- United States

- /

- Life Sciences

- /

- NasdaqGS:SHC

A Look at Sotera Health (SHC) Valuation After $471M Equity Offering and Robust Q3 Results

Reviewed by Simply Wall St

Sotera Health (SHC) drew the market’s eye after completing a $471 million follow-on equity offering, just days after reporting strong third quarter results and confirming its full-year revenue outlook.

See our latest analysis for Sotera Health.

Strong quarterly results and the $471 million equity raise gave Sotera Health a shot of momentum, but investors have already seen plenty of action this year. The company’s share price has climbed 18.4% year-to-date, and while its latest 1-year total shareholder return sits at 3.8%, the three-year total return of 131% underscores how much the longer-term trend remains firmly positive.

If Sotera’s mix of growth and resilience got your attention, you might want to broaden your search and uncover opportunities among fast growing stocks with high insider ownership.

But with shares already up this year and new capital in hand, the big question remains: Is Sotera Health still attractively valued, or has the market already factored in the company’s next phase of growth?

Most Popular Narrative: 5% Undervalued

With Sotera Health closing at $16.13 and the most widely followed narrative pegging fair value at $17, there is a modest upside eyed by the market’s consensus. This staged premium reflects analyst optimism about key underlying drivers supporting earnings and profitability.

Continued investments in high-efficiency and expanded sterilization capacity, including recently launched and planned facility expansions, will enhance Sotera Health's ability to capture incremental market share and drive margin improvement as new capacity comes online, positively impacting EBITDA and net margins.

What exactly powers this bullish stance? There is a clear set of optimistic bets fueling these numbers, including significant shifts in margins, future profits, and revenue momentum that most companies can only dream about. Wondering how these projections align to that price target? Explore the narrative and uncover the assumptions that sent Sotera’s fair value above the current price.

Result: Fair Value of $17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing regulatory scrutiny and rising compliance costs could limit Sotera Health’s potential. These factors may act as catalysts that challenge the current growth outlook.

Find out about the key risks to this Sotera Health narrative.

Another View: Are Shares as Cheap as They Look?

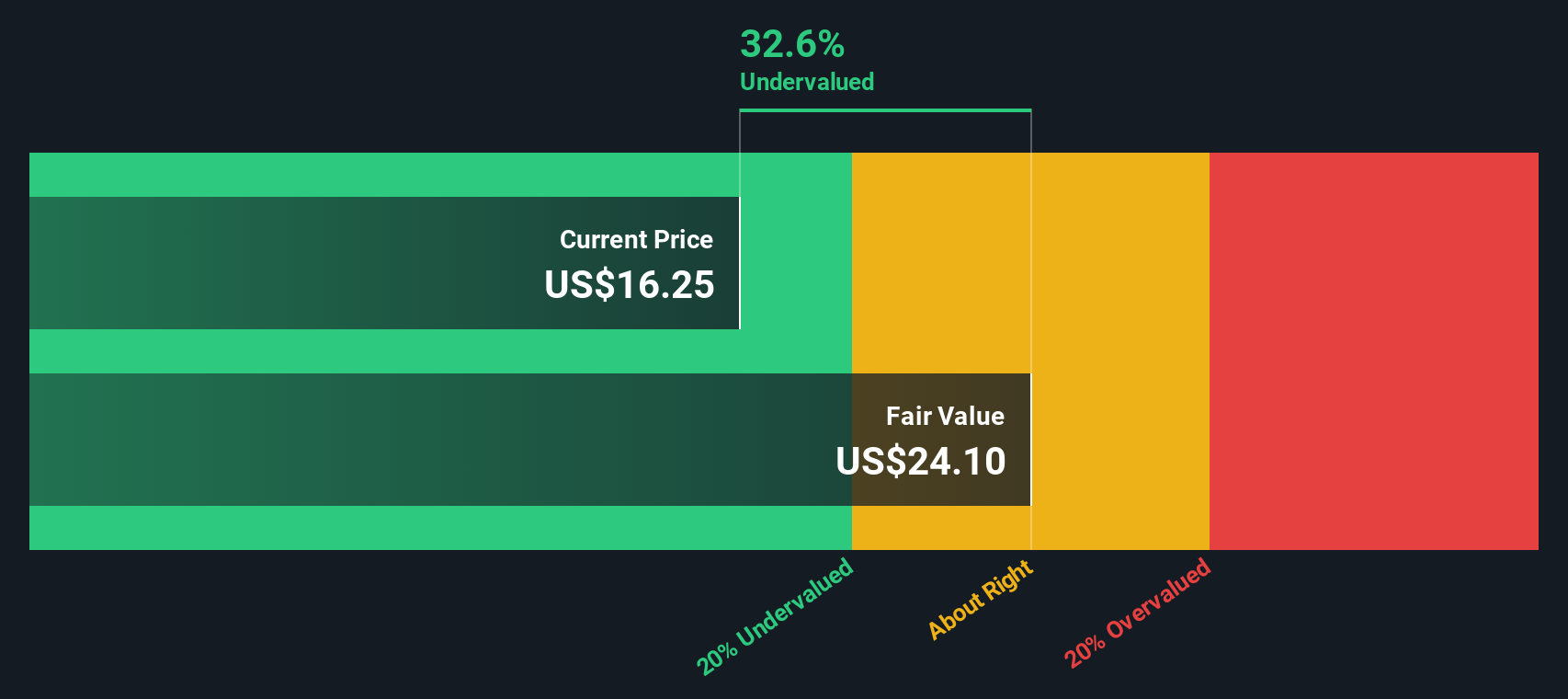

While the analyst consensus views Sotera Health as moderately undervalued based on future profits, our SWS DCF model takes a different stance. It suggests Sotera could be trading nearly 33% below its fair value, which is a much larger gap. Could this be a rare opportunity or just a difference in outlook?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Sotera Health Narrative

If you want to see the numbers differently or would rather put your own thinking to the test, it's easy to create your own Sotera Health narrative in just a few minutes, your way. Do it your way.

A great starting point for your Sotera Health research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investing Ideas?

Act now to spot tomorrow’s winners before everyone else. These hand-picked investment angles could reveal strong returns and set your portfolio apart.

- Unlock income potential and strengthen your holdings with these 15 dividend stocks with yields > 3% offering yields over 3% and proven reliability in fluctuating markets.

- Tap into groundbreaking breakthroughs and up-and-coming innovations by checking out these 25 AI penny stocks leading AI-driven transformation across industries.

- Capitalize on value by zeroing in on these 855 undervalued stocks based on cash flows that the market is overlooking for future growth potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SHC

Sotera Health

Provides sterilization, lab testing, and advisory services for the healthcare industry in the United States, Canada, Europe, and internationally.

Reasonable growth potential with low risk.

Similar Companies

Market Insights

Community Narratives