- United States

- /

- Biotech

- /

- NasdaqCM:VRDN

Is Viridian Therapeutics a Bargain After Pipeline Results Spark Optimism?

Reviewed by Bailey Pemberton

- Wondering if Viridian Therapeutics is truly a bargain or simply treading water? Here is a closer look at what makes this stock potentially interesting for value-minded investors.

- The share price climbed 8.3% in the past month but is still down 7.1% over the last year. This may suggest shifting investor sentiment and possible untapped growth.

- Markets have responded dynamically to the company’s recent announcement of promising results from its pipeline treatments for rare diseases. These updates have generated optimism about longer-term prospects. This renewed interest comes as investors remain watchful for further updates around regulatory progress and, potentially, new partnerships.

- Based on our six-point valuation check, Viridian Therapeutics scores a 3/6 for undervaluation. This may indicate that there is more to uncover. We will break down those traditional valuation methods in a moment, and provide a fresh perspective on what really drives long-term value here.

Find out why Viridian Therapeutics's -7.1% return over the last year is lagging behind its peers.

Approach 1: Viridian Therapeutics Discounted Cash Flow (DCF) Analysis

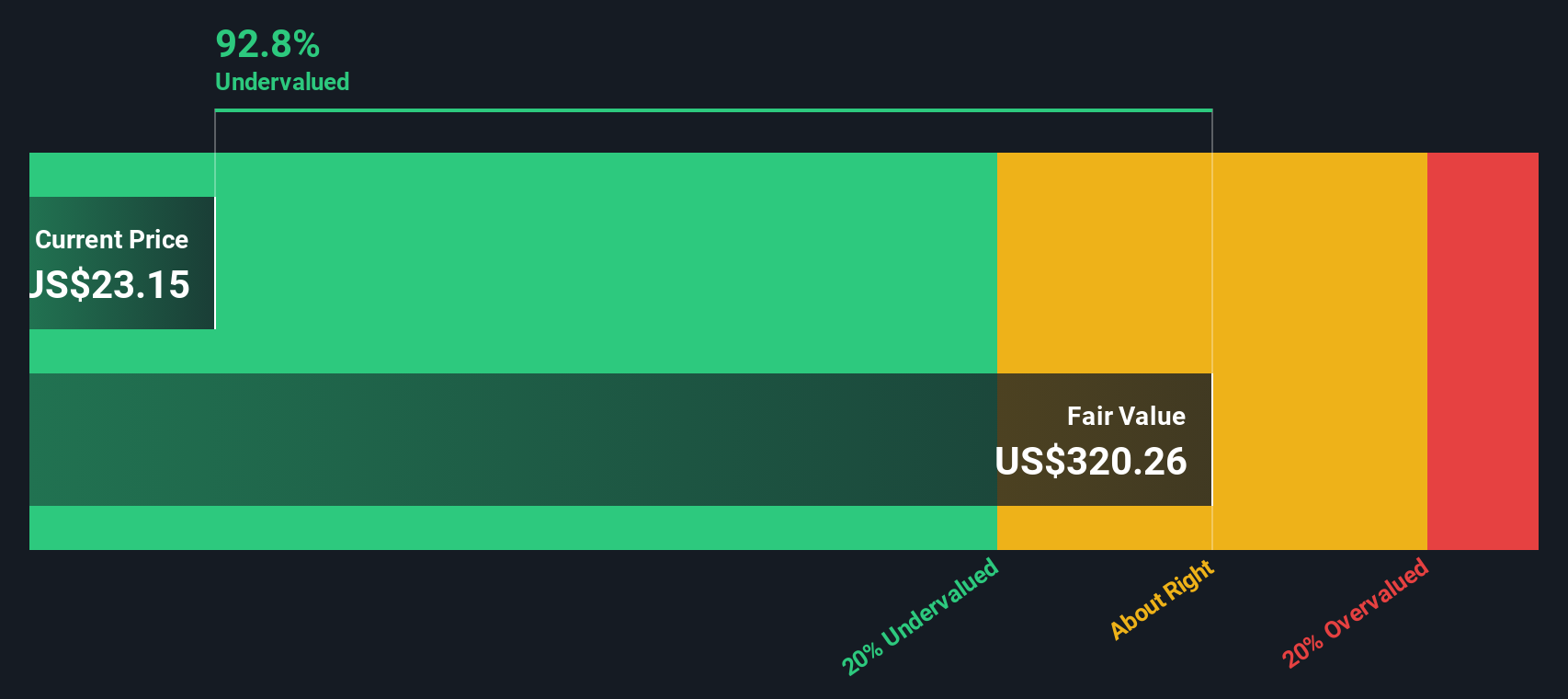

A Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today’s value. This approach offers a data-driven view of what the business might be worth.

For Viridian Therapeutics, current Free Cash Flow (FCF) stands at -$309.3 million. Analyst estimates guide FCF projections over the next five years, and beyond that, industry methodologies are used to extrapolate future growth. According to these calculations, the FCF is forecast to reach $278.7 million by 2029. If projections continue, the company could be generating over $1.6 billion in FCF by 2035.

Based on the two-stage Free Cash Flow to Equity model, these cash flows have been discounted to today’s terms using a standard rate. This calculation results in an estimated intrinsic value of $331 per share. Relative to the current market price, this implies the stock is trading at a 93.2% discount, indicating substantial undervaluation.

If the model’s assumptions hold, Viridian Therapeutics may represent an opportunity for value investors searching for long-term growth in the biotech sector.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Viridian Therapeutics is undervalued by 93.2%. Track this in your watchlist or portfolio, or discover 840 more undervalued stocks based on cash flows.

Approach 2: Viridian Therapeutics Price vs Book

The price-to-book (PB) ratio is a favored valuation tool for companies like Viridian Therapeutics, especially when earnings are negative or volatile but the company's underlying assets remain a focal point. This metric compares a firm’s market value to its book value, providing perspective on whether the stock is priced above or below its net asset value.

Growth expectations and risk profiles play a major role in setting what a “fair” PB ratio should be. High future growth or lower risk typically justify a higher ratio, while greater uncertainty or stagnant outlooks generally warrant a lower one.

Viridian’s current PB ratio stands at 5.64x, just below the peer average of 5.75x but more than double the biotechnology industry’s 2.39x. While these comparisons offer some context, they do not account for company-specific factors like future growth potential and risk profile.

This is where Simply Wall St’s proprietary Fair Ratio comes into play. Unlike basic peer or industry comparisons, the Fair Ratio blends forward-looking factors, including growth forecasts, profit margins, the company’s size, industry dynamics, and overall risk. This unique perspective helps identify whether the current valuation aligns with what a reasonable investor should expect, taking more variables into account than simple benchmarks.

Comparing Viridian’s actual PB ratio of 5.64x with its Fair Ratio suggests the valuation is about right, indicating the market price is reasonably in line with the company’s fundamental position.

Result: ABOUT RIGHT

PB ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

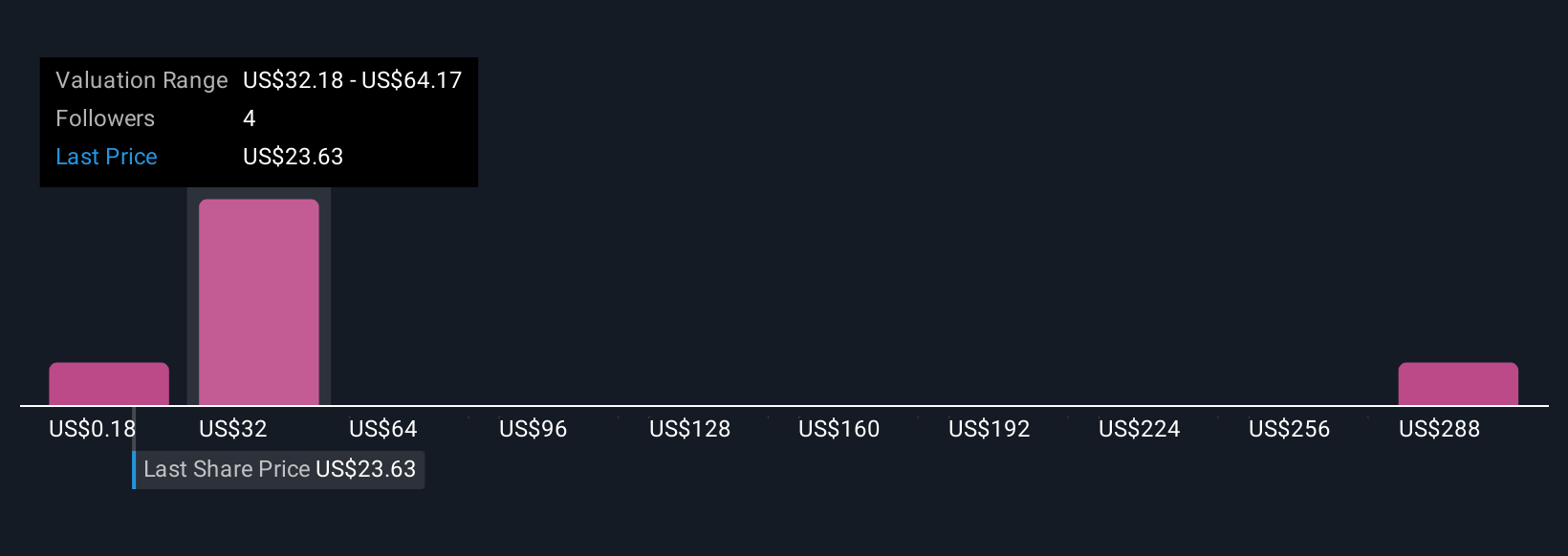

Upgrade Your Decision Making: Choose your Viridian Therapeutics Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is a simple, powerful tool that lets you create or use a story around a company. It connects your perspective on factors like future revenue, margins, and fair value to what the numbers show.

Narratives link a company's story to a custom financial forecast, making it easy to visualize how your view translates into fair value estimates. On Simply Wall St's Community page, millions of investors use Narratives to see how their expectations compare to others and to quickly assess buying or selling opportunities as fair value and current price change over time.

As new events, earnings, or company updates appear, Narratives update dynamically, ensuring your valuation always reflects the latest information. For example, some Viridian Therapeutics investors project rapid approval and strong sales growth, resulting in a high fair value, while others price in slower regulatory progress and assign a more conservative outlook for the stock.

Do you think there's more to the story for Viridian Therapeutics? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:VRDN

Viridian Therapeutics

Engages in discovering, developing, and commercializing treatments for serious and rare diseases.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives