- United States

- /

- Biotech

- /

- NYSE:BHVN

Biohaven (BHVN) Is Down 50.4% After FDA Rejection of VYGLXIA and Pipeline Restructuring – What's Changed

Reviewed by Sasha Jovanovic

- Biohaven recently announced it received a Complete Response Letter from the U.S. FDA rejecting its New Drug Application for VYGLXIA (troriluzole) in spinocerebellar ataxia, citing concerns about study design and reliance on real-world evidence.

- This setback prompted Biohaven to implement substantial R&D cost reductions, pause or delay some pipeline programs, and shift focus toward its remaining late-stage clinical assets.

- We'll explore how Biohaven's decision to prioritize resources following the FDA's rejection could shape the company's investment narrative going forward.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Biohaven's Investment Narrative?

To be a shareholder in Biohaven right now, it’s important to weigh the company’s story as a builder of innovative, late-stage clinical assets against the specific hurdles it faces. The recent FDA rejection of VYGLXIA for spinocerebellar ataxia has clearly altered the near-term catalysts, removing a prominent approval event while triggering a sharp cost-cutting initiative and a shift in strategic focus. With no commercial revenue and an expanding net loss of US$766.97 million, the spotlight now moves to the company’s remaining programs in areas like IgA nephropathy, Graves’ disease, epilepsy, depression, SMA, and obesity. In the short term, investor attention will turn to progress in these trials and whether reduced R&D spend can meaningfully extend Biohaven’s cash runway. The downside is also clear: a 77.12% year-to-date share price decline and the real risk that financial constraints could limit Biohaven’s ability to advance multiple assets simultaneously. This news makes near-term trial results and financing all the more significant when reassessing both risk and opportunity.

On the other hand, risks from limited cash runway could soon take center stage for investors.

Exploring Other Perspectives

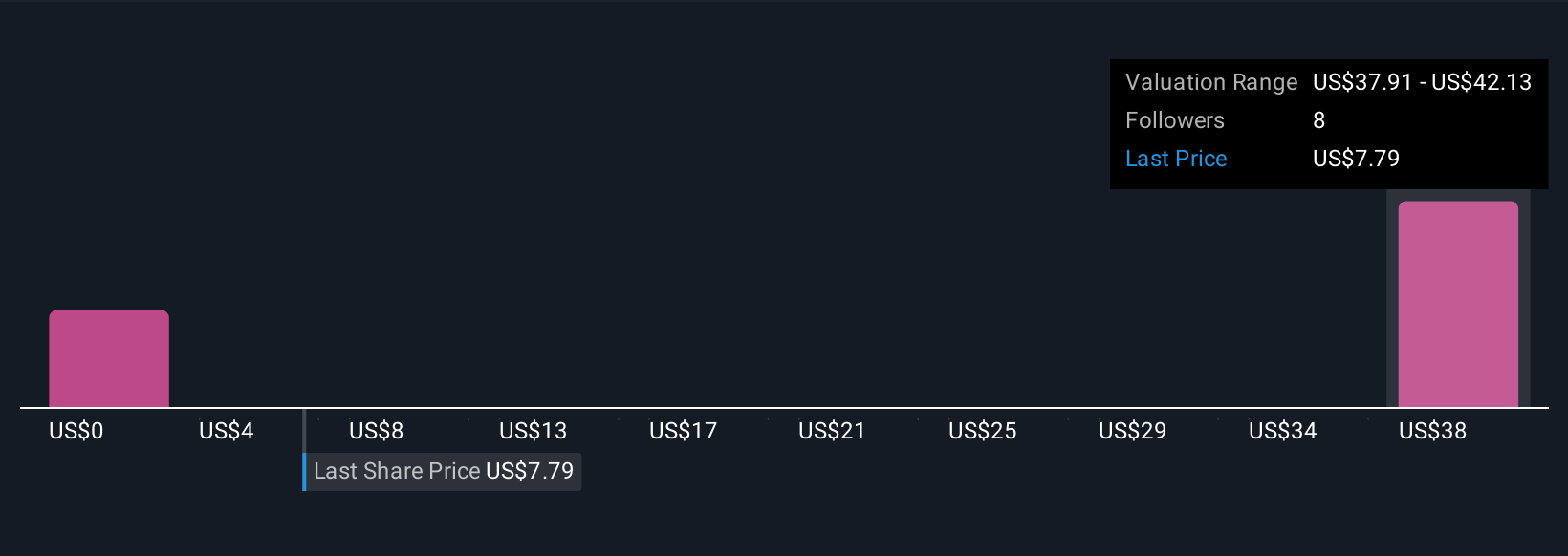

Explore 5 other fair value estimates on Biohaven - why the stock might be worth less than half the current price!

Build Your Own Biohaven Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Biohaven research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Biohaven research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Biohaven's overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Biohaven might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BHVN

Biohaven

Biohaven Ltd. discovers, develops, and commercializes therapies for immunology, neuroscience, and oncology worldwide.

Adequate balance sheet with slight risk.

Market Insights

Community Narratives