- United States

- /

- Biotech

- /

- NasdaqGM:PTGX

Is Protagonist Therapeutics Fairly Priced After Clinical Trial Updates and Big Share Price Surge?

Reviewed by Bailey Pemberton

- Curious if Protagonist Therapeutics offers real value at today's price? You're not alone, and the market has been buzzing with activity.

- Shares have risen 113.5% year-to-date and are showing 79.0% gains over the past year. However, after that surge, the last month saw a dip of 4.3%.

- Recent news has kept investors on their toes, with notable clinical trial updates and regulatory milestones driving optimism about the company’s drug pipeline. These headlines appear to be fueling both the excitement and some short-term volatility in the stock’s price.

- On our valuation checks, Protagonist Therapeutics scores a 2 out of 6 for being undervalued, which we will break down in detail below. There is more to valuation than just the numbers, so keep reading to discover the full picture.

Protagonist Therapeutics scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Protagonist Therapeutics Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today’s dollars. This approach helps investors assess whether a stock is trading above or below its true worth based on anticipated financial performance.

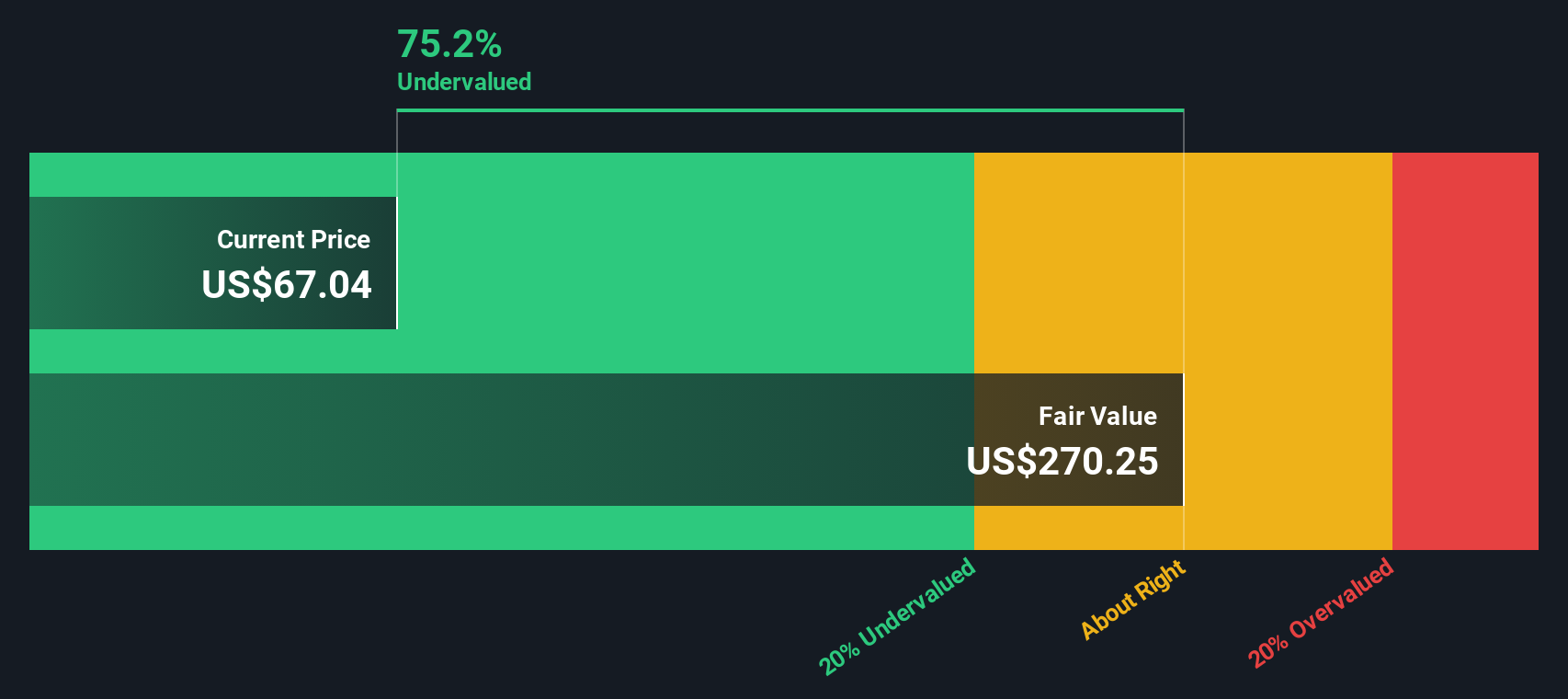

For Protagonist Therapeutics, the current Free Cash Flow is $64.1 million. Analysts expect a rapid increase, with projections indicating Free Cash Flow could climb to $265 million by 2029. Beyond this point, additional forecasts are extrapolated, rather than directly estimated by analysts, ultimately reaching $696 million by 2035. All projections are in US dollars. These numbers are based on a 2 Stage Free Cash Flow to Equity model. This means cash flow growth is initially forecast using detailed estimates, and then shifts to a more general trend in later years.

Using these cash flow predictions and discounting them to reflect today’s value, the DCF model calculates an intrinsic value of $194.31 per share. Given the current price, this suggests the stock could be trading at a 57.2% discount to its estimated fair value.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Protagonist Therapeutics is undervalued by 57.2%. Track this in your watchlist or portfolio, or discover 865 more undervalued stocks based on cash flows.

Approach 2: Protagonist Therapeutics Price vs Earnings

The Price-to-Earnings (PE) ratio is a reliable valuation yardstick for profitable companies because it connects a company’s share price to its actual earnings, allowing investors to gauge how much they are paying for each dollar of profit. A higher PE can signal expectations for stronger growth in the future, but it can also reflect a higher degree of risk or market optimism. A lower PE might suggest either lower growth expectations or potentially greater uncertainty.

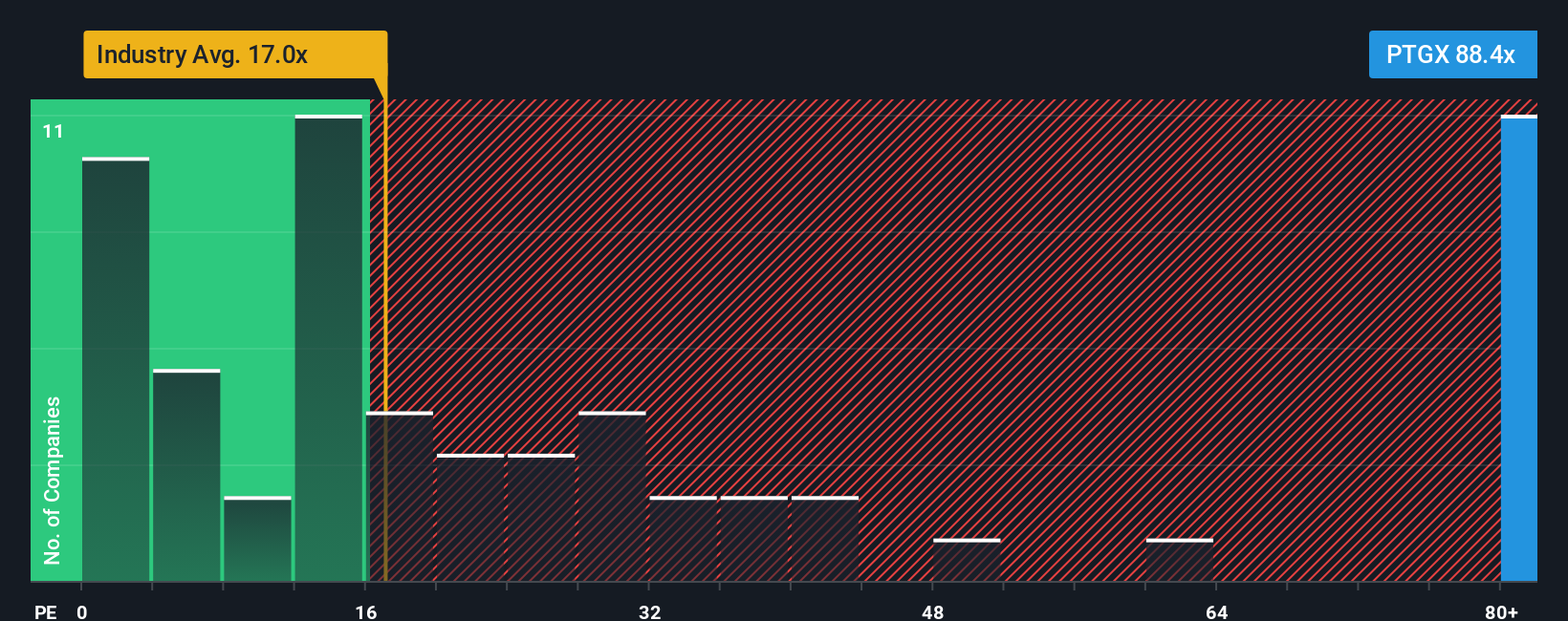

Protagonist Therapeutics currently trades at a PE ratio of 113.3x. That is significantly higher than both the average for the Biotechs industry at 17.0x and the average for its peers at 21.9x. At first glance, this premium may raise some eyebrows, especially given the sizable gap.

However, Simply Wall St’s proprietary Fair Ratio is designed to factor in more than just a basic industry or peer comparison. The Fair Ratio for Protagonist, at 36.3x, takes into account key variables such as the company’s expected earnings growth, profit margins, market capitalization, risks, and its position within the biotech sector. This makes it a more holistic and therefore more useful valuation benchmark than relying on simple averages.

Comparing the Fair Ratio of 36.3x with the actual PE of 113.3x, Protagonist’s stock appears to be trading at a premium well above what is justified by its fundamentals and outlook.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1402 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Protagonist Therapeutics Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple yet powerful story you create about a company, linking your own perspective about its future with concrete financial forecasts and an estimated fair value. Rather than relying just on ratios or models, Narratives let you consider assumptions about Protagonist Therapeutics' growth, profit margins, and risks, and see how those beliefs translate into value.

On Simply Wall St's Community page, used by millions of investors, Narratives are an accessible tool for anyone. You choose your own story, enter your expectations, and instantly see how your Fair Value compares to the current price. Narratives are always up-to-date, instantly reflecting new data like earnings or breaking news, so your investment decisions move with the market. For example, one investor might see Protagonist’s Fair Value as $98 per share based on cautious revenue forecasts, while another expects $230, believing in a highly successful drug pipeline. Narratives make it easy to compare these viewpoints and help you decide on your next steps based on your own story and the latest facts.

Do you think there's more to the story for Protagonist Therapeutics? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:PTGX

Protagonist Therapeutics

A biopharmaceutical company, develops peptide therapeutics for hematology and blood disorders, and inflammatory and immunomodulatory diseases.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives