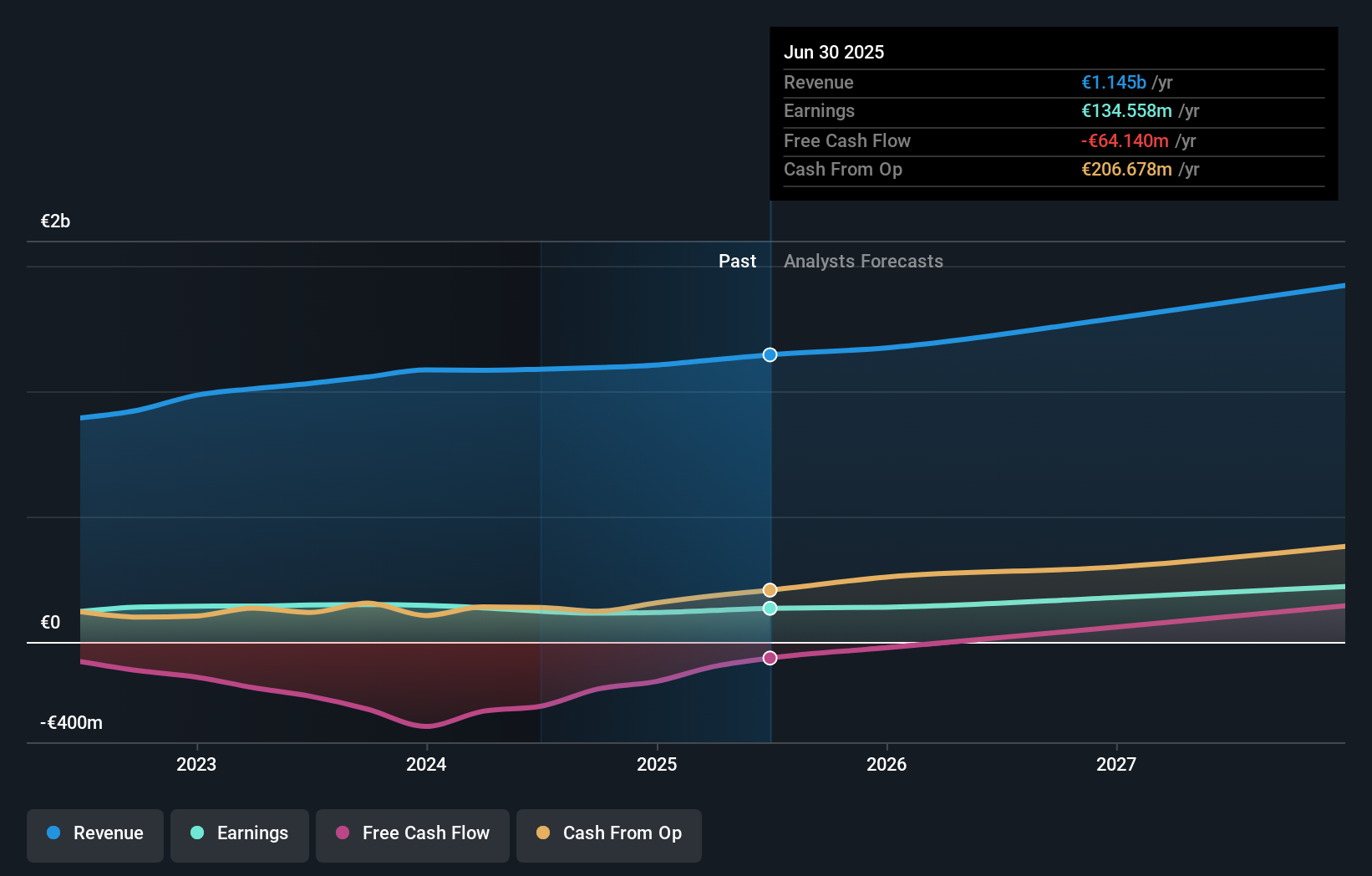

Stevanato Group's projections set revenue at €1.5 billion and earnings at €242.0 million by 2028. This outlook is based on an assumed annual revenue growth rate of 9.2%, representing a €107.4 million increase in earnings from the current €134.6 million.

Uncover how Stevanato Group's forecasts yield a $28.62 fair value, a 19% upside to its current price.

Exploring Other Perspectives

Two Simply Wall St Community fair value estimates fall in a tight €28.59 to €28.62 range. As profit growth in high-value solutions continues, you may want to compare the community’s methods and wider views for a well-rounded perspective.

Explore 2 other fair value estimates on Stevanato Group - why the stock might be worth just $28.59!

Build Your Own Stevanato Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Stevanato Group research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Stevanato Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Stevanato Group's overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:STVN

Stevanato Group

Engages in the design, production, and distribution of products and processes to provide solutions for biopharma and healthcare industries in Europe, the Middle East, Africa, North America, South America, and the Asia Pacific.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives