- United States

- /

- Biotech

- /

- NasdaqGS:PTCT

Assessing PTC Therapeutics (PTCT) Valuation Following Strong Earnings Turnaround and Updated Revenue Guidance

Reviewed by Simply Wall St

PTC Therapeutics (PTCT) delivered its third-quarter results, showing positive net income after last year’s loss, along with higher revenue for both the quarter and the past nine months. The company also narrowed its full-year revenue guidance.

See our latest analysis for PTC Therapeutics.

Following the upbeat earnings, PTC Therapeutics’ momentum has picked up significantly. The share price is up nearly 60% over the past 90 days, and total shareholder return has surged almost 69% over the past year. These gains reflect renewed confidence as management not only delivered positive net income but also issued more focused revenue guidance, hinting at growing optimism around future performance.

If you’re tracking companies with promising turnarounds and steady leadership, now’s a great time to broaden your search and discover fast growing stocks with high insider ownership

After such a sharp rally and a strong financial turnaround, is PTC Therapeutics still undervalued, or have its recent gains already priced in all the expected growth? Could there be more upside for new investors?

Most Popular Narrative: 7% Overvalued

With PTC Therapeutics closing at $72.59 and the most widely followed narrative estimating a fair value of $67.93, the shares are trading slightly above consensus expectations. The narrative considers both near-term commercial momentum and upcoming regulatory events to justify its outlook.

The analysts have a consensus price target of $66.688 for PTC Therapeutics based on their expectations of its future earnings growth, profit margins, and other risk factors. However, there is a degree of disagreement among analysts, with the most bullish reporting a price target of $118.0, and the most bearish reporting a price target of just $44.0.

Want to know what assumptions are shaking up this high valuation? The story is driven by a surprising twist on future earnings, requiring a profit multiple typically reserved for growth giants. What aggressive financial projections are analysts banking on? Uncover the full set of assumptions that feed into this bold price target.

Result: Fair Value of $67.93 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, setbacks in regulatory approvals or disappointing uptake for new launches could quickly shift sentiment and challenge the optimistic outlook currently reflected in the price.

Find out about the key risks to this PTC Therapeutics narrative.

Another Perspective: What Multiples Tell Us

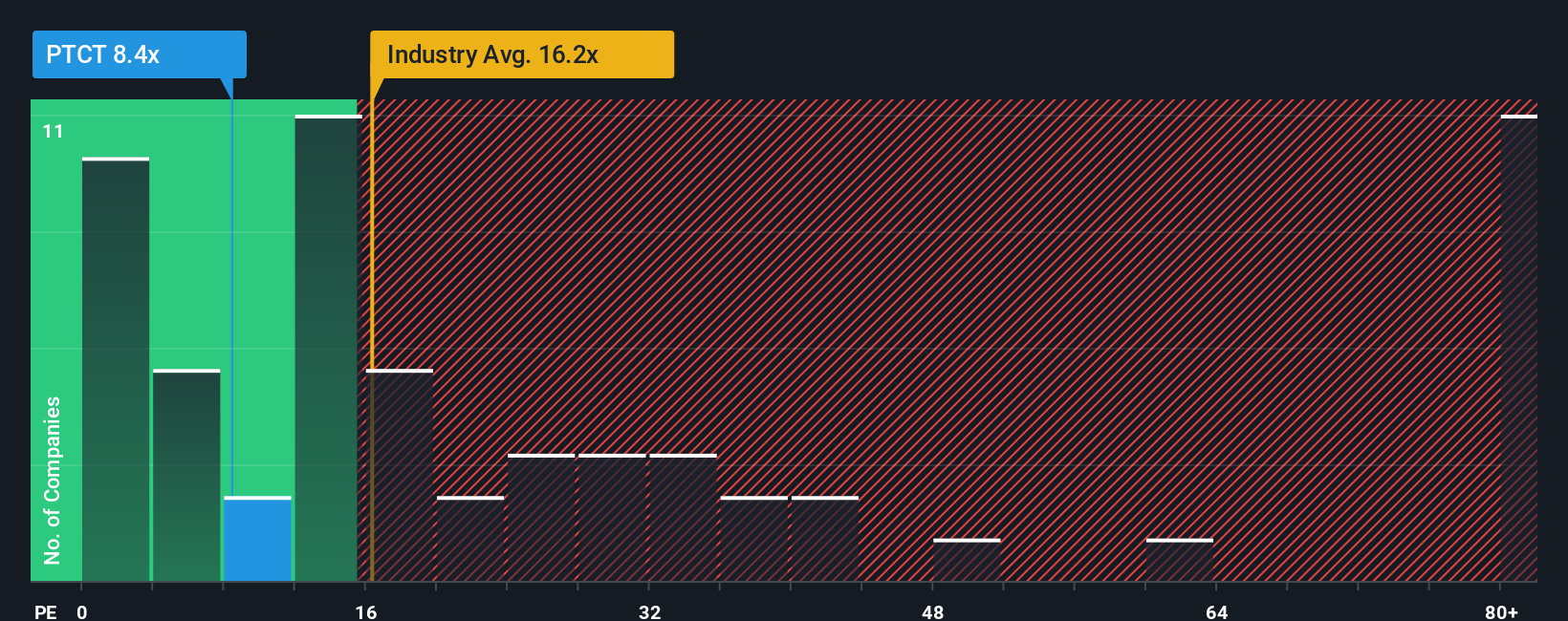

Looking at valuation another way, PTC Therapeutics’ shares trade at a price-to-earnings ratio of 7.8x. This is well below the US Biotechs industry average of 17.5x and the peer average of 14.7x. It is also under the company's fair ratio of 9.6x, implying the stock is attractively valued using this metric. Does this discount reflect real risks, or could investors be overlooking a potential opportunity?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own PTC Therapeutics Narrative

If you have a different take or want to dig into the numbers yourself, it’s simple to craft your own view in just a few minutes. Do it your way

A great starting point for your PTC Therapeutics research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Want to make your next smart investing move? Expand your watchlist by checking out some of the most exciting opportunities we've identified with our screeners. Don't let these trends pass you by.

- Tap into market upswings by targeting these 860 undervalued stocks based on cash flows that could be flying under the radar, offering substantial potential for your portfolio.

- Boost your passive income strategy when you access these 17 dividend stocks with yields > 3% with robust yields and solid fundamentals.

- Ride the innovation wave by scanning these 25 AI penny stocks at the forefront of artificial intelligence transformation and rapid sector growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PTCT

PTC Therapeutics

A biopharmaceutical company, focuses on the discovery, development, and commercialization of medicines to children and adults living with rare disorders in the United States and internationally.

Undervalued with slight risk.

Similar Companies

Market Insights

Community Narratives