- United States

- /

- Life Sciences

- /

- NYSE:A

What Agilent Technologies (A)'s New Innovation Hub Partnership Could Mean for Its Asia-Pacific Ambitions

Reviewed by Sasha Jovanovic

- Agilent Technologies recently announced the launch of the Agilent Innovation Hub in partnership with the University of Melbourne to advance environmental research and population health across the Asia-Pacific region.

- This collaboration leverages next-generation analytical technologies to identify previously unregulated environmental chemicals, highlighting Agilent's ongoing emphasis on scientific and technological leadership.

- We'll explore how Agilent's expanded environmental research collaboration could influence the company's outlook within its current investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Agilent Technologies Investment Narrative Recap

For Agilent shareholders, the core belief rests on continued long-term growth in life sciences and analytical markets, supported by innovation and expanding regulations in healthcare and environmental safety. The newly announced Agilent Innovation Hub strengthens Agilent's presence in Asia-Pacific research collaboration; however, it does not materially shift the primary short-term catalyst of recurring revenue expansion or the key risk of increased supply chain complexity and tariffs affecting margins.

Among recent company highlights, Agilent's growing partnerships in environmental research, such as the new Center of Excellence with Georgia Tech, reinforce its drive to expand its international footprint and research reach. These efforts align with rising global demand for analytical solutions and complement catalysts like robust recurring revenues and adoption of advanced lab technologies.

Yet, in contrast, investors should be alert to ongoing supply chain risks and tariff-driven cost volatility which could affect future profitability if not managed effectively...

Read the full narrative on Agilent Technologies (it's free!)

Agilent Technologies' outlook anticipates $8.0 billion in revenue and $1.7 billion in earnings by 2028. This scenario assumes a 5.8% annual revenue growth rate and an increase in earnings of approximately $0.5 billion from the current $1.2 billion level.

Uncover how Agilent Technologies' forecasts yield a $149.90 fair value, in line with its current price.

Exploring Other Perspectives

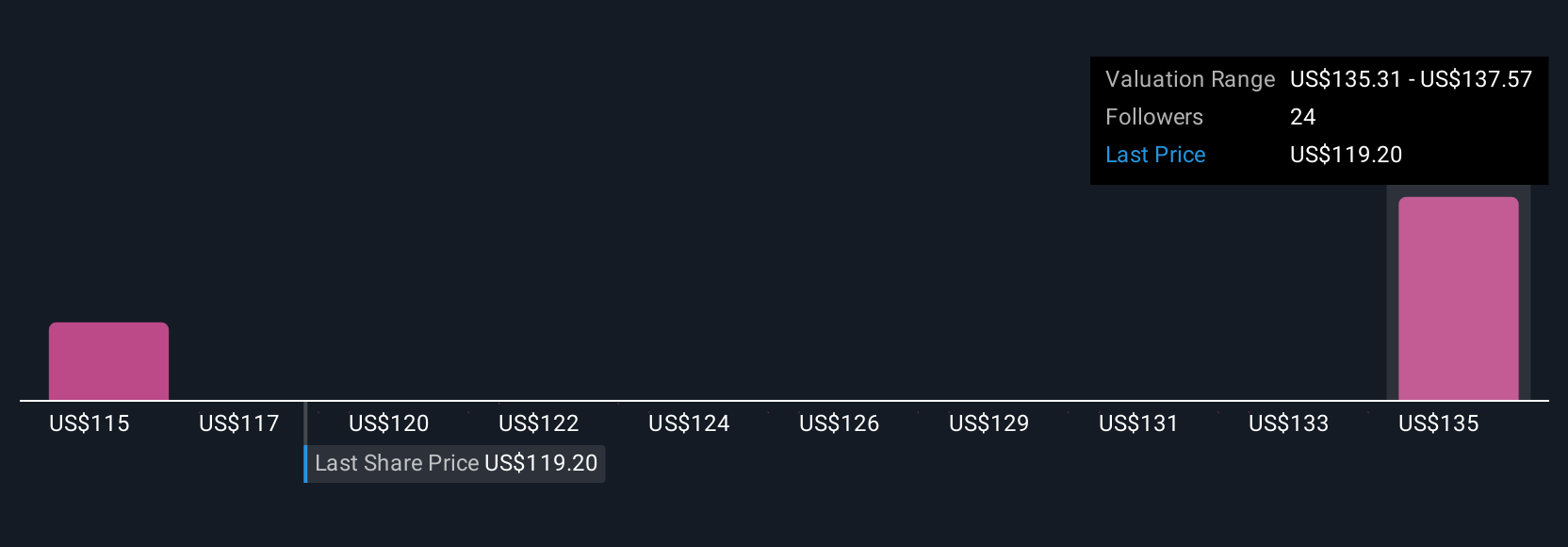

Four fair value opinions from the Simply Wall St Community range from US$90.53 to US$149.90 per share. While many anticipate recurring revenue expansion as a key catalyst, you will find a range of opinions and risk assessments to consider.

Explore 4 other fair value estimates on Agilent Technologies - why the stock might be worth 39% less than the current price!

Build Your Own Agilent Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Agilent Technologies research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Agilent Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Agilent Technologies' overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:A

Agilent Technologies

Provides application focused solutions to the life sciences, diagnostics, and applied chemical markets worldwide.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives