- United States

- /

- Biotech

- /

- NYSE:RCUS

Arcus Biosciences (RCUS): Evaluating Valuation After $250 Million Equity Offering and New Underwriter Support

Reviewed by Simply Wall St

Arcus Biosciences (RCUS) just wrapped up a major follow-on equity offering, bringing in $250 million with a fresh lineup of co-lead underwriters. Moves like this matter for investors, since capital raises can shift both sentiment and future prospects.

See our latest analysis for Arcus Biosciences.

The $250 million capital raise follows strong momentum for Arcus Biosciences, whose share price has increased by nearly 39% over the last month and more than doubled in the past 90 days. While the recent equity offering has generated buzz, the company’s total shareholder return over the past year is around 21%. However, long-term holders remain underwater with a negative 32% three-year total return. Overall, short-term optimism is building as investors respond positively to the company’s capital-raising efforts.

If you want to explore more opportunities beyond biotech, now is an ideal time to broaden your search and discover fast growing stocks with high insider ownership

With shares surging in recent months and a sizeable discount to analyst price targets, the real question now is whether Arcus Biosciences remains undervalued or if future growth is already factored into the current price.

Most Popular Narrative: 32.8% Undervalued

Arcus Biosciences last closed at $20.29. The most widely followed narrative argues for a fair value significantly higher, highlighting a substantial gap versus the current market price. This sets the stage for a debate over whether the latest clinical breakthroughs and earnings path can justify this bullish stance.

Arcus Biosciences is prioritizing the launch of its late-stage development program for the HIF-2 alpha inhibitor, casdatifan, which has shown significant efficacy differentiation relative to existing market competitors. This could enhance future revenue through competitive advantage in the RCC market.

Want to know why analysts are backing such a big jump? The underlying drivers include aggressive revenue expansion and a profit turnaround scenario typically seen in the sector’s fastest growers. Curious which key financial milestones need to be hit for this price? Only a full read will reveal the assumptions powering this ambitious valuation.

Result: Fair Value of $30.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, regulatory approval delays or increased competition from other late-stage therapies could quickly challenge the bullish outlook on Arcus Biosciences.

Find out about the key risks to this Arcus Biosciences narrative.

Another View: What Do the Multiples Say?

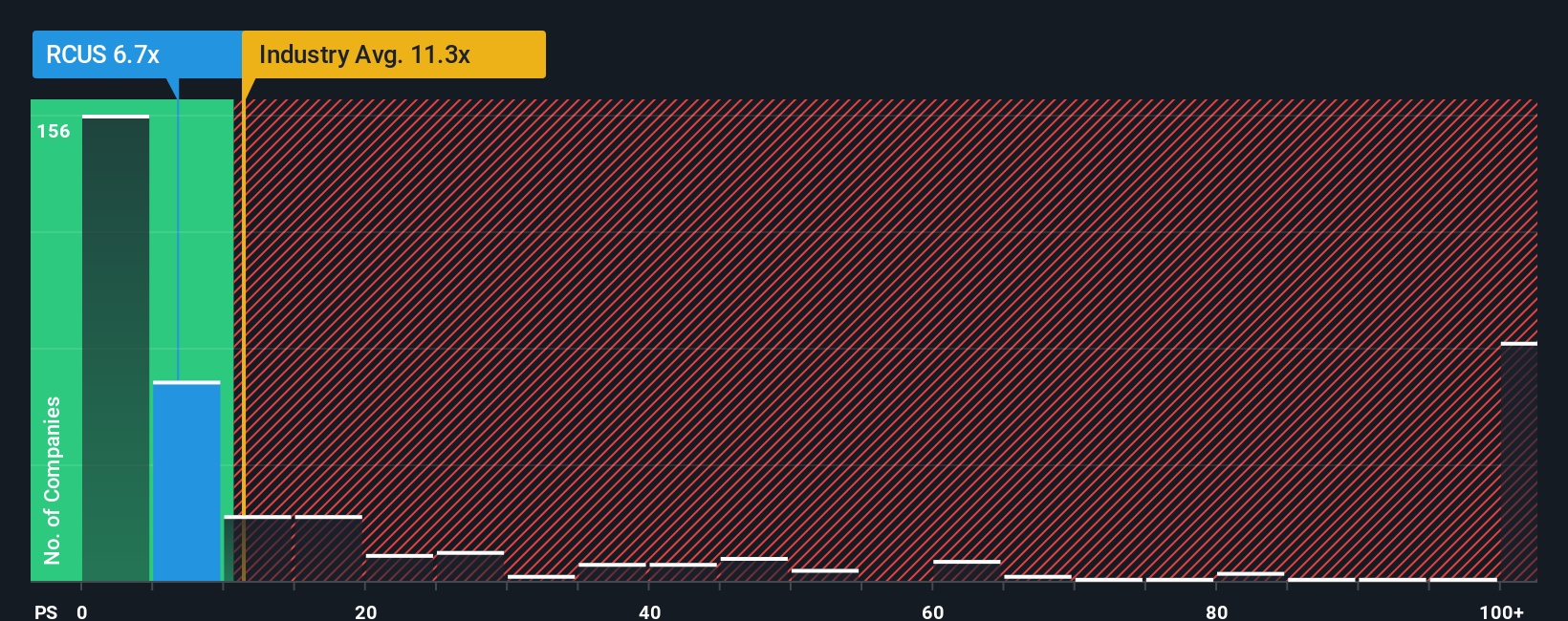

Looking through the lens of price-to-sales, Arcus Biosciences currently trades at 9.1 times revenue, well below the US biotech industry average of 10.8 times and the peer average of 31.6 times. However, the fair ratio suggests a far lower level at just 0.7. This stark mismatch highlights both opportunity and plenty of valuation risk. Will the market reward Arcus for its growth, or are these levels unsustainable?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Arcus Biosciences Narrative

If you have a different perspective or want to dig into the numbers on your own, crafting a personalized narrative takes just a few minutes. Do it your way

A great starting point for your Arcus Biosciences research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Your next winning opportunity could be just a click away. Let Simply Wall Street help you uncover unique stocks you might otherwise overlook and stay ahead of market trends that others miss.

- Power up your strategy by tracking top companies with strong yields through these 15 dividend stocks with yields > 3%.

- Ride the wave of technology transformation and tap into rapid advancements in artificial intelligence by selecting these 25 AI penny stocks.

- Grow your portfolio’s potential for outsized returns by targeting standouts trading below their intrinsic value with these 855 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RCUS

Arcus Biosciences

A clinical-stage biopharmaceutical company, develops and commercializes cancer therapies in the United States.

Excellent balance sheet and good value.

Market Insights

Community Narratives