- United States

- /

- Pharma

- /

- NYSE:PFE

Should FDA Approval of Updated COVID Vaccine for Vulnerable Groups Prompt a Closer Look at Pfizer (PFE)?

Reviewed by Simply Wall St

- On August 27, 2025, BioNTech SE and Pfizer Inc. announced that the U.S. FDA approved their supplemental Biologics License Application for the LP.8.1-adapted monovalent COVID-19 vaccine (COMIRNATY LP.8.1 COVID-19 Vaccine, mRNA), authorizing its use for adults 65 and older and high-risk individuals ages 5 to 64.

- This approval expands access to updated COVID-19 protection for vulnerable populations, highlighting the ongoing importance of vaccine adaptation in public health efforts.

- We'll evaluate how regulatory approval of the new vaccine for at-risk groups influences Pfizer's investment narrative and future outlook.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Pfizer Investment Narrative Recap

Owning Pfizer means believing in its ability to leverage a deep pipeline while overcoming pricing and competitive headwinds. The FDA's approval of the updated COVID-19 vaccine for older and high-risk individuals extends Pfizer’s COVID-related relevance, but its impact on overall revenue and the primary short-term catalyst, late-stage launches in oncology and rare diseases, is limited. The major risk remains regulatory pricing pressure and upcoming patent expirations impacting legacy product revenue, both of which could influence how investors weigh Pfizer’s potential.

Of Pfizer's recent announcements, the August 12 Phase 3 survival benefit data for PADCEV plus KEYTRUDA in muscle-invasive bladder cancer most closely aligns with key catalysts. This reinforces the significance of late-stage oncology assets and label expansions, which analysts cite as central to shoring up earnings as COVID-related sales moderate and pipeline execution becomes more essential for future growth. Progress in these high-impact indications will remain a focus for both short- and long-term shareholders.

However, offsetting new approvals are mounting legal and regulatory risks that investors must keep front of mind, such as ...

Read the full narrative on Pfizer (it's free!)

Pfizer's outlook anticipates $59.7 billion in revenue and $13.2 billion in earnings by 2028. This is based on a forecast annual revenue decline of 2.2% and a $2.5 billion increase in earnings from the current level of $10.7 billion.

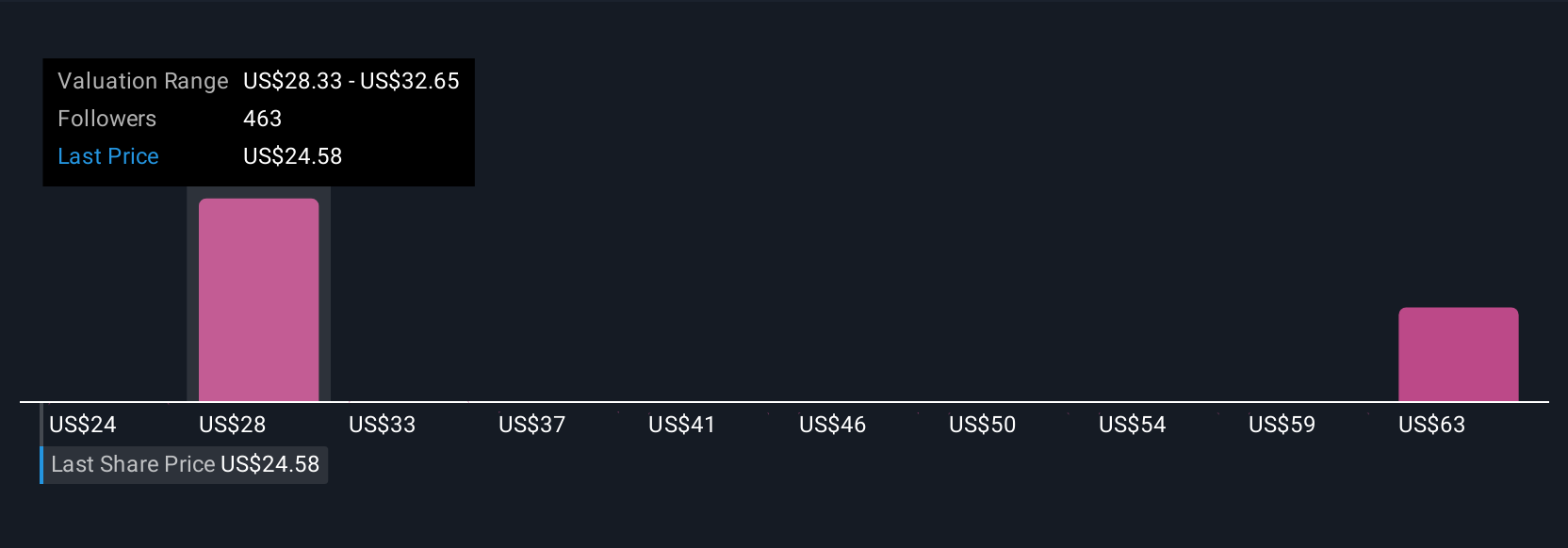

Uncover how Pfizer's forecasts yield a $28.77 fair value, a 16% upside to its current price.

Exploring Other Perspectives

The most optimistic analysts expect US$65.7 billion revenue and US$16.6 billion earnings by 2028. They see emerging markets and accelerated approvals as bigger growth engines than consensus suggests. That means if you think the latest vaccine and regulatory wins hint at a faster path to expansion, you might align with this bullish outlook. As always, investor expectations vary widely, so consider how this recent news could reshape both cautious and optimistic outlooks before making up your mind.

Explore 32 other fair value estimates on Pfizer - why the stock might be worth just $24.00!

Build Your Own Pfizer Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Pfizer research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Pfizer research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Pfizer's overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PFE

Pfizer

Pfizer Inc. discovers, develops, manufactures, markets, distributes, and sells biopharmaceutical products in the United States and internationally.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives