- United States

- /

- Biotech

- /

- NasdaqCM:SGMO

Sangamo Therapeutics (SGMO) Is Down 21.1% After Nasdaq Compliance Extension and Q3 Revenue Decline - Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- Sangamo Therapeutics recently reported its third-quarter 2025 results, revealing a sharp year-over-year revenue decline to US$581,000 and a net loss of US$34.93 million.

- Alongside operational losses, the company was granted a 180-day Nasdaq extension to regain compliance with minimum bid price rules, highlighting concerns around ongoing listing status.

- We will assess how these financial pressures and Nasdaq compliance challenges weigh on Sangamo's investment outlook and pipeline momentum.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Sangamo Therapeutics Investment Narrative Recap

Shareholders in Sangamo Therapeutics are essentially betting on the company's ability to deliver a breakthrough in gene therapy, particularly with its Fabry disease program, while successfully bridging current funding and listing challenges. The recent sharp revenue decline and ongoing Nasdaq compliance extension directly emphasize the biggest near-term risk, securing sufficient capital or a commercialization partner before running out of cash, while clinical momentum remains a crucial potential catalyst; as of now, this news materially heightens focus on these risks without altering the core near-term catalyst.

Amid these challenges, Sangamo’s announcement of positive midway results from its Phase 1/2 STAAR study in Fabry disease stands out, as recent FDA engagement clarified the regulatory path to accelerated approval. This progress provides a critical catalyst for potential future revenue, but operational and financial pressures threaten to slow the transition from pipeline to commercialization.

However, investors should be aware that despite a promising clinical milestone, Sangamo’s ability to regain financial and listing stability will depend on...

Read the full narrative on Sangamo Therapeutics (it's free!)

Sangamo Therapeutics' outlook anticipates $167.9 million in revenue and $27.0 million in earnings by 2028. Achieving this would require 27.1% annual revenue growth and an $90.3 million increase in earnings from the current $-63.3 million.

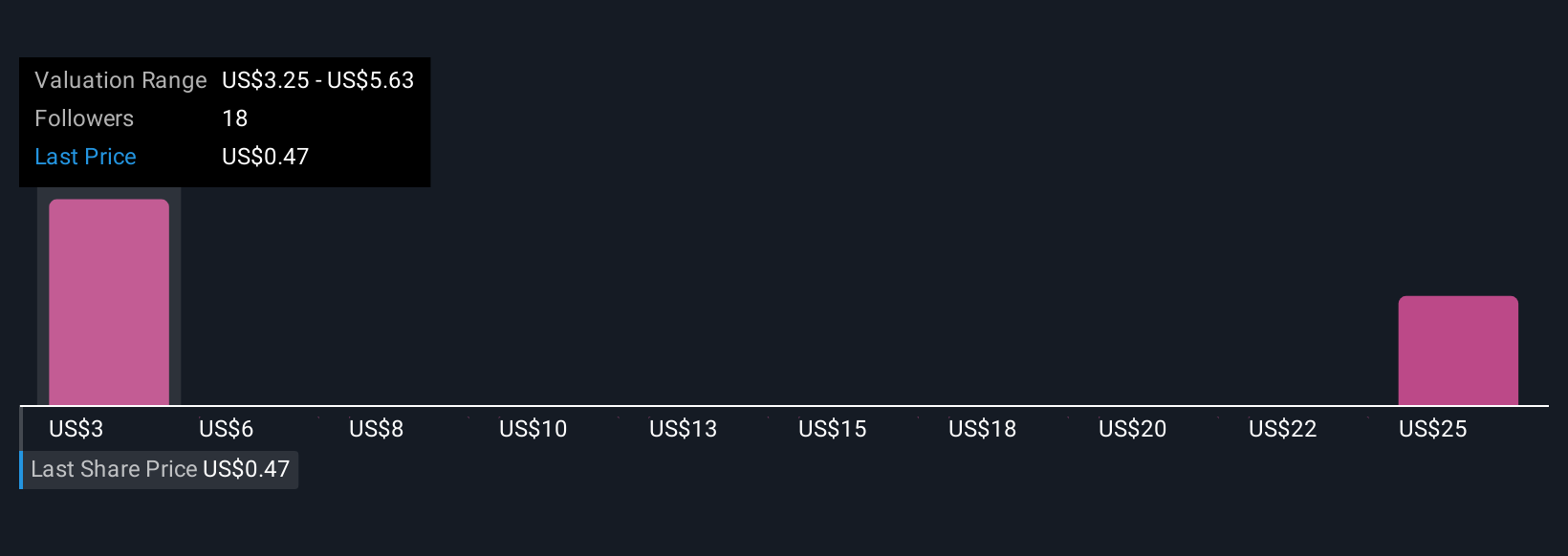

Uncover how Sangamo Therapeutics' forecasts yield a $3.25 fair value, a 589% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members place Sangamo’s fair value anywhere from US$3.25 to US$27.03, based on four distinct analyses. While estimates vary widely, many continue to see the upcoming Fabry study results and accelerated approval opportunity as holding major implications for future performance.

Explore 4 other fair value estimates on Sangamo Therapeutics - why the stock might be worth just $3.25!

Build Your Own Sangamo Therapeutics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sangamo Therapeutics research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Sangamo Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sangamo Therapeutics' overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:SGMO

Sangamo Therapeutics

A clinical-stage genomic medicine company, focuses on translating science into medicines that transform the lives of patients and families afflicted with serious diseases in the United States.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives