- United States

- /

- Biotech

- /

- NasdaqGM:TNGX

Should Tango Therapeutics’ (TNGX) Strong Q3 Profitability Shift Prompt Investor Action?

Reviewed by Sasha Jovanovic

- Tango Therapeutics reported third quarter 2025 earnings, revealing revenue of US$53.81 million and a net income of US$15.88 million, compared to a net loss and lower revenue in the same period last year.

- This marked a major turnaround for the company, as it moved from loss to profitability on sharply higher revenue during the quarter.

- We'll explore how the company's positive swing to profitability in the third quarter shapes Tango Therapeutics' investment narrative.

Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

What Is Tango Therapeutics' Investment Narrative?

For anyone considering Tango Therapeutics, the big picture centers on belief in the company’s ability to turn breakthrough oncology research into consistent financial results. The third quarter’s move to both profitability and sharply higher revenue is a meaningful shift that could impact key short-term catalysts, like confidence in ongoing clinical trials and management’s ability to execute. Previously, risks such as sustained unprofitability, heavy share dilution, and concerns around high valuation metrics weighed heavily. Now, the swing to profitability may temporarily soften those worries, potentially providing breathing room as the company continues ambitious product development and ramps up cash needs after recent fundraises. That said, the valuation remains well above industry averages and, with lingering questions about sustained earnings, volatility tied to further trial outcomes or market expectations could intensify. The recent earnings beat may change risk calculations for both bulls and skeptics, at least in the near term. On the other hand, investors should not overlook the potential impact of share dilution after recent fundraising.

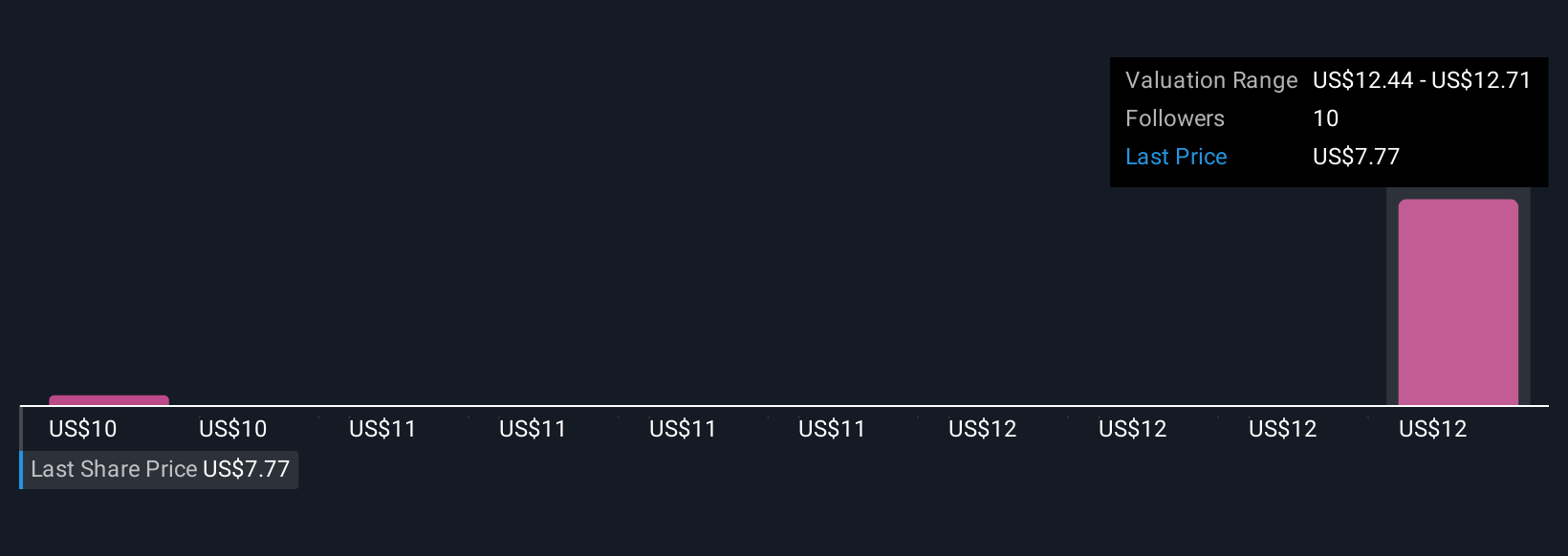

Insights from our recent valuation report point to the potential overvaluation of Tango Therapeutics shares in the market.Exploring Other Perspectives

Explore 2 other fair value estimates on Tango Therapeutics - why the stock might be worth just $10.00!

Build Your Own Tango Therapeutics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tango Therapeutics research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Tango Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tango Therapeutics' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tango Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:TNGX

Tango Therapeutics

A precision oncology company, focuses on the discovery and development of drugs in defined patient populations with unmet medical need.

Flawless balance sheet with low risk.

Market Insights

Community Narratives