- United States

- /

- Pharma

- /

- NasdaqGS:PCRX

Pacira BioSciences (PCRX): Examining Valuation After Recent Share Price Momentum and Strategic Developments

Reviewed by Simply Wall St

See our latest analysis for Pacira BioSciences.

While Pacira BioSciences’ 4.5% jump in share price over the last day certainly stands out, the bigger story is the stock’s 20.3% share price return year-to-date and a 27.9% total shareholder return over one year, despite several months of volatility. Momentum is building as investors respond to the company’s recent results and optimism around future growth, even though its long-term total returns remain negative.

If you’re interested in spotting more opportunities among healthcare and biotech stocks, now is a great moment to discover See the full list for free.

With shares trading at a discount to analyst price targets and recent earnings growth, is Pacira BioSciences being underestimated by the market? Or is future upside already reflected in the current price?

Most Popular Narrative: 24% Undervalued

With the most widely followed narrative setting Pacira BioSciences’ fair value at $29, the stock’s last close of $22.05 sits notably below this target. Market watchers are considering whether key catalysts are powerful enough to drive shares higher as anticipated by consensus.

The new strategic partnership with Johnson & Johnson MedTech for ZILRETTA is expected to double sales coverage and significantly expand reach across new physician specialties and healthcare systems. This may provide a forward catalyst for revenue growth in 2026 and beyond.

Want to know what’s fueling this bullish price target? Behind it are aggressive projections for profit turnaround and expanding margins, as well as a forecast that rivals some growth stocks. Interested in the key details? Check out the factors that could influence Pacira’s future value.

Result: Fair Value of $29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, challenges such as slow market adoption of new products and Pacira’s dependence on EXPAREL could limit the pace of future growth.

Find out about the key risks to this Pacira BioSciences narrative.

Another View: Market Multiples Tell a Different Story

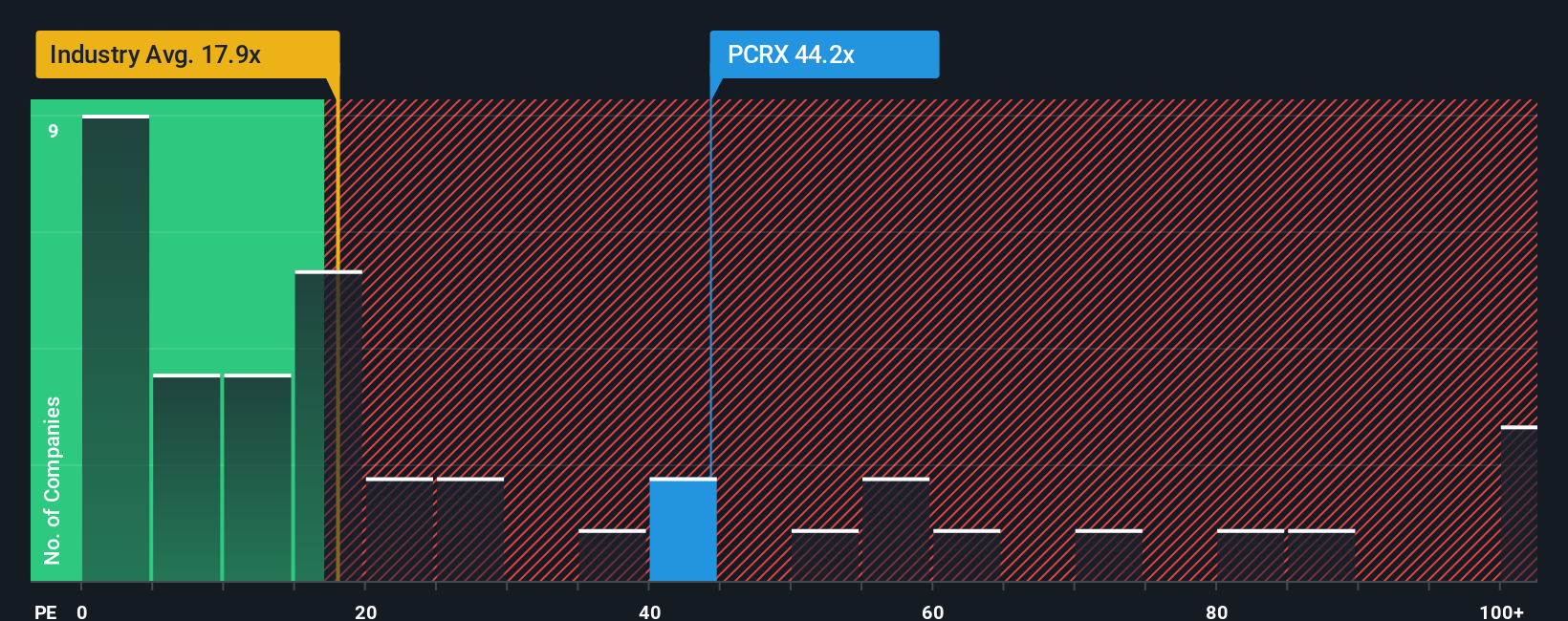

Looking at Pacira BioSciences through the lens of the price-to-earnings ratio, the shares appear expensive at 46.2x, which is more than double the US Pharmaceuticals industry average of 17.9x and the peer average of 24.6x. Even compared to the fair ratio of 21.9x, the current valuation is steep. This wide gap highlights substantial valuation risk if expectations fall short. Are investors overestimating Pacira’s future earnings power, or is there something they see that others are missing?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Pacira BioSciences Narrative

If you want to dig deeper or come to your own conclusions, it’s easy to build your own perspective using the data in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Pacira BioSciences.

Looking for More Investment Ideas?

Smart investors always stay a step ahead. Accelerate your investing journey by checking out unique stock opportunities you might be missing right now. Expand your portfolio and uncover potential winners.

- Uncover high-yield opportunities for stable income by assessing these 16 dividend stocks with yields > 3% with consistent returns and solid fundamentals.

- Capitalize on innovations shaping healthcare by targeting these 32 healthcare AI stocks spearheading breakthroughs in patient care and medical technology.

- Get ahead in the digital finance wave by analyzing these 82 cryptocurrency and blockchain stocks creating value with blockchain and next-generation transaction technologies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PCRX

Pacira BioSciences

Engages in the development, manufacture, marketing, distribution, and sale of non-opioid pain management and regenerative health solutions to healthcare practitioners in the United States.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives