- United States

- /

- Biotech

- /

- NasdaqGS:QURE

A Deep Dive into uniQure (QURE) Valuation After FDA Uncertainty Shakes Huntington’s Disease Program

Reviewed by Simply Wall St

uniQure (NasdaqGS:QURE) shares experienced a sharp reaction after the FDA unexpectedly indicated that Phase I/II data for AMT-130 in Huntington’s disease may not support the company’s Biologics License Application. This change introduces new regulatory uncertainty for investors.

See our latest analysis for uniQure.

This regulatory curveball comes after a volatile year for uniQure. Enthusiasm from promising clinical trial results quickly turned to caution as investors reassessed the timeline and likelihood of AMT-130’s approval. Even with revenue growth and clinical milestones, the 1-day share price return of nearly 18% reflects how sensitive the stock is to regulatory news, especially after last month's sharp 49.9% decline. Looking longer term, total shareholder return over the past year has soared more than 350% as expectations for gene therapy innovation have ebbed and surged with each new update.

If recent volatility has you eager to find opportunities with improving momentum, now is an ideal moment to discover fast growing stocks with high insider ownership.

With such dramatic swings and regulatory uncertainty clouding the outlook, investors are left to decide whether uniQure is undervalued at current levels or if the market is already factoring in the risks and future growth. Is this a genuine buying opportunity, or is everything already priced in?

Most Popular Narrative: 58.9% Undervalued

The most widely followed narrative values uniQure at $75.09 per share, far above the last close of $30.84. This dramatic gap between price and perceived worth sets the stage for an in-depth look at the catalysts behind the valuation.

The potential accelerated approval for AMT-130 in treating Huntington's disease could significantly boost future revenues as it would be one of the first disease-modifying treatments available for this condition. Expansion of the clinical pipeline with new studies in refractory temporal lobe epilepsy, Fabry disease, and SOD1-ALS could lead to additional revenue streams if these treatments are successful and commercialized.

What drives such an ambitious price target? The blueprint behind this narrative involves bold revenue growth assumptions and breakthrough profit margins that most companies only dream of. Want to see how analysts connect future market leadership with explosive earnings power? The surprising math behind this story is just a click away.

Result: Fair Value of $75.09 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing dependence on AMT-130’s regulatory progress and potential manufacturing challenges means setbacks in either area could quickly change uniQure’s outlook.

Find out about the key risks to this uniQure narrative.

Another View: Is uniQure Actually Overvalued on Book Value?

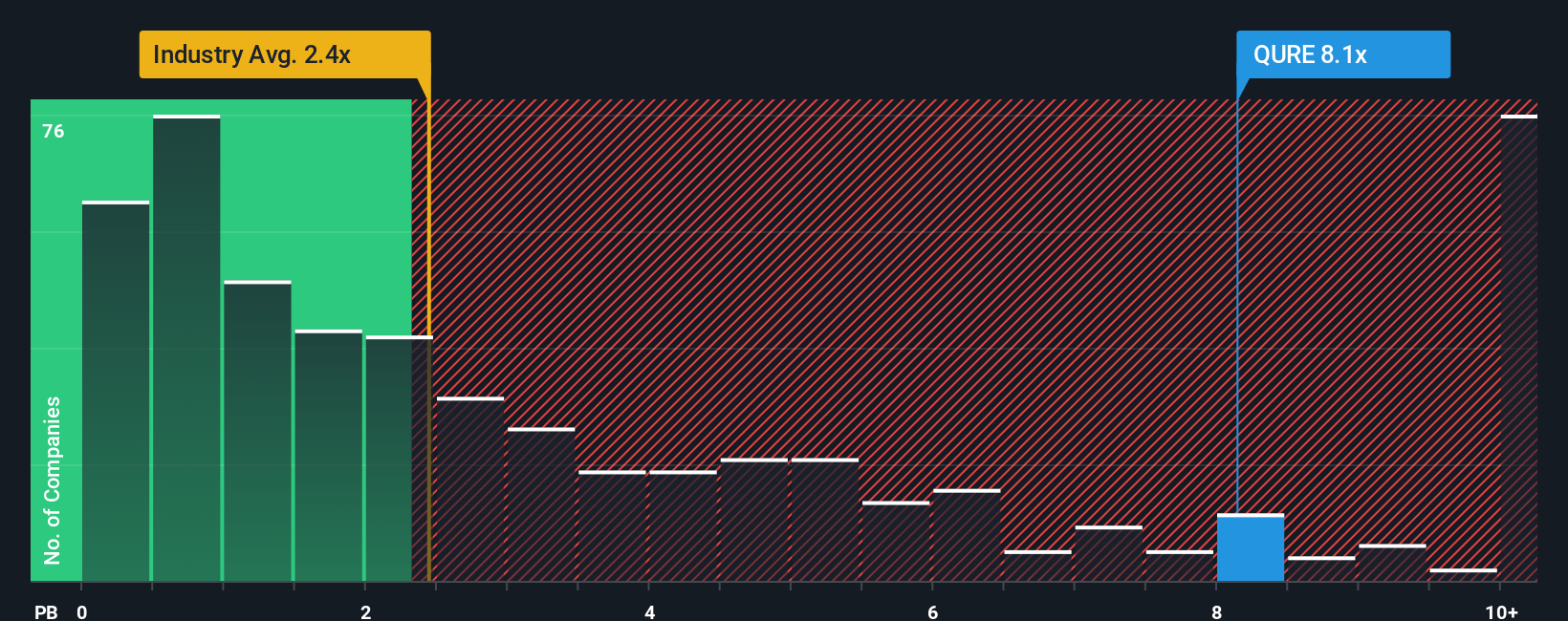

While our fair value estimate suggests uniQure is deeply undervalued, a look at its price-to-book ratio paints a different picture. At 8.3x, uniQure trades far above both its peer average (5.2x) and the US Biotechs industry average (2.5x). This signals that the market is pricing in a lot of optimism, raising questions about potential valuation risks.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own uniQure Narrative

If you see the numbers differently or want your own take on uniQure's story, you can build a narrative using the data in just a few minutes. Do it your way.

A great starting point for your uniQure research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never settle for just one angle. You could be a step ahead by checking out these handpicked opportunities before the market acts.

- Boost your portfolio’s income potential and see which companies are offering more than 3% yields with these 15 dividend stocks with yields > 3%.

- Ride the momentum in artificial intelligence by tapping into tremendous growth stories through these 25 AI penny stocks.

- Catch undervalued winners early by using these 858 undervalued stocks based on cash flows to see which companies look set for a re-rating based on solid cash flow metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if uniQure might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:QURE

uniQure

Develops treatments for patients suffering from rare and other devastating diseases in the United States.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives