Stock Analysis

- United States

- /

- Mortgage REITs

- /

- NYSE:GPMT

US Penny Stocks To Watch In November 2024

Reviewed by Simply Wall St

As the U.S. stock market reaches record highs, fueled by a post-election rally and optimism surrounding interest rate cuts, investors are exploring various opportunities to capitalize on this momentum. Penny stocks, though often overlooked and considered a relic of past market days, remain an intriguing investment area for those seeking potential growth in smaller or lesser-known companies. By focusing on penny stocks with strong financial health and clear growth trajectories, investors might uncover promising opportunities that align with today's dynamic market conditions.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.78 | $5.56M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $170.72M | ★★★★★★ |

| Flexible Solutions International (NYSEAM:FSI) | $4.37 | $51.05M | ★★★★★★ |

| RLX Technology (NYSE:RLX) | $1.60 | $2.07B | ★★★★★★ |

| AsiaFIN Holdings (OTCPK:ASFH) | $0.97 | $79.11M | ★★★★★★ |

| PHX Minerals (NYSE:PHX) | $3.35 | $128.93M | ★★★★★☆ |

| So-Young International (NasdaqGM:SY) | $1.25 | $88.26M | ★★★★☆☆ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $69.71M | ★★★★★★ |

| Puma Biotechnology (NasdaqGS:PBYI) | $3.30 | $141.37M | ★★★★★★ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $1.015 | $96.23M | ★★★★★☆ |

Click here to see the full list of 738 stocks from our US Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Bitcoin Depot (NasdaqCM:BTM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Bitcoin Depot Inc. operates a network of cryptocurrency kiosks across North America and has a market cap of $102.86 million.

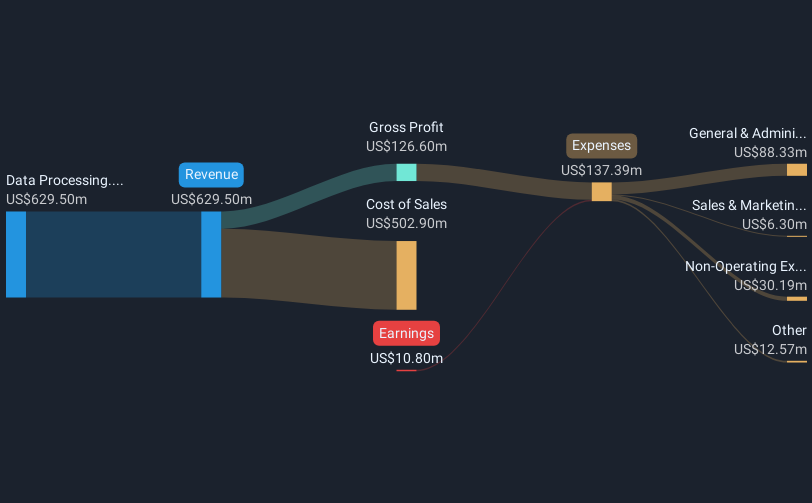

Operations: The company's revenue is primarily generated from its data processing segment, totaling $629.50 million.

Market Cap: $102.86M

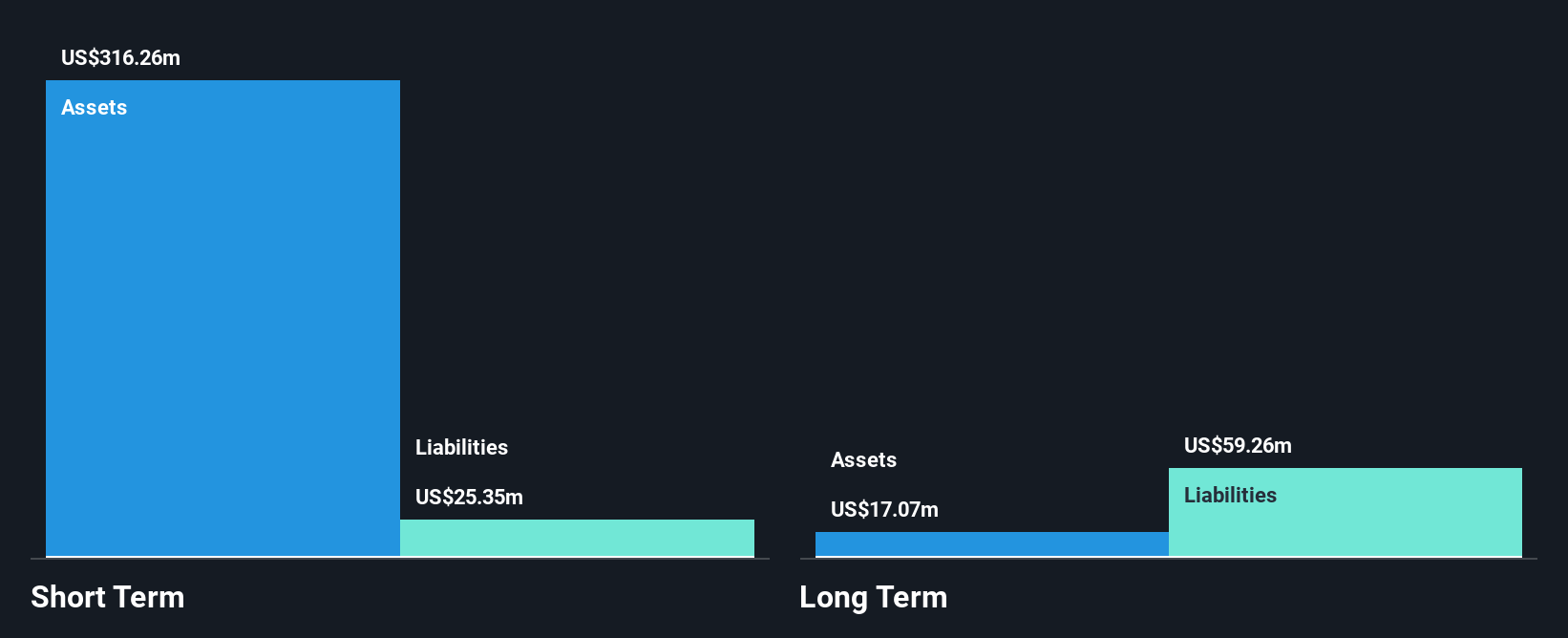

Bitcoin Depot Inc., with a market cap of US$102.86 million, operates in the volatile penny stock space and has shown mixed financial performance. Despite being unprofitable, it reported a net income of US$11.26 million for Q2 2024, reversing a loss from the previous year. The company's short-term assets exceed both its short- and long-term liabilities, indicating solid liquidity management. However, shareholder dilution occurred over the past year, and its share price remains highly volatile. Recent strategic moves include seeking M&A opportunities and changing auditors to Wolf & Company amid delayed SEC filings.

- Take a closer look at Bitcoin Depot's potential here in our financial health report.

- Gain insights into Bitcoin Depot's future direction by reviewing our growth report.

Taysha Gene Therapies (NasdaqGS:TSHA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Taysha Gene Therapies, Inc. is a gene therapy company that develops and commercializes adeno-associated virus-based treatments for monogenic diseases of the central nervous system, with a market cap of $307.41 million.

Operations: The company generates revenue of $12.87 million from its focus on developing adeno-associated virus-based therapies for rare monogenic diseases.

Market Cap: $307.41M

Taysha Gene Therapies, Inc., with a market cap of US$307.41 million, operates in the biotech penny stock sector and remains pre-revenue despite generating US$1.11 million in sales for Q2 2024, down from US$2.4 million the previous year. The company has sufficient cash runway for over a year and holds more cash than its total debt, providing some financial stability amid ongoing losses—US$20.93 million net loss reported for Q2 2024 compared to US$24.6 million last year. Shareholder dilution occurred recently, while its addition to the S&P Global BMI Index marks an important milestone.

- Get an in-depth perspective on Taysha Gene Therapies' performance by reading our balance sheet health report here.

- Understand Taysha Gene Therapies' earnings outlook by examining our growth report.

Granite Point Mortgage Trust (NYSE:GPMT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Granite Point Mortgage Trust Inc. is a real estate investment trust that focuses on originating, investing in, and managing senior floating-rate commercial mortgage loans and other debt-related commercial real estate investments in the United States, with a market cap of approximately $157.37 million.

Operations: Granite Point Mortgage Trust's revenue segment is primarily derived from its REIT - Mortgage operations, reporting a revenue of -$140.09 million.

