- United States

- /

- Biotech

- /

- NasdaqGM:ZLAB

Zai Lab Limited (NASDAQ:ZLAB) Analysts Are Cutting Their Estimates: Here's What You Need To Know

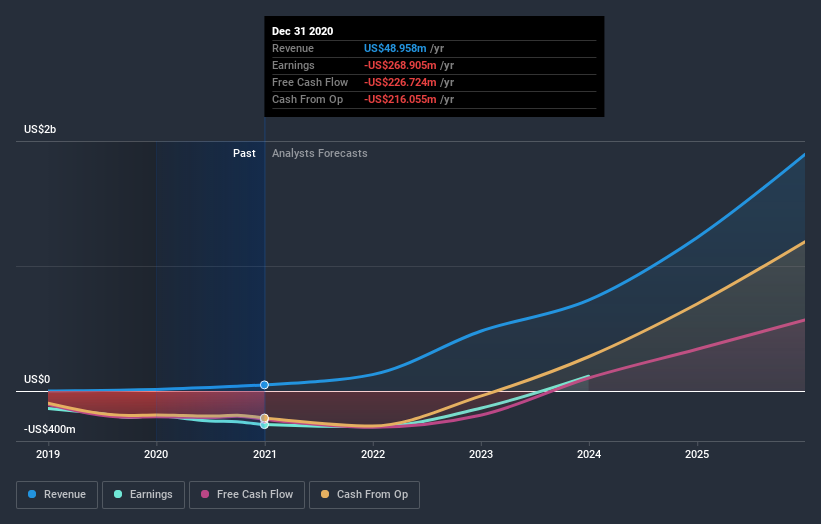

As you might know, Zai Lab Limited (NASDAQ:ZLAB) last week released its latest full-year, and things did not turn out so great for shareholders. Earnings fell badly short of analyst estimates, with US$49m revenue falling -13% short, and statutory losses of US$3.46 per share being -11% greater than forecast. Earnings are an important time for investors, as they can track a company's performance, look at what the analysts are forecasting for next year, and see if there's been a change in sentiment towards the company. With this in mind, we've gathered the latest statutory forecasts to see what the analysts are expecting for next year.

View our latest analysis for Zai Lab

After the latest results, the twelve analysts covering Zai Lab are now predicting revenues of US$130.9m in 2021. If met, this would reflect a substantial 167% improvement in sales compared to the last 12 months. The loss per share is expected to ameliorate slightly, reducing to US$3.37. Yet prior to the latest earnings, the analysts had been forecasting revenues of US$224.7m and losses of US$2.73 per share in 2021. There's been a definite change in sentiment in this update, with the analysts administering a notable cut to next year's revenue estimates, while at the same time increasing their loss per share forecasts.

The average price target lifted 10% to US$187, clearly signalling that the weaker revenue and EPS outlook are not expected to weigh on the stock over the longer term. There's another way to think about price targets though, and that's to look at the range of price targets put forward by analysts, because a wide range of estimates could suggest a diverse view on possible outcomes for the business. The most optimistic Zai Lab analyst has a price target of US$262 per share, while the most pessimistic values it at US$105. Note the wide gap in analyst price targets? This implies to us that there is a fairly broad range of possible scenarios for the underlying business.

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. We would highlight that Zai Lab's revenue growth is expected to slow, with the forecast 167% annualised growth rate until the end of 2021 being well below the historical 275% growth over the last year. By way of comparison, the other companies in this industry with analyst coverage are forecast to grow their revenue at 18% annually. So it's pretty clear that, while Zai Lab's revenue growth is expected to slow, it's still expected to grow faster than the industry itself.

The Bottom Line

The most important thing to take away is that the analysts increased their loss per share estimates for next year. Regrettably, they also downgraded their revenue estimates, but the latest forecasts still imply the business will grow faster than the wider industry. We note an upgrade to the price target, suggesting that the analysts believes the intrinsic value of the business is likely to improve over time.

Following on from that line of thought, we think that the long-term prospects of the business are much more relevant than next year's earnings. We have estimates - from multiple Zai Lab analysts - going out to 2025, and you can see them free on our platform here.

That said, it's still necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Zai Lab , and understanding these should be part of your investment process.

When trading Zai Lab or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Zai Lab might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGM:ZLAB

Zai Lab

A biopharmaceutical company, focuses on discovering, developing, and commercializing products that address medical conditions in the areas of oncology, immunology, neuroscience, and infectious diseases.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026