- United States

- /

- Biotech

- /

- NasdaqGM:SMMT

Does Positive Lung Cancer Trial Data Change the Bull Case for Summit Therapeutics (SMMT)?

Reviewed by Sasha Jovanovic

- Summit Therapeutics recently announced that the HARMONi-A Phase III trial of ivonescimab combined with chemotherapy in non-small cell lung cancer patients showed significant improvements in overall survival, reducing the risk of death by 26%.

- This clinical progress underscores ivonescimab’s potential to address gaps in cancer care where other therapies have not succeeded.

- We’ll explore how these promising trial results could reshape Summit Therapeutics’ investment narrative, especially given ivonescimab’s unique benefits in lung cancer treatment.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Summit Therapeutics' Investment Narrative?

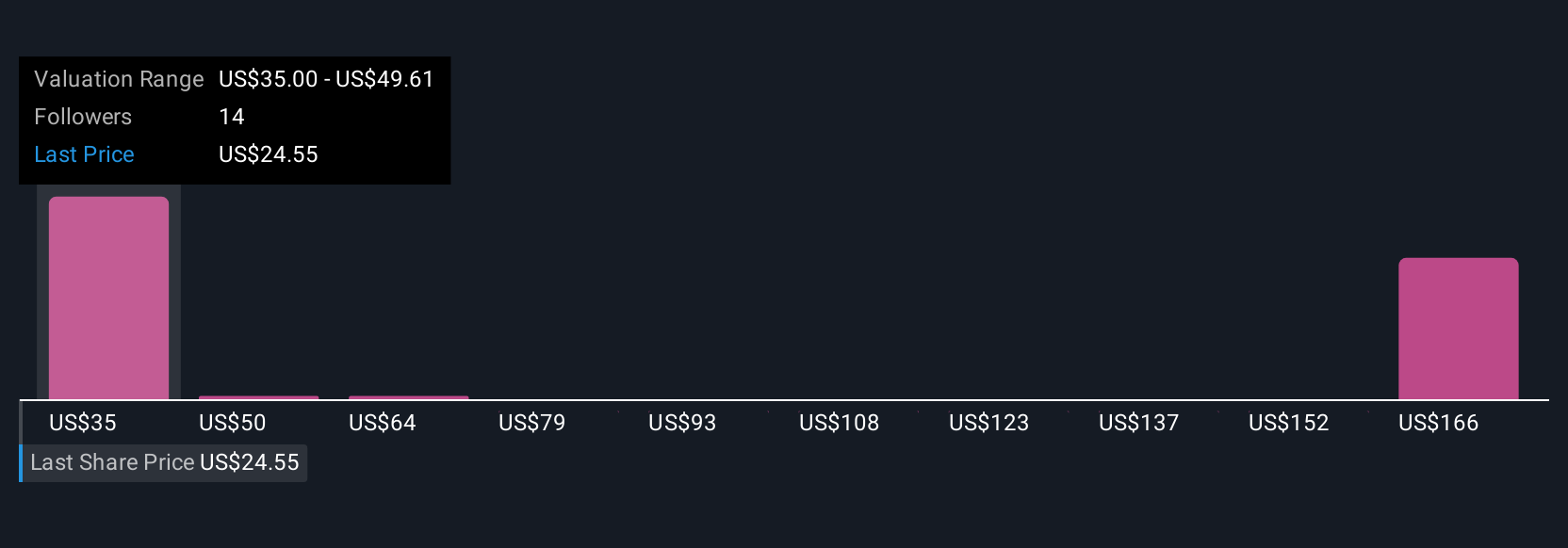

For most shareholders, the big picture behind Summit Therapeutics is all about buying into the pipeline’s promise, especially with ivonescimab’s recent Phase III results putting a spotlight on the potential for first-in-class therapies in lung cancer. With survival benefits now validated in a large trial, one of the biggest near-term catalysts, regulatory submission and potential approval, feels closer at hand and could change the company’s outlook. The recent shelf registration for US$513.1 million and the large private placement suggest bold ambitions but also highlight ongoing cash needs due to mounting losses and zero revenue. While analysts previously emphasized Summit’s fast forecasted revenue growth, persistent and growing losses remain a significant risk, especially when compared to peers. The positive trial news could lessen uncertainty around clinical risk, but financing and profitability challenges continue to loom large in the short term.

On the flip side, dilution risk from new share issuances is worth considering, as it could affect existing holdings.

Exploring Other Perspectives

Explore 6 other fair value estimates on Summit Therapeutics - why the stock might be worth over 10x more than the current price!

Build Your Own Summit Therapeutics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Summit Therapeutics research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Summit Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Summit Therapeutics' overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:SMMT

Summit Therapeutics

A biopharmaceutical company, focuses on discovery, development, and commercialization of patient, physician, caregiver, and societal friendly medicinal therapies.

Flawless balance sheet with low risk.

Market Insights

Community Narratives