- United States

- /

- Biotech

- /

- NasdaqGM:PTGX

Is Protagonist Therapeutics Still a Good Value After Doubling in 2025?

Reviewed by Bailey Pemberton

- Ever wondered if Protagonist Therapeutics is still a bargain at its current price, or if the best days are already behind it? Let’s dig in to find out what might be driving its value now.

- The stock has put up astonishing numbers lately, rising 5.0% over the past week, an impressive 21.3% over the last month, and it has even doubled year-to-date with a 101.7% gain.

- These gains have been fueled by positive developments around the company’s flagship drug candidates and strong results from recent clinical study updates. This has boosted optimism regarding its growth potential. Industry partnerships and favorable regulatory updates have also added to the momentum, highlighting a wave of developments that is hard to ignore.

- Right now, Protagonist Therapeutics scores a 2 out of 6 on our undervaluation checks, which puts its valuation in the spotlight. We will explore several methods for assessing its real worth and reveal an additional way to think about value at the end of this article.

Protagonist Therapeutics scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Protagonist Therapeutics Discounted Cash Flow (DCF) Analysis

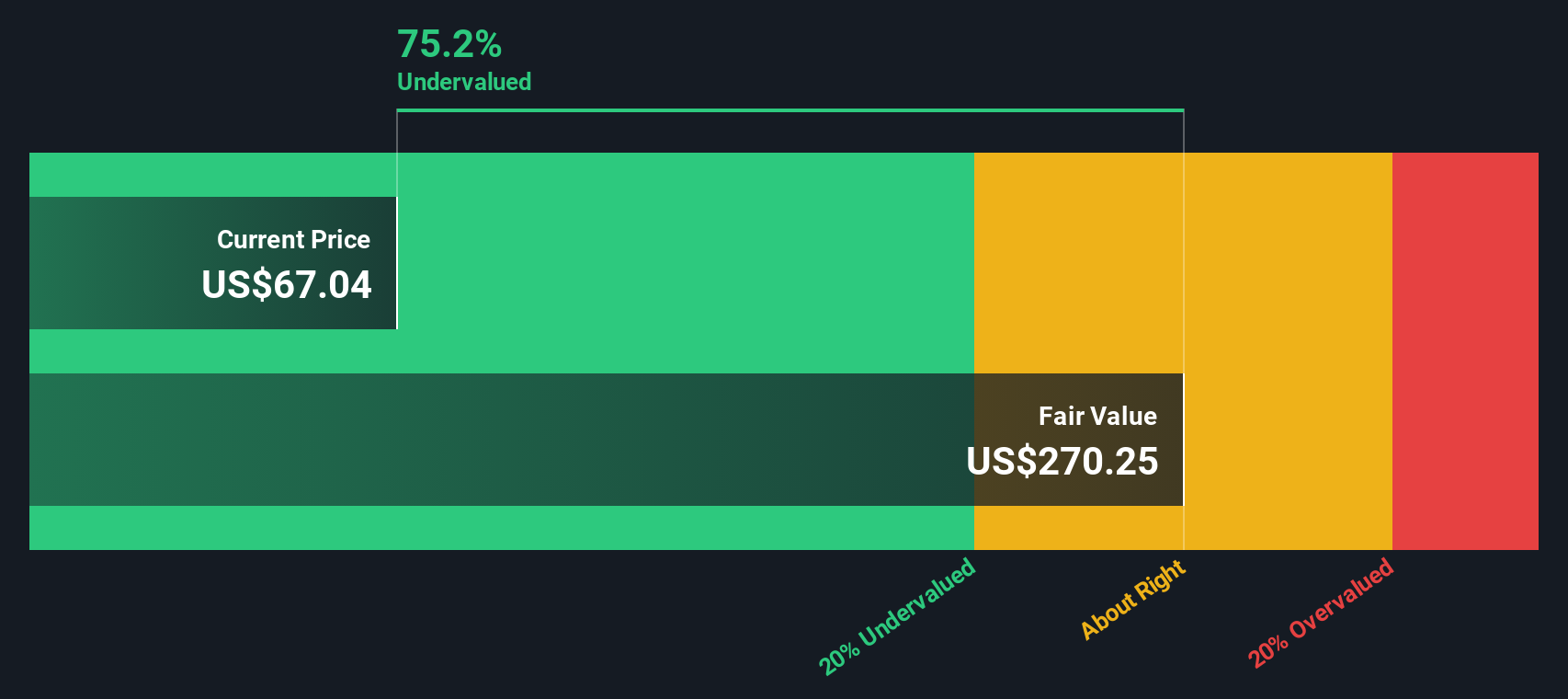

A Discounted Cash Flow (DCF) model estimates what a company is worth today by projecting all future cash flows and discounting them back to their present value. For Protagonist Therapeutics, the DCF uses a 2 Stage Free Cash Flow to Equity approach, factoring in both near-term analyst forecasts and longer-term extrapolated cash flows.

The company’s current Free Cash Flow (FCF) stands at $38.1 Million. Analyst estimates extend cash flow projections up to 2029, where FCF is expected to reach $264.5 Million. Beyond 2029, future cash flows are extrapolated, projecting a steady increase through 2035 according to Simply Wall St’s assumptions.

Based on these projections, the estimated intrinsic value per share is $259.94. The DCF calculation indicates the stock trades at a 69.8% discount to this figure. The model suggests Protagonist Therapeutics is significantly undervalued at its current price.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Protagonist Therapeutics is undervalued by 69.8%. Track this in your watchlist or portfolio, or discover 840 more undervalued stocks based on cash flows.

Approach 2: Protagonist Therapeutics Price vs Earnings

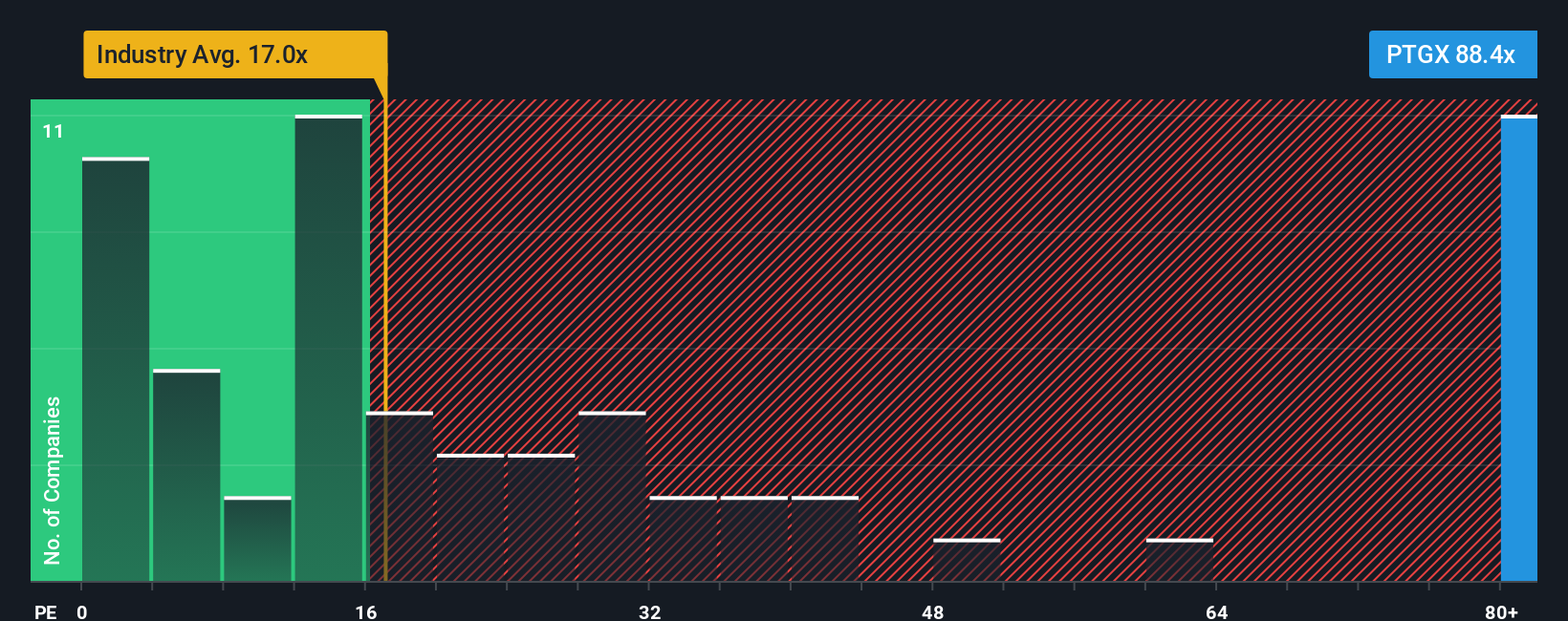

The Price-to-Earnings (PE) ratio is a preferred multiple for valuing profitable companies because it directly relates a company's share price to its underlying earnings. A higher PE can signal strong earnings growth or investor optimism, while a lower PE may reflect risks or slower prospects.

The "right" or "fair" PE ratio for a stock depends on factors such as growth expectations, market confidence, profitability, and risk. Fast-growing or low-risk companies often trade at higher PE ratios, while those with more uncertainty or slower earnings growth tend to justify lower PEs.

Currently, Protagonist Therapeutics trades at a lofty 94x PE ratio. In comparison, the biotechnology industry's average is 17.7x, and its peer group averages about 55.3x. These differences show that the market is pricing in significant future growth potential for Protagonist Therapeutics.

Simply Wall St’s proprietary "Fair Ratio" reflects what you might expect for Protagonist based on its own growth, margins, size, and risk profile. This metric may be more insightful than industry and peer averages because it gives a tailored benchmark for valuation. The Fair Ratio for Protagonist stands at 35.3x, well below its current PE.

Since 94x is substantially above the Fair Ratio of 35.3x, Protagonist Therapeutics appears overvalued using this measure.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1414 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Protagonist Therapeutics Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your way to tell the story behind Protagonist Therapeutics by linking your perspective on its future with the numbers, and by setting your own fair value and estimates for revenue, earnings, and profit margins.

Narratives connect a company’s story directly to a financial forecast and then to a fair value, giving you a clear thread from your expectations to what you think the stock is worth. This tool makes sophisticated investing easy and accessible, with millions of investors using Narratives on Simply Wall St's Community page to share and compare their perspectives.

With Narratives, investors can quickly decide if Protagonist Therapeutics is a buy, sell, or hold by directly comparing their own Fair Value to the latest Price. In addition, Narratives are updated automatically as new information such as earnings announcements or news headlines is released, so your view always stays current.

For example, some investors see Protagonist Therapeutics as having a much higher fair value based on breakthrough drug success, while others may be more conservative if they foresee clinical hurdles ahead.

Do you think there's more to the story for Protagonist Therapeutics? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:PTGX

Protagonist Therapeutics

A biopharmaceutical company, develops peptide therapeutics for hematology and blood disorders, and inflammatory and immunomodulatory diseases.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives