- United States

- /

- Biotech

- /

- NasdaqGM:RNA

Should Doubling of Net Losses in Q3 Require Action From Avidity Biosciences (RNA) Investors?

Reviewed by Sasha Jovanovic

- Avidity Biosciences, Inc. recently announced its third quarter 2025 earnings, reporting a net loss of US$174.44 million, more than double the loss from the same period last year.

- This considerable increase in losses may point to higher operating expenses or other challenges impacting the company's financial trajectory.

- With heightened net losses as a focal point, we'll explore how this development shapes Avidity Biosciences' investment narrative moving forward.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Avidity Biosciences' Investment Narrative?

For investors in Avidity Biosciences, the big-picture thesis has always hinged on the company's clinical pipeline, upcoming regulatory milestones, and the recently announced US$10.6 billion takeover by Novartis. The sharp rise in third-quarter net losses, doubling to US$174.44 million compared to last year, may raise some eyebrows but appears unlikely to materially alter the central short-term catalysts, which remain focused on the planned biologics license application (BLA) submission for del-zota and the anticipated Phase 3 data for del-desiran. With Novartis set to acquire the company, the importance of standalone financial performance arguably recedes in the near-term, although accelerated losses could still impact negotiations around subsidiary spinoffs and payouts. The most pressing risk now is whether ongoing operating costs or unexpected setbacks could delay clinical or regulatory timelines before the acquisition closes, potentially affecting shareholder outcomes.

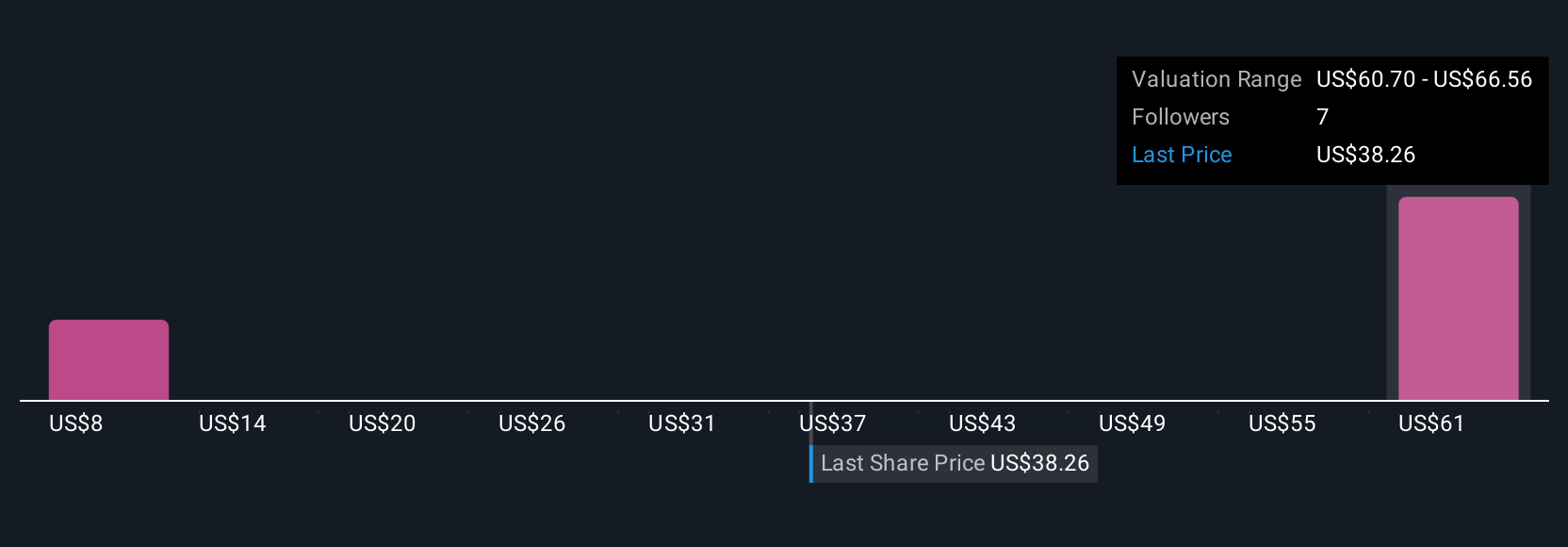

On the other hand, investors may want to watch for any signs of regulatory delays or cost overruns. Avidity Biosciences' shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 2 other fair value estimates on Avidity Biosciences - why the stock might be worth 49% less than the current price!

Build Your Own Avidity Biosciences Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Avidity Biosciences research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Avidity Biosciences research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Avidity Biosciences' overall financial health at a glance.

Interested In Other Possibilities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:RNA

Avidity Biosciences

A biopharmaceutical company, engages in the delivery of RNA therapeutics called antibody oligonucleotide conjugates (AOCs).

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives