- United States

- /

- Biotech

- /

- NasdaqGS:SNDX

FDA Expansion and Rising Revenues Could Be a Game Changer for Syndax Pharmaceuticals (SNDX)

Reviewed by Sasha Jovanovic

- Syndax Pharmaceuticals recently reported third-quarter earnings, revealing revenue of US$45.87 million and a reduced net loss compared to the previous year, driven by strong sales of lead therapies Revuforj and Niktimvo.

- Following FDA approval that expanded Revuforj’s indications and a significant increase in inducement equity awards to attract key talent, Syndax signals a commitment to broadening its footprint in oncology.

- We'll explore how Syndax’s rapid revenue growth and expanded market reach could reshape its future investment outlook.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Syndax Pharmaceuticals Investment Narrative Recap

To be a Syndax Pharmaceuticals shareholder, you need conviction in the company's ability to transform consistent revenue gains from its newly approved therapies, particularly Revuforj and Niktimvo, into long-term profitability. While the latest earnings report shows rapid sales growth and reduced losses, the importance of continued label expansion and early-line adoption for these two drugs remains the main short-term catalyst, with any clinical or regulatory setback representing the biggest risk; these recent figures, though strong, do not meaningfully change that equation for now.

Among recent announcements, the FDA's expanded approval for Revuforj directly ties to this quarter’s revenue jump and is highly relevant to the near-term catalyst, as it significantly increases the drug’s addressable market and underpins ambitions for ongoing revenue acceleration.

Yet, in contrast, investors should be aware that concentrated dependence on just two lead products could magnify the financial impact if one encounters...

Read the full narrative on Syndax Pharmaceuticals (it's free!)

Syndax Pharmaceuticals' narrative projects $603.4 million in revenue and $43.5 million in earnings by 2028. This requires 97.8% yearly revenue growth and a $378.5 million increase in earnings from -$335.0 million today.

Uncover how Syndax Pharmaceuticals' forecasts yield a $38.85 fair value, a 147% upside to its current price.

Exploring Other Perspectives

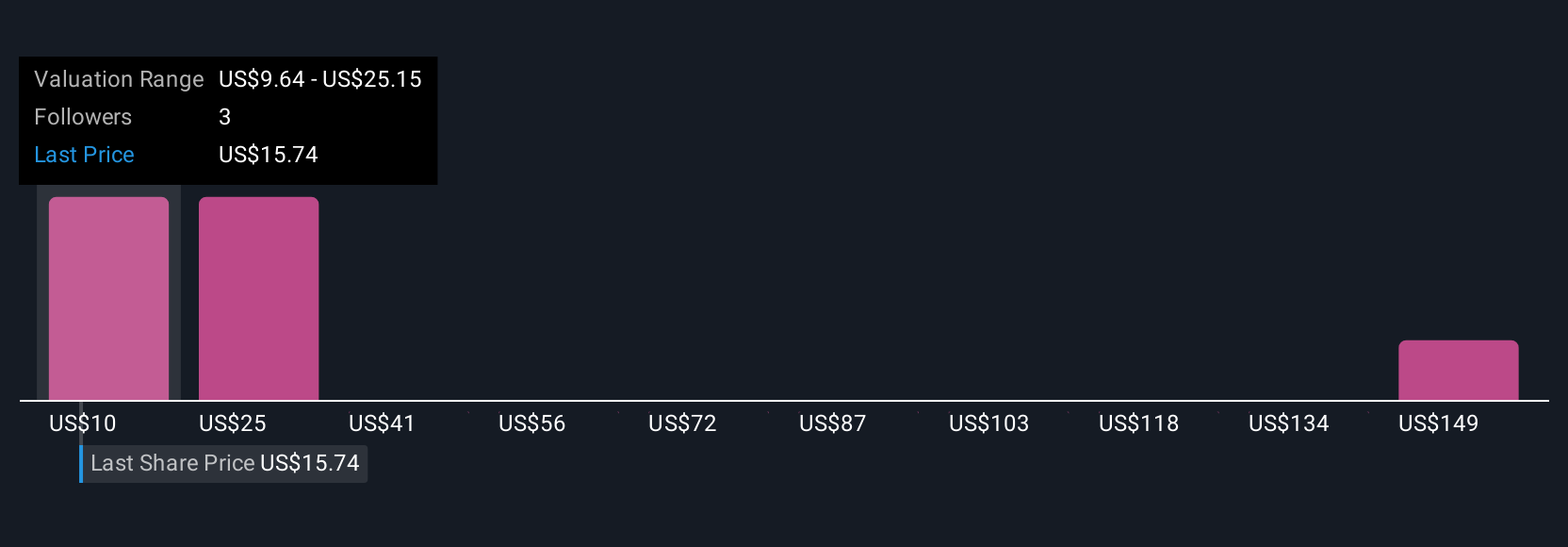

Six distinct fair value estimates from the Simply Wall St Community span from US$9.64 up to US$208.36 per share. With this wide range, it is critical to consider that heavy reliance on Revuforj and Niktimvo can heighten exposure to any clinical or regulatory challenges, which may sharply affect future returns, explore these diverse viewpoints before forming your outlook.

Explore 6 other fair value estimates on Syndax Pharmaceuticals - why the stock might be a potential multi-bagger!

Build Your Own Syndax Pharmaceuticals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Syndax Pharmaceuticals research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Syndax Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Syndax Pharmaceuticals' overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SNDX

Syndax Pharmaceuticals

A commercial-stage biopharmaceutical company, develops therapies for the treatment of cancer.

Exceptional growth potential with adequate balance sheet.

Market Insights

Community Narratives