- United States

- /

- Biotech

- /

- NasdaqGS:STOK

Stoke Therapeutics (STOK) Profitability Milestone Tests Bullish Narratives as Earnings Face Declines

Reviewed by Simply Wall St

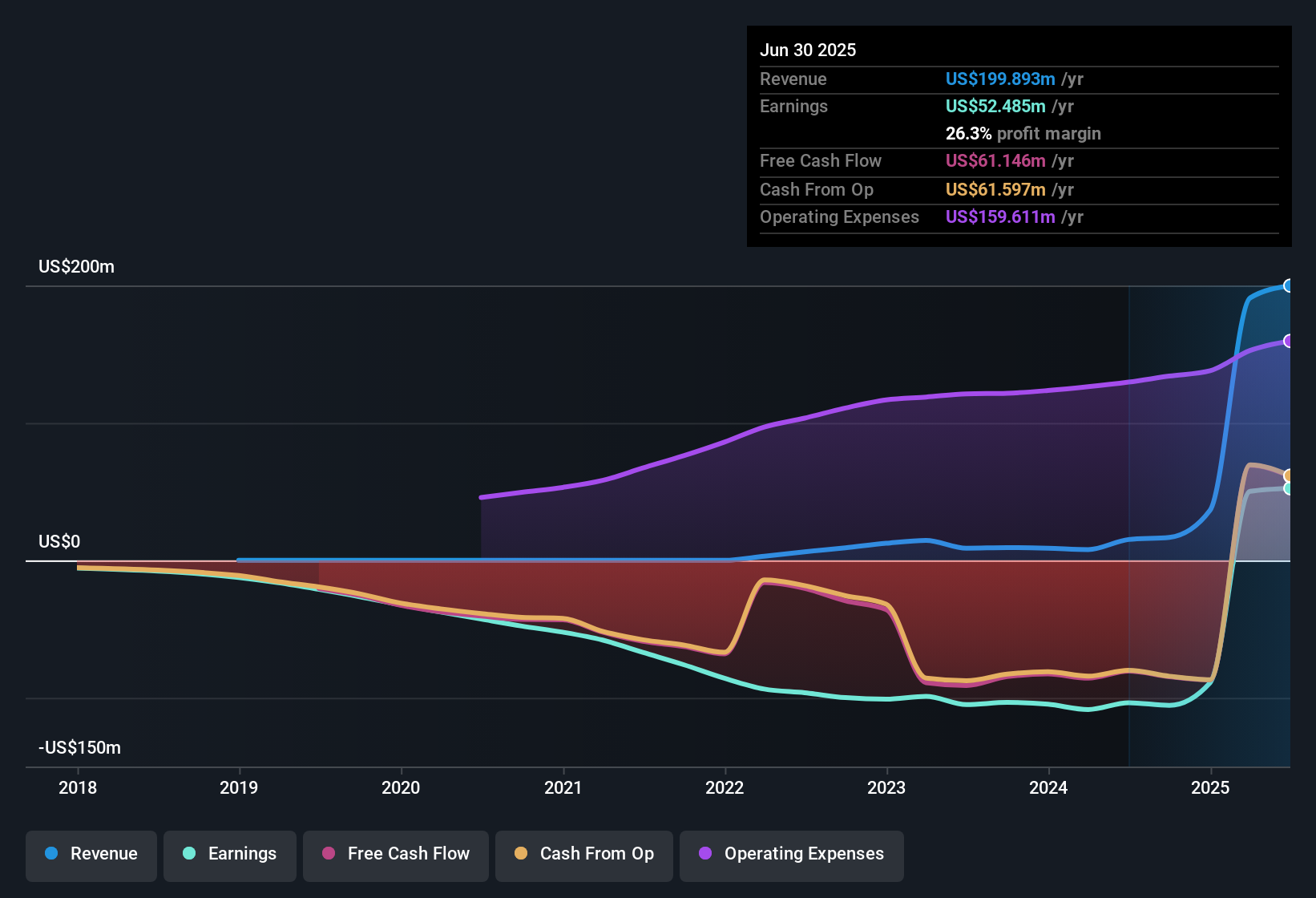

Stoke Therapeutics (STOK) has moved into profitability over the past year and is now forecasting revenue growth of 20.1% per year, which handily outpaces the broader US market's 10.5% annual growth expectation. However, earnings are projected to decline by 5.6% each year over the next three years, suggesting the company's recently achieved profit status may be tested as the bottom line comes under pressure. The premium valuation and mixed outlook put investor attention squarely on how management will execute and defend margins from this point forward.

See our full analysis for Stoke Therapeutics.Next, we will put these latest numbers in the context of the current market narratives to see which storylines hold up and which might need rethinking.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Status: Still New and Fragile

- Stoke has only just reached profitability, with earnings growing at a 7.3% annual rate over the past five years. However, forecasts now expect annual earnings to fall by 5.6% in the next three years, which is a quick reversal that illustrates how profit gains may be vulnerable.

- What’s surprising is that while this recent profit growth helps sentiment, the company’s future remains in flux as sustainability depends on top-line momentum and successful execution.

- Recent moves into profitability have captured attention. Yet, the fact that earnings are set to decline keeps investors focused on whether this turning point will persist or be short-lived.

- Pipeline progress and possible trial data announcements remain top of mind for those watching, as these can shift expectations rapidly when the business model is still transitioning.

Premium Valuation Outpaces Industry Peers

- Stoke is trading at a Price-To-Earnings Ratio of 23.8x, notably higher than both the US biotech industry average of 16.9x and its direct peer group at 22.5x. This reflects a meaningful premium in today’s share price.

- Market watchers point out that this premium price tag heavily supports optimism for strong revenue growth, but stretches the risk if projected earnings declines materialize.

- The expectation for ongoing 20.1% annual revenue growth puts Stoke in a favorable light, justifying some of the valuation enthusiasm, especially compared to the broader US market’s 10.5% growth forecast.

- At the same time, the lack of a discounted cash flow fair value estimate removes a key reference point, making the current share price more sensitive to swings in sentiment and news flow.

Share Price Swings and Margin Scrutiny

- Stoke’s share price has shown instability over the past three months, bringing increased attention to how management will defend profit margins given the forecast for earnings declines amid strong revenue increases.

- Bears argue that market volatility is a warning sign, especially since profit outlooks are pressured, the rate of margin improvement may slow, and value could compress quickly in the face of setback.

- Share price movements often reflect shifting investor attitudes, with swings amplified when fundamentals are challenged or industry risks are in the spotlight.

- Scrutiny is likely to intensify if margins slip or if there is any stumble in execution, since the profitability milestone is still recent and untested.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Stoke Therapeutics's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite strong revenue growth forecasts, Stoke's recent profitability is shaky. Projected earnings declines raise concerns about sustaining performance and justifying its premium valuation.

If consistent track records matter to you, use stable growth stocks screener (2073 results) and focus on companies with reliable, steady earnings and revenue growth that aren’t vulnerable to sharp reversals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:STOK

Stoke Therapeutics

An early-stage biopharmaceutical company, engages in the development of treatments for severe genetic diseases by upregulating protein expression.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives