- United States

- /

- Biotech

- /

- NYSE:ABBV

Will AbbVie’s (ABBV) US Biologics Bet Reinforce Its Competitive Edge in Oncology?

Reviewed by Sasha Jovanovic

- AbbVie recently submitted a Biologics License Application to the FDA for pivekimab sunirine, an investigational therapy targeting rare blood cancers, and began a US$70 million expansion of its Bioresearch Center in Massachusetts to boost US biologics manufacturing capabilities.

- This combination of advancing oncology pipeline assets and domestic manufacturing investment underscores AbbVie's focus on strengthening its future portfolio and responding to policy incentives for US-based pharmaceutical production.

- We’ll examine how AbbVie’s renewed investment in US biologics manufacturing could shape the company’s investment narrative going forward.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

AbbVie Investment Narrative Recap

To invest in AbbVie, you need to believe that its innovative pipeline and US manufacturing investments can offset exposure to patent loss and healthcare cost controls. While the recent FDA submission for pivekimab sunirine and accelerated domestic manufacturing expansion support its leadership in oncology and operations resilience, these moves are not likely to materially shift the company’s biggest short-term catalyst, sustained immunology revenue growth, or its main risk from exposure to upcoming biosimilar competition and pricing pressures.

Within its latest announcements, the BLA submission for Pivekimab sunirine stands out, as it reinforces the expanding oncology pipeline that could help buffer any near-term slowing in established product revenues. This aligns with AbbVie's focus on therapeutic diversity, which is increasingly important as it faces intensifying biosimilar threats to cornerstone products like Humira and, ultimately, Skyrizi and Rinvoq.

Yet, in contrast to pipeline optimism, investors should be aware of the real risk tied to concentrated portfolio exposure if...

Read the full narrative on AbbVie (it's free!)

AbbVie's narrative projects $73.0 billion revenue and $20.8 billion earnings by 2028. This requires 7.7% yearly revenue growth and a $17.1 billion earnings increase from $3.7 billion today.

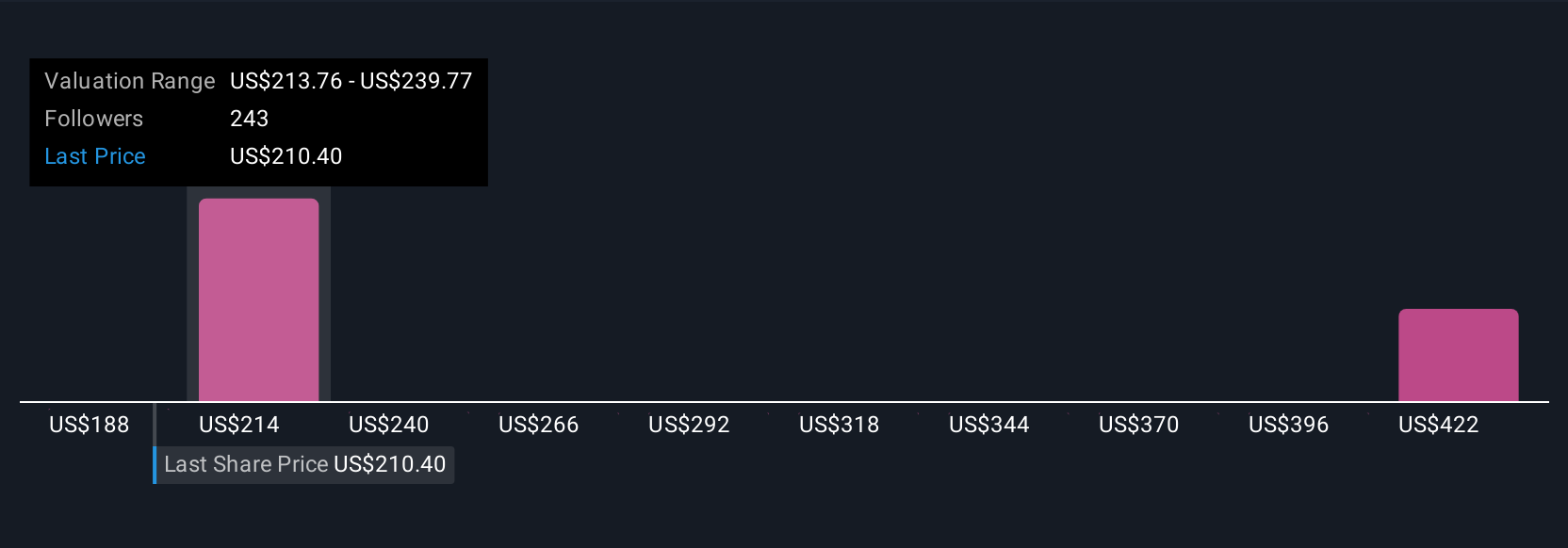

Uncover how AbbVie's forecasts yield a $227.22 fair value, a 3% downside to its current price.

Exploring Other Perspectives

Eight estimates from the Simply Wall St Community place AbbVie's fair value between US$187.76 and US$434.26 per share. As you consider these varied perspectives, keep in mind that intensifying biosimilar and generic competition remains a critical challenge for future revenue stability.

Explore 8 other fair value estimates on AbbVie - why the stock might be worth as much as 86% more than the current price!

Build Your Own AbbVie Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AbbVie research is our analysis highlighting 2 key rewards and 6 important warning signs that could impact your investment decision.

- Our free AbbVie research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AbbVie's overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 32 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ABBV

AbbVie

A research-based biopharmaceutical company, engages in the research and development, manufacture, commercialization, and sale of medicines and therapies worldwide.

Moderate risk, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives