- United States

- /

- Biotech

- /

- NasdaqGS:SRPT

Should Investors View Sarepta (SRPT) Differently After ESSENCE Study Details and Q3 Results?

Reviewed by Sasha Jovanovic

- In the past week, Sarepta Therapeutics reported third-quarter 2025 earnings with revenue of US$399.36 million and a net loss of US$179.95 million, alongside announcing results from the Phase 3 ESSENCE study of its Duchenne muscular dystrophy therapies AMONDYS 45 and VYONDYS 53, which did not meet the primary endpoint for statistical significance overall.

- An updated analysis of the ESSENCE trial excluding COVID-impacted periods showed a potentially meaningful reduction in disease progression for non-impacted patients and plans are underway to seek traditional FDA approval, highlighting the company’s emphasis on real-world evidence and long-term benefits of its therapies.

- To understand how these results could affect Sarepta's growth outlook, we'll explore how the ESSENCE study outcomes and recent earnings performance shape its investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Sarepta Therapeutics Investment Narrative Recap

The core belief for Sarepta shareholders centers on the success of its Duchenne muscular dystrophy portfolio and the company’s ability to expand product approvals, especially with recent attention on ESSENCE study results for AMONDYS 45 and VYONDYS 53. Despite topline results missing statistical significance, the subgroup analyses and safety data suggest the short-term catalyst, full FDA approval of these therapies, remains, although the biggest risk around regulatory scrutiny and confidence in the broader exon-skipping and gene therapy pipeline is still present. Overall, the recent news does not materially change the main catalysts or risks but adds complexity to the regulatory dialogue that investors will be monitoring closely. One particularly relevant recent announcement was Sarepta’s revised full-year 2025 revenue guidance to between US$2.3 billion and US$2.6 billion, down from an earlier range of US$2.9 billion to US$3.1 billion. This guidance revision reflects the intersection of product launch dynamics, operational bottlenecks, and macro challenges discussed in the latest earnings and underpins why regulatory clarity and further safety and efficacy updates for AMONDYS 45, VYONDYS 53, and ELEVIDYS remain key short-term inflection points. However, against the optimism of advancing therapies, investors should not overlook growing regulatory scrutiny and how...

Read the full narrative on Sarepta Therapeutics (it's free!)

Sarepta Therapeutics' narrative projects $1.4 billion revenue and $171.6 million earnings by 2028. This requires a 17.0% yearly revenue decline and a $229.6 million earnings increase from current earnings of -$58.0 million.

Uncover how Sarepta Therapeutics' forecasts yield a $21.55 fair value, a 22% upside to its current price.

Exploring Other Perspectives

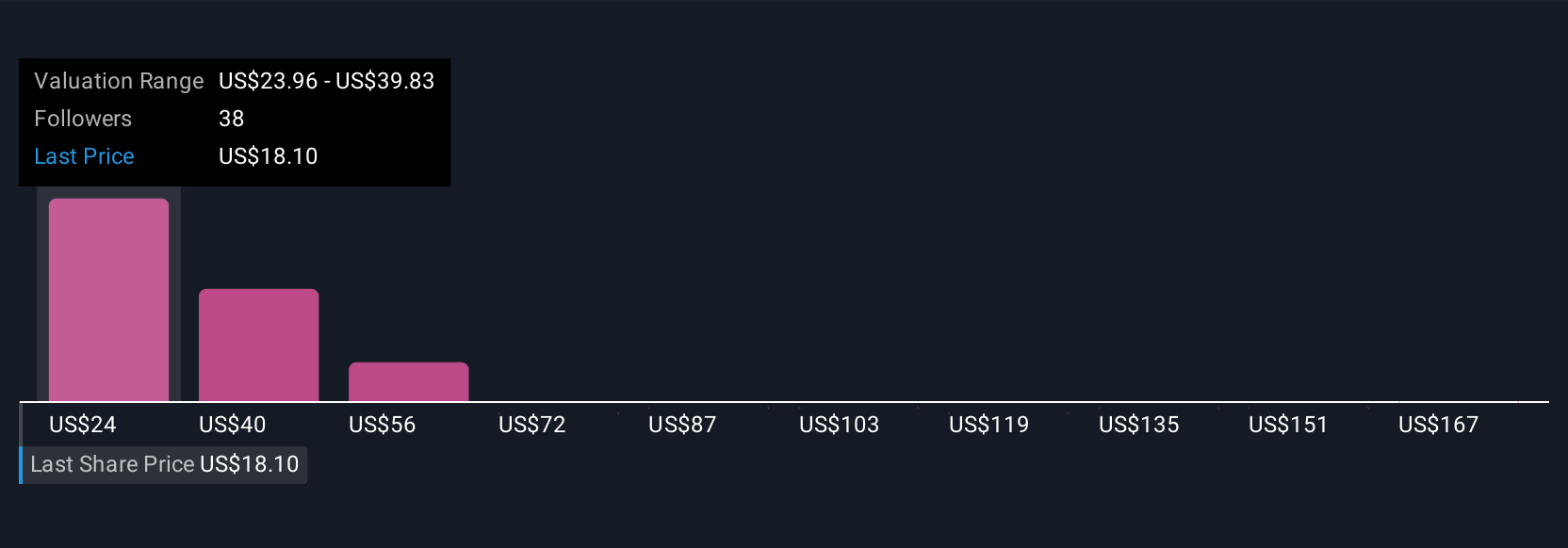

Ten fair value estimates from the Simply Wall St Community range widely, from US$21.55 to US$168.51 per share. With regulatory concerns now in focus after the ESSENCE findings, expect opinions and investment strategies to vary even further.

Explore 10 other fair value estimates on Sarepta Therapeutics - why the stock might be worth just $21.55!

Build Your Own Sarepta Therapeutics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sarepta Therapeutics research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Sarepta Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sarepta Therapeutics' overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SRPT

Sarepta Therapeutics

A commercial-stage biopharmaceutical company, focuses on the discovery and development of RNA-targeted therapeutics, gene therapies, and other genetic therapeutic modalities for the treatment of rare diseases.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives