- United States

- /

- Biotech

- /

- NasdaqGM:PTGX

Protagonist Therapeutics (PTGX) Valuation in Focus Following Rapid Share Price Gains

Reviewed by Simply Wall St

See our latest analysis for Protagonist Therapeutics.

Building on its strong recent run, Protagonist Therapeutics’ share price has soared over 100% year-to-date, far outpacing most biotech peers and reflecting growing optimism among investors. Even when looking further back, the stock has delivered outstanding long-term results with a 3-year total shareholder return of nearly 838%, which suggests momentum is still building.

If this kind of surge has you curious about what else is delivering big results, it could be the perfect moment to discover See the full list for free.

But after such a rapid rise, is Protagonist Therapeutics still trading at a bargain? Or have markets already priced in the company’s growth prospects, leaving limited room for further upside?

Price-to-Earnings of 107.8x: Is it justified?

Protagonist Therapeutics currently trades at a hefty price-to-earnings (P/E) ratio of 107.8x, making it appear significantly more expensive than its peers. The most recent closing price is $79.54, which signals that the market has high expectations for future earnings growth.

The P/E ratio measures the company’s current share price relative to its per-share earnings and is widely used to gauge how the market values a company against its profits. In the biotech sector, elevated ratios can sometimes reflect investor optimism about breakthrough therapies or robust growth potential. However, such high multiples also mean investors are paying a large premium for projected results.

For Protagonist Therapeutics, this multiple is much higher than the averages: the US Biotechs industry on average has a P/E of 16.2x, and even the peer average is just 30.4x. In addition, the estimated “fair” price-to-earnings ratio is 37.6x. This highlights just how stretched the current valuation is compared to what might be considered reasonable if growth expectations soften or profits do not scale as expected.

Explore the SWS fair ratio for Protagonist Therapeutics

Result: Price-to-Earnings of 107.8x (OVERVALUED)

However, slower revenue growth or unexpected profit shortfalls could quickly challenge the optimism surrounding Protagonist Therapeutics and put pressure on its elevated valuation.

Find out about the key risks to this Protagonist Therapeutics narrative.

Another View: What Does the SWS DCF Model Say?

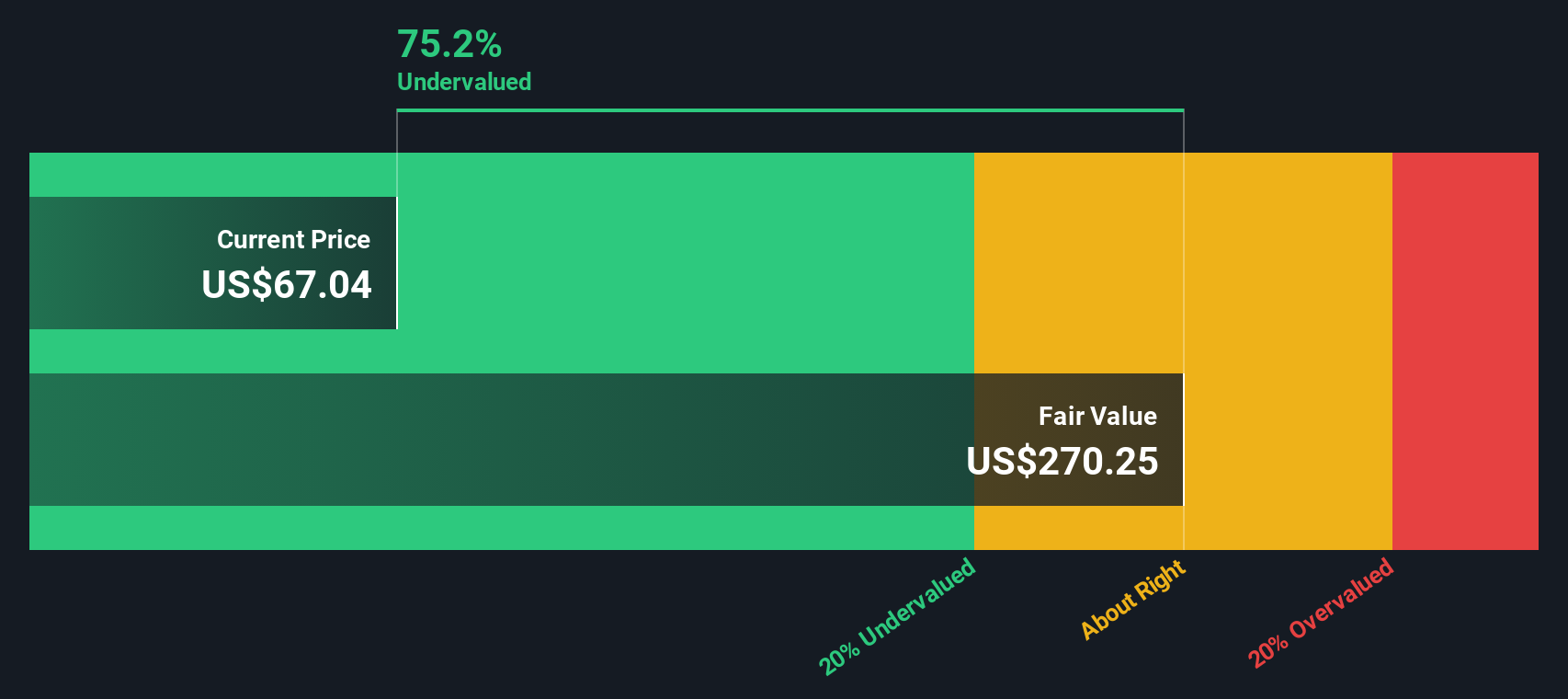

While the price-to-earnings ratio suggests Protagonist Therapeutics is expensive compared to peers, our DCF model tells a different story. It estimates the company's fair value at $267.12 per share, which is more than three times its current price. Could the market be missing something, or is the DCF model too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Protagonist Therapeutics for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Protagonist Therapeutics Narrative

If you see things differently or want to dig deeper into the numbers yourself, it's easy to craft your own narrative in just a few minutes. Do it your way

A great starting point for your Protagonist Therapeutics research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready to Uncover Even More Smart Investment Opportunities?

Don't hold back your ambition and tap into some of the most promising themes in the market with tools designed to help you spot your next great investment idea.

- Accelerate your search for tomorrow’s tech winners by reviewing these 24 AI penny stocks on the cutting edge of artificial intelligence innovation and growth.

- Strengthen your income strategy with these 16 dividend stocks with yields > 3%, spotlighting stocks that offer reliable yields above 3% for consistent returns.

- Seize the chance to get ahead of the market by targeting these 870 undervalued stocks based on cash flows positioned for potential upside based on their current cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:PTGX

Protagonist Therapeutics

A biopharmaceutical company, develops peptide therapeutics for hematology and blood disorders, and inflammatory and immunomodulatory diseases.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives