- United States

- /

- Pharma

- /

- NasdaqGS:VTRS

Does Viatris Offer Value After Its 18.5% Price Drop and Restructuring News?

Reviewed by Bailey Pemberton

- If you have ever wondered whether Viatris is a bargain or just another pharmaceutical stock, you are in the right place.

- Viatris shares have fluctuated lately, with a 1.5% uptick over the last month but still down 18.5% for the year. Investors are clearly reassessing the story here.

- Recent headlines around Viatris have focused on its ongoing restructuring plans, including divesting some non-core assets and simplifying its operations. This adds more intrigue to why the price has moved the way it has. Activity in the generic drug market and regulatory changes have also played a role in shaping sentiment over the past quarter.

- When we ran Viatris through our 6-step valuation checklist, the stock scored 5 out of 6, indicating it may be undervalued by several key measures. We will explore what those measures reveal and discuss a smarter way to judge value later in the article.

Find out why Viatris's -18.1% return over the last year is lagging behind its peers.

Approach 1: Viatris Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model works by forecasting a company’s future cash flows and discounting them back to the present day. This helps estimate what the business is truly worth if you factor in all the money it is expected to generate over time.

For Viatris, the current Free Cash Flow stands at $1.64 billion. Analyst estimates project Free Cash Flow rising to $2.49 billion by 2029. Beyond that, Simply Wall St extrapolates additional moderate cash flow growth for future years. Because the DCF model bases valuation on all of these projected figures, it can capture the potential upside often missed by looking only at near-term profits.

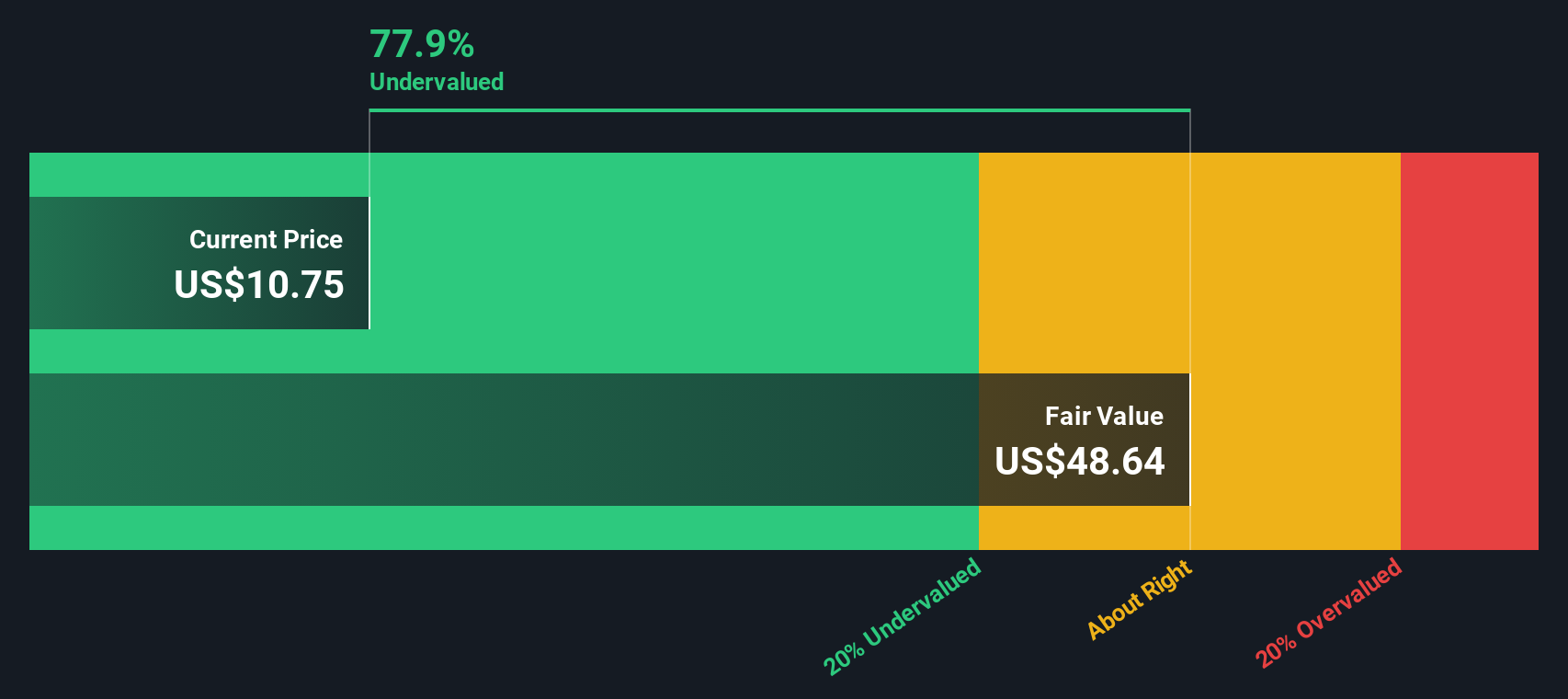

Based on these projections, the DCF model arrives at an intrinsic value for Viatris of $47.25 per share. With this figure, the stock is currently trading at a 78.6% discount compared to its estimated fair value. In other words, the model suggests Viatris is deeply undervalued relative to how much cash it is expected to produce.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Viatris is undervalued by 78.6%. Track this in your watchlist or portfolio, or discover 870 more undervalued stocks based on cash flows.

Approach 2: Viatris Price vs Sales

The Price-to-Sales (P/S) multiple is a useful way to value companies, especially when they have volatile or negative earnings, since it focuses on the relationship between a stock's price and its total revenue. For established pharmaceutical companies like Viatris, the P/S multiple can help investors look past short-term profit swings and instead assess how highly the market values each dollar of sales.

A company’s growth prospects and risk profile play a crucial role in what counts as a fair or normal P/S ratio. Businesses expected to grow faster or with more stable revenue streams typically warrant a higher multiple, while those with uncertain outlooks or greater risks justify a lower one.

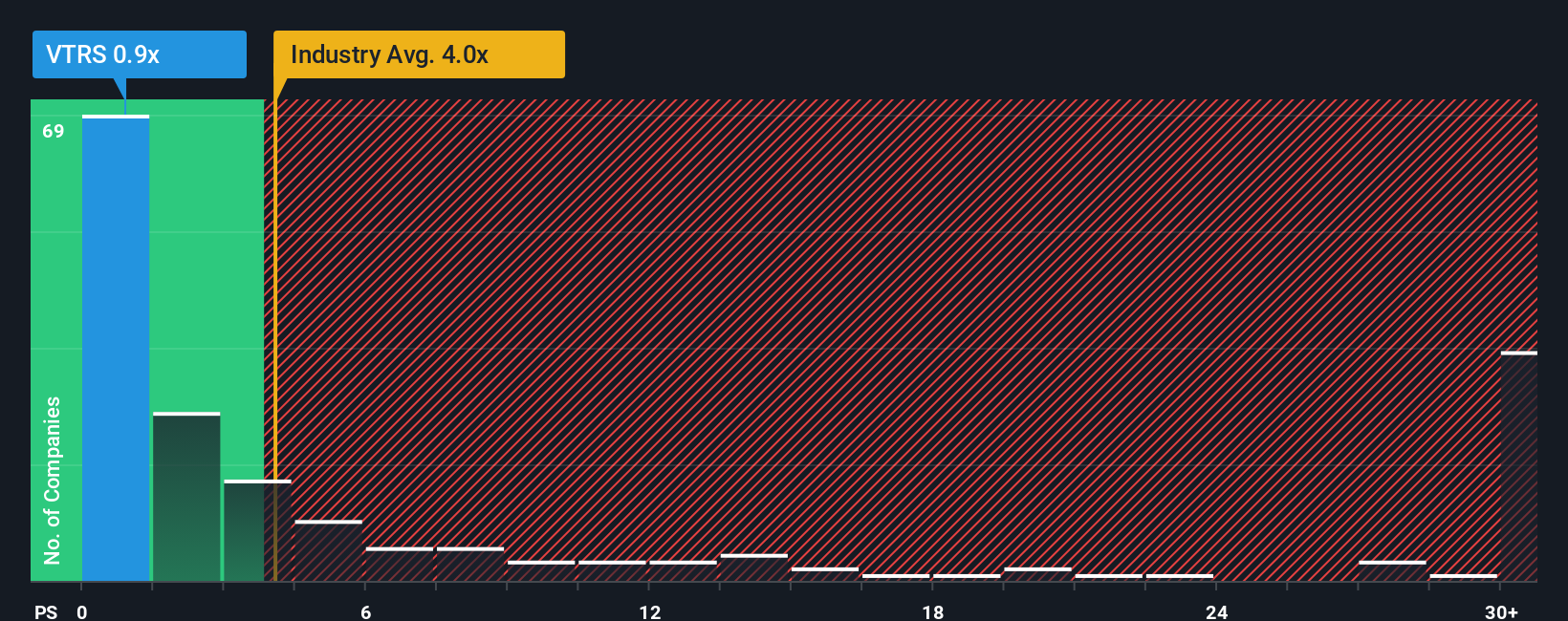

Currently, Viatris trades at a P/S ratio of 0.83x. This is well below the Pharmaceuticals industry average of 3.94x and its peers’ average of 3.22x, suggesting a significant discount relative to the broader sector. To go one step further, Simply Wall St calculates a proprietary “Fair Ratio” for Viatris at 3.17x. This figure goes beyond industry averages as it specifically considers the company’s earnings growth, risk profile, profit margin, market cap and sector dynamics.

The Fair Ratio offers a more nuanced benchmark than simply comparing to peers or the industry. Because it takes into account Viatris’s specific characteristics, it is a better way to judge whether the current share price undervalues or overvalues the company’s fundamentals.

With Viatris’s P/S ratio of 0.83x sitting well below the Fair Ratio of 3.17x, the stock still appears to be significantly undervalued based on this key measure.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1396 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Viatris Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives.

Narratives are a smarter, more dynamic approach to investing. Think of them as your chance to tell the story of Viatris using your own assumptions about its future revenue, earnings, margins, and fair value.

Rather than relying only on static ratios or consensus targets, a Narrative connects your unique perspective about the company’s path ahead directly to a financial forecast and ultimately to an estimated fair value.

Narratives are easy to use and available on Simply Wall St’s Community page, where millions of investors continually create and update their own views for Viatris.

This means you can see a spectrum of informed perspectives and compare your fair value against current market prices, helping you decide when it might be time to buy or sell.

What makes Narratives especially powerful is that they update live as new information, like earnings results or major news, is released. This gives your investment thesis a real-time edge.

For example, some investors might create bullish Narratives based on Viatris’s expansion into emerging markets and launching high-margin products, projecting a fair value as high as $14.00 per share. Others might focus on competitive risks and regulatory challenges, setting a more cautious fair value around $8.00 per share.

This lets you anchor your decisions to the numbers and story that make the most sense to you, turning investment analysis into a more insightful, personal process.

Do you think there's more to the story for Viatris? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VTRS

Viatris

Operates as a healthcare company in North America, Europe, China, Taiwan, Hong Kong, Japan, Australia, New Zealand, rest of Asia, Africa, Latin America, and the Middle East.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives