- United States

- /

- Biotech

- /

- NasdaqGS:PTCT

PTC Therapeutics (PTCT) Is Up 5.1% After Return to Profitability and Strong Sephience Launch – Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- PTC Therapeutics recently reported a surge in third-quarter 2025 revenue to US$211.01 million and achieved net income of US$15.9 million, marking a sharp turnaround from the net loss posted a year earlier, driven by the initial success of Sephience and steady contributions from its Duchenne muscular dystrophy franchise.

- This financial milestone, alongside the rapid uptake of Sephience and positive feedback from healthcare providers and payers, highlights PTC Therapeutics' growing momentum in addressing rare disease market needs.

- We'll explore how PTC Therapeutics' return to profitability and Sephience's successful launch influence the company’s fundamental investment outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

PTC Therapeutics Investment Narrative Recap

To be a shareholder in PTC Therapeutics, I need to believe that the recent return to profitability and strong uptake of Sephience signal a sustainable shift for the company, shifting reliance away from legacy products and toward future growth. While these results strengthen the investment case, they do not materially alter the most important short-term catalyst, FDA regulatory decisions for Translarna, nor do they eliminate the risk of concentrated revenue streams and unpredictable international reimbursement.

Among recent announcements, the narrowing of 2025 revenue guidance to US$750 to US$800 million stands out as especially relevant. This reinforces the company’s confidence in near-term revenue visibility following Sephience’s successful launch, but also highlights ongoing execution risk as PTC Therapeutics works to balance new product momentum with legacy franchise stability. Despite solid recent progress, investors should be aware that growing dependence on a handful of products still leaves the business exposed if...

Read the full narrative on PTC Therapeutics (it's free!)

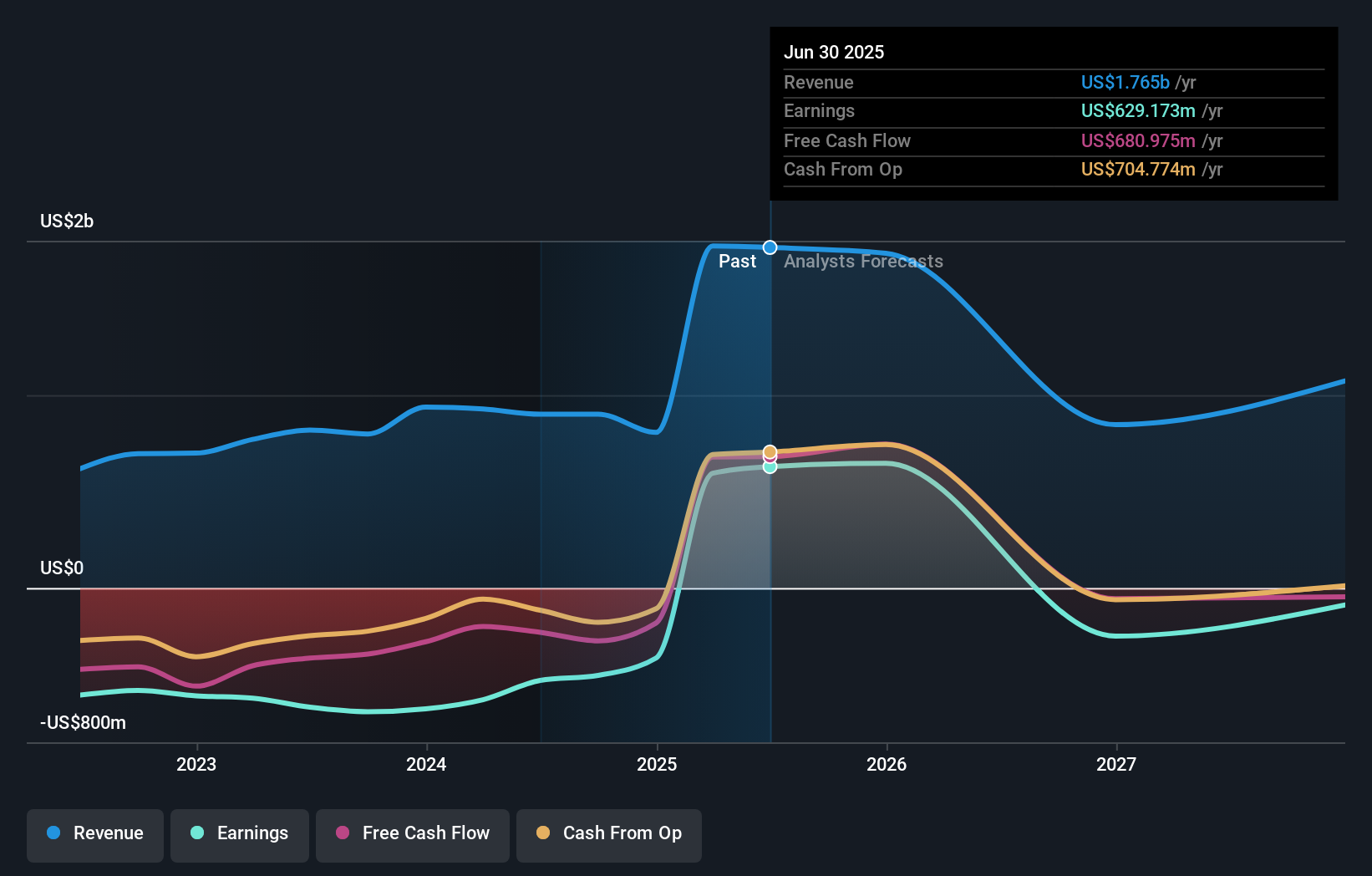

PTC Therapeutics' narrative projects $1.3 billion revenue and $55.4 million earnings by 2028. This requires a -10.3% yearly revenue decline and a $573.8 million decrease in earnings from $629.2 million today.

Uncover how PTC Therapeutics' forecasts yield a $67.93 fair value, a 5% downside to its current price.

Exploring Other Perspectives

Simply Wall St Community estimates for PTC Therapeutics’ fair value range from US$67.93 to US$190.54, based on 2 different analyses. While some see sizable upside, recent results remind us that concentrated revenue sources create uncertainty in future performance, check out a range of opinions shaping today’s market insights.

Explore 2 other fair value estimates on PTC Therapeutics - why the stock might be worth 5% less than the current price!

Build Your Own PTC Therapeutics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PTC Therapeutics research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free PTC Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PTC Therapeutics' overall financial health at a glance.

Interested In Other Possibilities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PTCT

PTC Therapeutics

A biopharmaceutical company, focuses on the discovery, development, and commercialization of medicines to children and adults living with rare disorders in the United States and internationally.

Undervalued with slight risk.

Similar Companies

Market Insights

Community Narratives