Market Cap: $157.37M

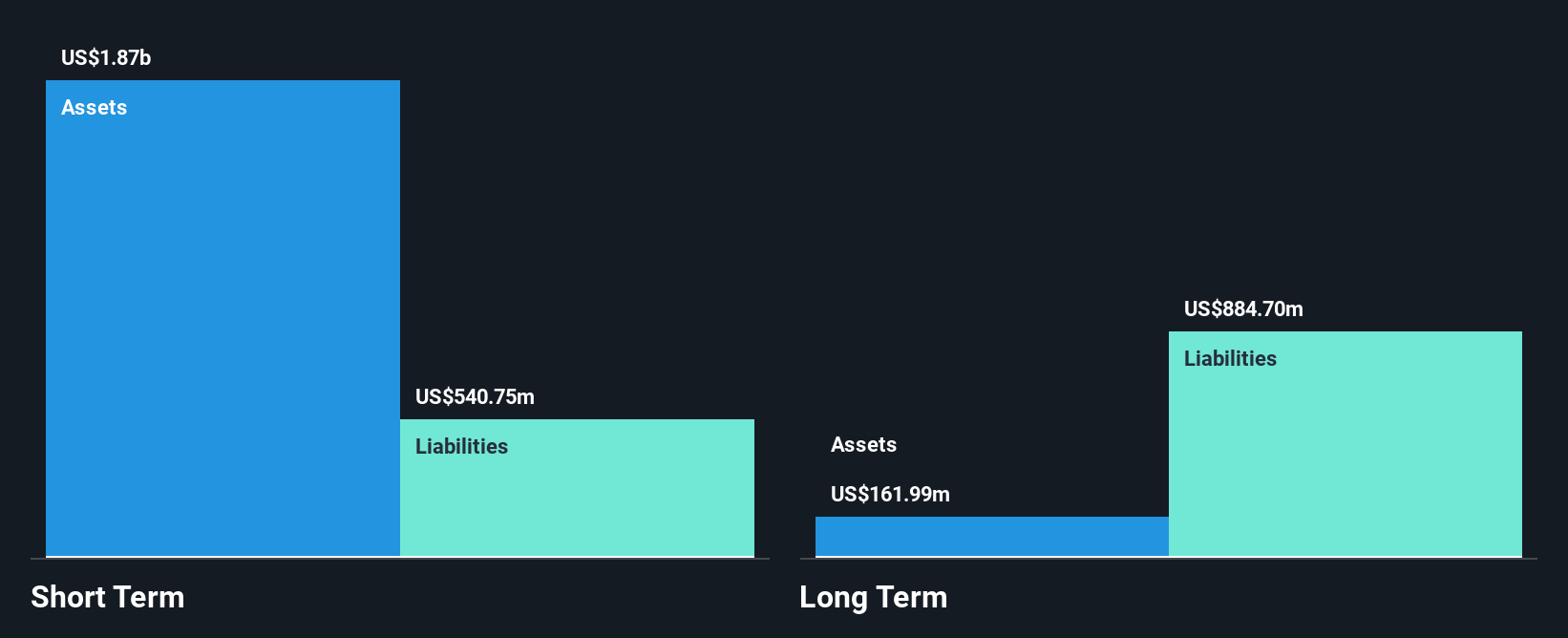

Granite Point Mortgage Trust, with a market cap of US$157.37 million, is currently unprofitable and reported a net loss of US$31.02 million for Q3 2024, up from US$20.94 million the previous year. Despite this, it maintains a strong cash position with short-term assets of US$2.2 billion exceeding both short- and long-term liabilities, providing a cash runway for over three years even as free cash flow shrinks slightly annually. The company's high net debt to equity ratio remains a concern; however, recent management changes and an increased share buyback plan may signal strategic adjustments moving forward.

- Click here and access our complete financial health analysis report to understand the dynamics of Granite Point Mortgage Trust.

- Gain insights into Granite Point Mortgage Trust's outlook and expected performance with our report on the company's earnings estimates.

Key Takeaways

- Navigate through the entire inventory of 738 US Penny Stocks here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GPMT

Granite Point Mortgage Trust

A real estate investment trust, originates, invests in, and manages senior floating-rate commercial mortgage loans, and other debt and debt-like commercial real estate investments in the United States.