Warren Buffett famously said, 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Quanterix Corporation (NASDAQ:QTRX) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Quanterix

What Is Quanterix's Debt?

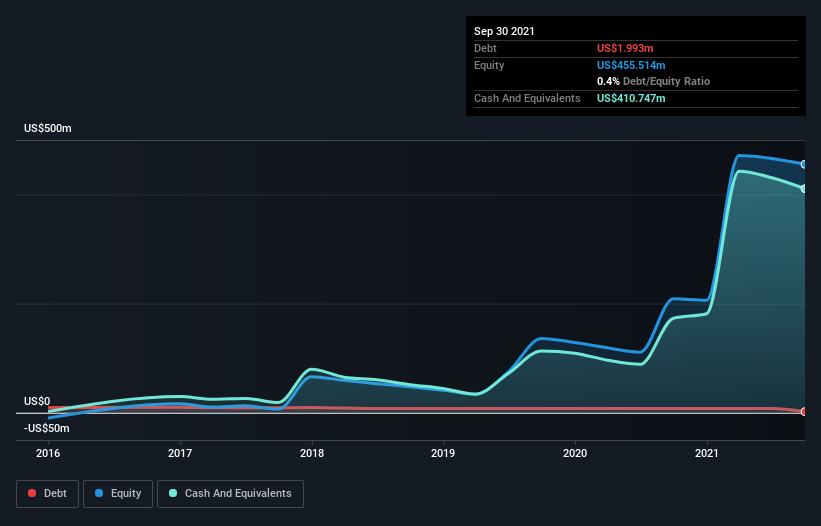

You can click the graphic below for the historical numbers, but it shows that Quanterix had US$1.99m of debt in September 2021, down from US$7.65m, one year before. However, it does have US$410.7m in cash offsetting this, leading to net cash of US$408.8m.

How Strong Is Quanterix's Balance Sheet?

The latest balance sheet data shows that Quanterix had liabilities of US$31.2m due within a year, and liabilities of US$24.1m falling due after that. Offsetting these obligations, it had cash of US$410.7m as well as receivables valued at US$18.4m due within 12 months. So it actually has US$373.9m more liquid assets than total liabilities.

This surplus strongly suggests that Quanterix has a rock-solid balance sheet (and the debt is of no concern whatsoever). On this view, lenders should feel as safe as the beloved of a black-belt karate master. Succinctly put, Quanterix boasts net cash, so it's fair to say it does not have a heavy debt load! The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Quanterix can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

In the last year Quanterix wasn't profitable at an EBIT level, but managed to grow its revenue by 40%, to US$106m. Shareholders probably have their fingers crossed that it can grow its way to profits.

So How Risky Is Quanterix?

Statistically speaking companies that lose money are riskier than those that make money. And in the last year Quanterix had an earnings before interest and tax (EBIT) loss, truth be told. Indeed, in that time it burnt through US$46m of cash and made a loss of US$47m. But at least it has US$408.8m on the balance sheet to spend on growth, near-term. Quanterix's revenue growth shone bright over the last year, so it may well be in a position to turn a profit in due course. Pre-profit companies are often risky, but they can also offer great rewards. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. We've identified 3 warning signs with Quanterix , and understanding them should be part of your investment process.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

Valuation is complex, but we're here to simplify it.

Discover if Quanterix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:QTRX

Quanterix

A life sciences company, engages in development and marketing of digital immunoassay platforms that advances precision health for life sciences research and diagnostics in North America, Europe, the Middle East, Africa, and the Asia Pacific regions.

Flawless balance sheet and overvalued.