- United States

- /

- Biotech

- /

- NasdaqCM:SLNO

Soleno Therapeutics (SLNO): Rethinking Valuation After Unexpected Q3 Profit Turnaround

Reviewed by Simply Wall St

Soleno Therapeutics (SLNO) released its third quarter results, revealing a swing from a large net loss last year to positive net income. This change is catching the attention of investors who are eager for signs of progress.

See our latest analysis for Soleno Therapeutics.

That shift to positive net income may be fueling renewed investor interest, especially after Soleno’s share price jumped 9.55% in a single day despite a challenging recent stretch. While short-term momentum remains volatile given last week’s 28.98% decline and a 23.97% drop over the past month, the real standout is the company’s 4,400% total shareholder return over three years. This impressive run highlights the stock’s long-term growth story, even if it has hit a rough patch lately.

If you’re intrigued by big moves and even bigger potential turnarounds, it’s worth broadening your search and discovering fast growing stocks with high insider ownership

The big question now is whether Soleno Therapeutics’ turnaround means the stock is trading at a bargain, or if the current share price already reflects anticipated future gains and leaves little room for upside.

Price-to-Sales of 26x: Is it justified?

Soleno Therapeutics trades at a lofty price-to-sales ratio of 26x, notably higher than both its peers and the broader U.S. Biotech sector. With the stock closing at $47.70, investors pay a steep premium relative to the company’s current level of sales.

The price-to-sales (P/S) ratio measures how much investors are willing to pay for each dollar of a company’s revenue. This valuation metric is often used for growth-stage biotech firms that are not yet profitable. A high P/S can suggest that the market expects substantial future growth, especially for companies with promising products or pipelines.

For Soleno, the P/S multiple is significantly above the peer group average of 10x and the broader U.S. Biotech industry average of 11.2x. Even the estimated fair P/S ratio for the company is 21.6x, which is well below where the stock is currently trading. This indicates that the market's expectations for Soleno exceed the growth already priced into both its sector and historical comparables.

Explore the SWS fair ratio for Soleno Therapeutics

Result: Preferred multiple of 26x price-to-sales (OVERVALUED)

However, continued revenue volatility and the company’s steep valuation remain risks. These factors could trigger a shift in market sentiment going forward.

Find out about the key risks to this Soleno Therapeutics narrative.

Another View: SWS DCF Model Suggests a Different Story

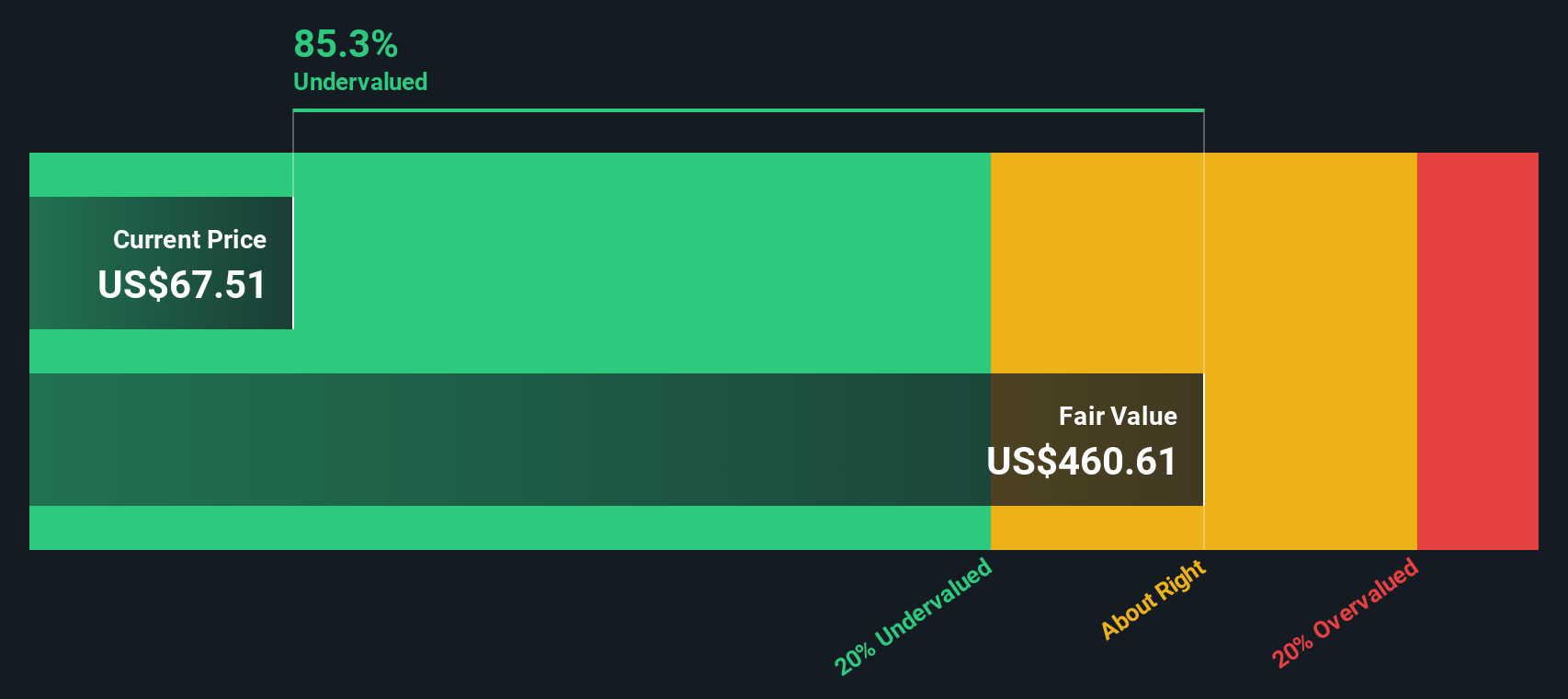

While the price-to-sales ratio points to Soleno being overvalued, the SWS DCF model presents a very different perspective. According to this method, Soleno’s shares trade at nearly 90% below their estimated fair value, based on long-term cash flow forecasts. Can such a sizable gap signal overlooked potential, or are there hidden risks the market sees?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Soleno Therapeutics for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Soleno Therapeutics Narrative

If our analysis doesn’t quite fit your view or you’d rather dive into the numbers yourself, you can craft your own narrative in just a few minutes with Do it your way.

A great starting point for your Soleno Therapeutics research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t leave your portfolio’s potential on the table. Use the Simply Wall Street Screener to quickly spot fresh, actionable investment angles you might have missed:

- Uncover regular income opportunities by tapping into these 16 dividend stocks with yields > 3% with yields above 3%, which is suitable for building a steady cash flow.

- Ride the wave of disruptive innovation and outsmart the market by exploring these 24 AI penny stocks, which are reshaping tomorrow’s industries with real AI breakthroughs.

- Capitalize on the overlooked gems of digital finance and security by checking out these 82 cryptocurrency and blockchain stocks, as these are transforming the blockchain landscape.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:SLNO

Soleno Therapeutics

A clinical-stage biopharmaceutical company, focuses on the development and commercialization of novel therapeutics for the treatment of rare diseases.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives