- United States

- /

- Life Sciences

- /

- NYSE:QGEN

Could Qiagen's (QGEN) Leadership Change Reveal Shifts in Its Long-Term Growth Priorities?

Reviewed by Sasha Jovanovic

- Qiagen N.V. recently reported third-quarter results, with sales rising to US$532.58 million and net income reaching US$130.04 million, and reaffirmed its full-year 2025 sales outlook while announcing that CEO Thierry Bernard will step down once a successor is appointed.

- An interesting insight is that these developments come alongside continued expansion in Qiagen's automated sample processing portfolio and further adoption of its life sciences instruments globally.

- We'll explore how the reaffirmed guidance and CEO transition might influence Qiagen's investment outlook moving forward.

Find companies with promising cash flow potential yet trading below their fair value.

Qiagen Investment Narrative Recap

Qiagen’s investment case often revolves around belief in ongoing adoption of automated sample processing and the global shift toward molecular diagnostics. The recent reaffirmation of sales guidance and upcoming CEO transition do not appear to materially change the principal short-term catalyst, expanding instrument placements, nor diminish the main risk stemming from industry-wide margin pressures and continued macroeconomic volatility in life sciences funding.

The 4,000th placement of QIAcube Connect, along with thousands of cumulative instrument installations, stands out this quarter. This milestone directly reinforces Qiagen’s critical catalyst, as increasing automation across labs underpins recurring consumables revenue and long-term top-line growth.

In contrast, one key concern investors should be aware of is how Qiagen’s margin headwinds are being shaped by...

Read the full narrative on Qiagen (it's free!)

Qiagen's outlook forecasts $2.5 billion in revenue and $554.3 million in earnings by 2028. This is based on 6.9% annual revenue growth and a $180.9 million increase in earnings from the current $373.4 million.

Uncover how Qiagen's forecasts yield a $51.64 fair value, a 19% upside to its current price.

Exploring Other Perspectives

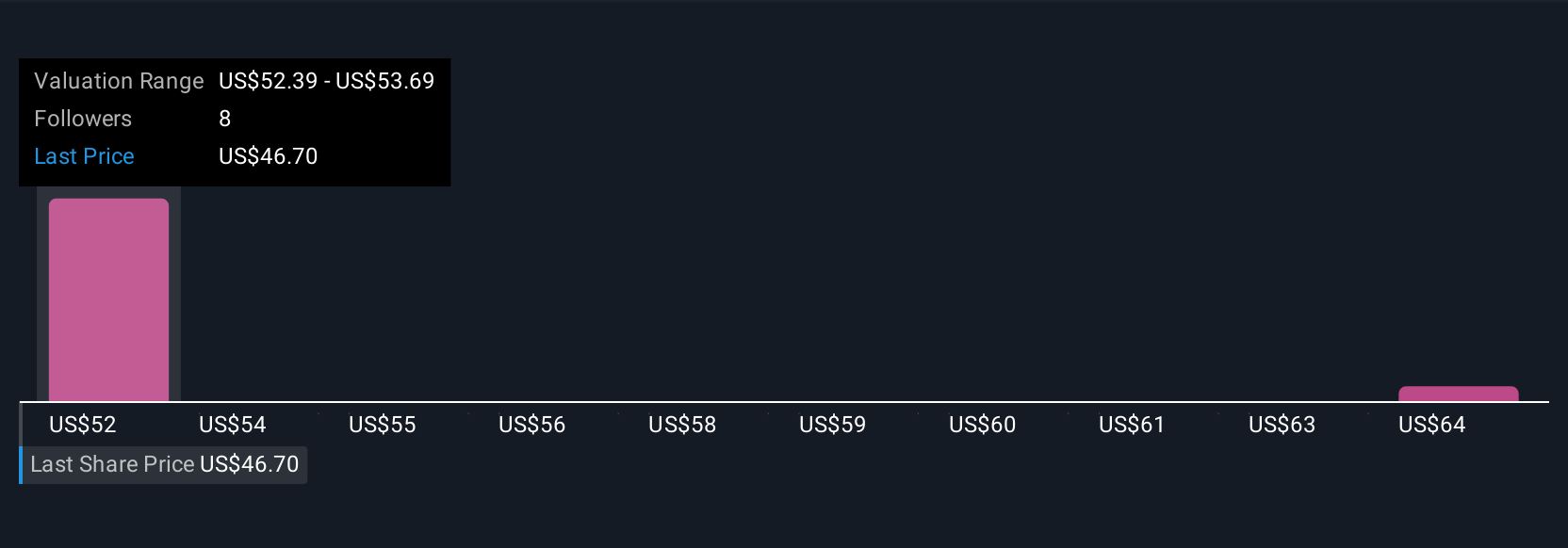

Fair value opinions from 2 Simply Wall St Community members fall between US$51.64 and US$56.12 per share. Alongside their diverse outlooks, ongoing margin pressures and macro volatility remain crucial themes shaping Qiagen’s outlook, consider several perspectives before making any conclusions.

Explore 2 other fair value estimates on Qiagen - why the stock might be worth as much as 29% more than the current price!

Build Your Own Qiagen Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Qiagen research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Qiagen research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Qiagen's overall financial health at a glance.

Contemplating Other Strategies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Qiagen might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:QGEN

Qiagen

Provides sample to insight solutions that transform biological samples into molecular insights in the Netherlands and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives