- United States

- /

- Biotech

- /

- NasdaqGS:TSHA

Will Taysha (TSHA)'s New CCO and Capital Raise Reshape Its Commercialization Strategy?

Reviewed by Sasha Jovanovic

- In November 2025, Taysha Gene Therapies announced the appointment of David McNinch as Chief Commercial Officer, reported a third quarter net loss of US$32.73 million with a sales decline to US$4.29 million for the nine months, and filed a US$200 million shelf registration to offer a variety of securities.

- The introduction of a seasoned commercial leader alongside expanded capital-raising options could signal Taysha’s intention to strengthen its commercialization strategy and financial footing.

- To assess the impact on the investment narrative, we’ll look at how the recent executive appointment shapes Taysha’s commercial readiness.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Taysha Gene Therapies Investment Narrative Recap

To be a Taysha Gene Therapies shareholder, you need to believe in the commercial potential of gene therapy for Rett syndrome, anchored by progress in the TSHA-102 program. While the new Chief Commercial Officer brings industry expertise, the most important short-term catalyst, clinical advancements leading to regulatory milestones, remains unchanged, and the main risk is still regulatory delays or costly trial outcomes. The recent leadership change is not material to these factors in the near term.

Among recent announcements, the US$200 million shelf registration stands out as directly relevant to capital needs. This option could help Taysha fund continued R&D activities and support a future TSHA-102 launch, keeping attention on funding as a persistent risk even with strong leadership in place.

By contrast, investors should be aware that even with promising clinical progress, future cash burn and the need for additional financing could…

Read the full narrative on Taysha Gene Therapies (it's free!)

Taysha Gene Therapies' outlook anticipates $88.9 million in revenue and $14.1 million in earnings by 2028. This projection relies on a 120.1% annual revenue growth rate and an earnings increase of $103.4 million from current earnings of -$89.3 million.

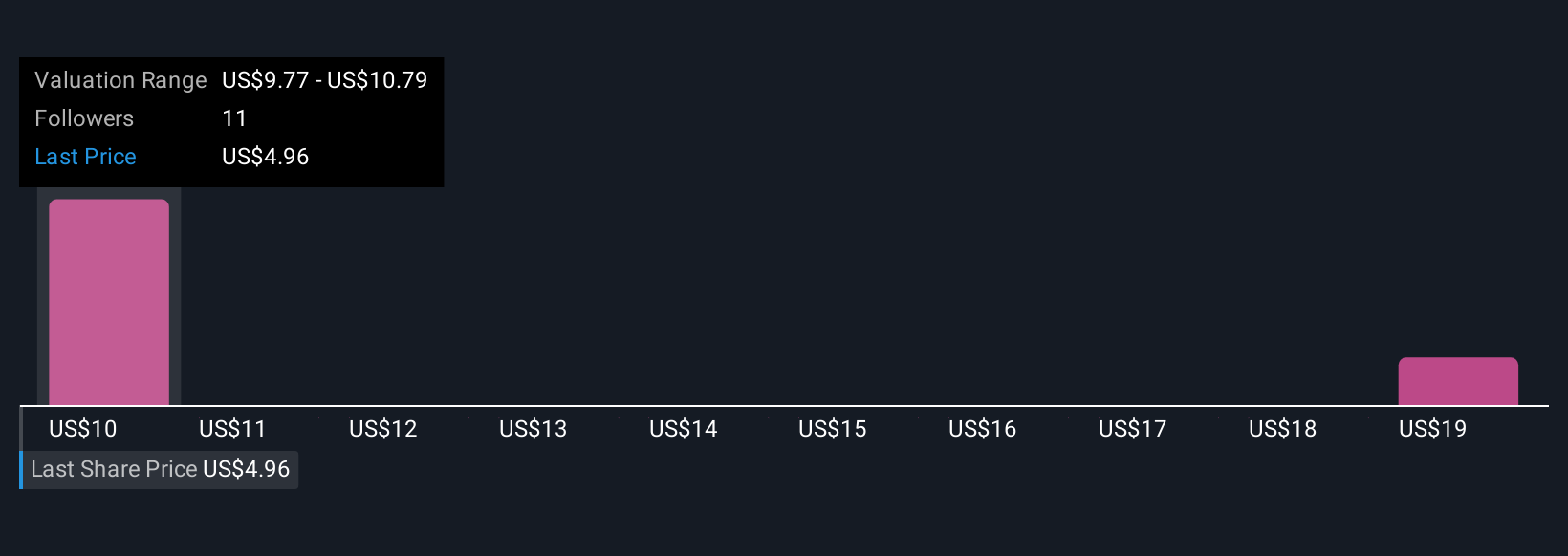

Uncover how Taysha Gene Therapies' forecasts yield a $9.77 fair value, a 151% upside to its current price.

Exploring Other Perspectives

Community estimates for Taysha range from US$9.77 to US$41.29, drawn from 2 Simply Wall St Community contributors. Lively debate continues as regulatory hurdles and funding risks still hold center stage for the company’s outlook.

Explore 2 other fair value estimates on Taysha Gene Therapies - why the stock might be worth over 10x more than the current price!

Build Your Own Taysha Gene Therapies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Taysha Gene Therapies research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Taysha Gene Therapies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Taysha Gene Therapies' overall financial health at a glance.

Searching For A Fresh Perspective?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taysha Gene Therapies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TSHA

Taysha Gene Therapies

A clinical-stage biotechnology company, focuses on developing and commercializing adeno-associated virus-based gene therapies for the treatment of monogenic diseases of the central nervous system.

Adequate balance sheet with slight risk.

Market Insights

Community Narratives