- United States

- /

- Pharma

- /

- NasdaqGM:SUPN

Supernus Pharmaceuticals (SUPN) Is Down 17.4% After Raising 2025 Guidance Amid Margin and Supply Pressures – Has the Bull Case Changed?

Reviewed by Sasha Jovanovic

- Supernus Pharmaceuticals recently reported past third-quarter results with revenue and earnings exceeding expectations, driven by strong sales of its neurology products Qelbree, GOCOVRI, and the launch of ONAPGO, while also raising its 2025 revenue guidance to a range of US$685 million to US$705 million.

- The company's performance was powered by increased demand for new treatments but was tempered by higher acquisition-related expenses, operating margin pressures, and temporary supply constraints for ONAPGO, all of which influenced its updated outlook.

- Now, we'll assess how Supernus Pharmaceuticals' solid sales momentum and challenges from higher costs and supply constraints affect its investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Supernus Pharmaceuticals Investment Narrative Recap

To be a shareholder in Supernus Pharmaceuticals, you would need confidence in the company's ability to deliver sustained sales growth through its key neurology products while overcoming rising costs and operational losses. The recent quarterly beat and revenue guidance increase reaffirm momentum behind new launches, particularly ONAPGO, but short-term catalysts are now largely tied to resolving ONAPGO's supply constraints, currently the most immediate risk. The latest results do not materially change the importance of cost control and margin improvement as critical near-term watchpoints.

Among recent developments, the launch and rapid uptake of ONAPGO for Parkinson’s disease stands out, given strong prescriber interest and its significant sales contributions. However, as highlighted this quarter, unresolved supply bottlenecks have forced the company to limit access for new patients, partially restraining ONAPGO’s growth potential despite buoyant demand and serving as a crucial challenge to near-term revenue acceleration.

Yet, in contrast to headline growth, investors should be aware that ONAPGO’s supply delays and increasing expense pressures may...

Read the full narrative on Supernus Pharmaceuticals (it's free!)

Supernus Pharmaceuticals is projected to generate $837.3 million in revenue and $55.4 million in earnings by 2028. This outlook is based on an anticipated 7.8% yearly revenue growth but reflects a decrease in earnings of $6.5 million from the current $61.9 million.

Uncover how Supernus Pharmaceuticals' forecasts yield a $59.33 fair value, a 29% upside to its current price.

Exploring Other Perspectives

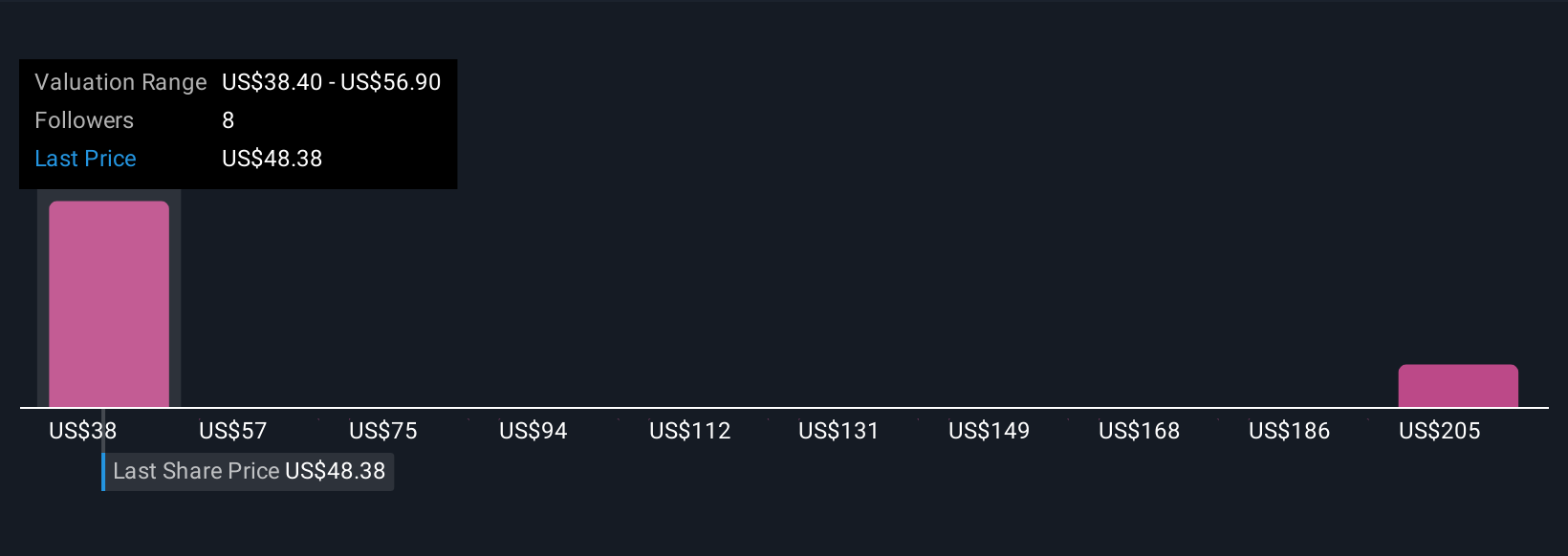

Three Simply Wall St Community fair value estimates for Supernus Pharmaceuticals span from US$38.40 to a high of US$217.63. While investor views differ widely, margin compression and supply risks remain critical for the company’s ongoing performance, consider exploring the full range of perspectives.

Explore 3 other fair value estimates on Supernus Pharmaceuticals - why the stock might be worth over 4x more than the current price!

Build Your Own Supernus Pharmaceuticals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Supernus Pharmaceuticals research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Supernus Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Supernus Pharmaceuticals' overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:SUPN

Supernus Pharmaceuticals

A biopharmaceutical company, develops and commercializes products for the treatment of central nervous system (CNS) diseases in the United States.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives