- United States

- /

- Pharma

- /

- NasdaqGM:PAHC

A Fresh Look at Phibro Animal Health's (PAHC) Valuation After Strong Recent Share Price Gains

Reviewed by Simply Wall St

See our latest analysis for Phibro Animal Health.

Momentum appears to be building for Phibro Animal Health, with a 90-day share price return of 47.44% and a year-to-date gain of 111.10%. Over the past year, the company delivered a total shareholder return of 74.43%, highlighting both recent excitement and longer-term value creation.

If animal health’s rally has you looking for more in this sector, our Healthcare Stocks Screener is a great place to uncover new ideas. See the full list for free.

But with shares up over 100 percent already this year, investors may be wondering whether Phibro Animal Health remains undervalued or if expectations for future growth are already fully reflected in the stock price.

Most Popular Narrative: 10.1% Overvalued

Phibro Animal Health’s last close at $43.76 stands above the most widely followed narrative’s fair value estimate of $39.75, indicating a premium that the market is currently placing on the stock. This dynamic creates an interesting backdrop for the tension between recent performance and forward expectations.

Favorable industry trends, strategic acquisitions, operational improvements, and diversification into higher-margin products position Phibro Animal Health for sustained growth and financial resilience.

Want to know what’s driving the buzz around Phibro’s price tag? The narrative relies on a combination of boosted margins and bullish growth projections. There is a bold forecast behind this number, based on profit expansion and earnings multiple compression. Curious what the analysts think needs to happen for these assumptions to hold? Discover which future financial milestones support the current market premium.

Result: Fair Value of $39.75 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, unforeseen regulatory changes or sluggish product innovation could undercut current optimism and cause Phibro’s growth outlook to fall short of expectations.

Find out about the key risks to this Phibro Animal Health narrative.

Another View: SWS DCF Model Suggests Undervaluation

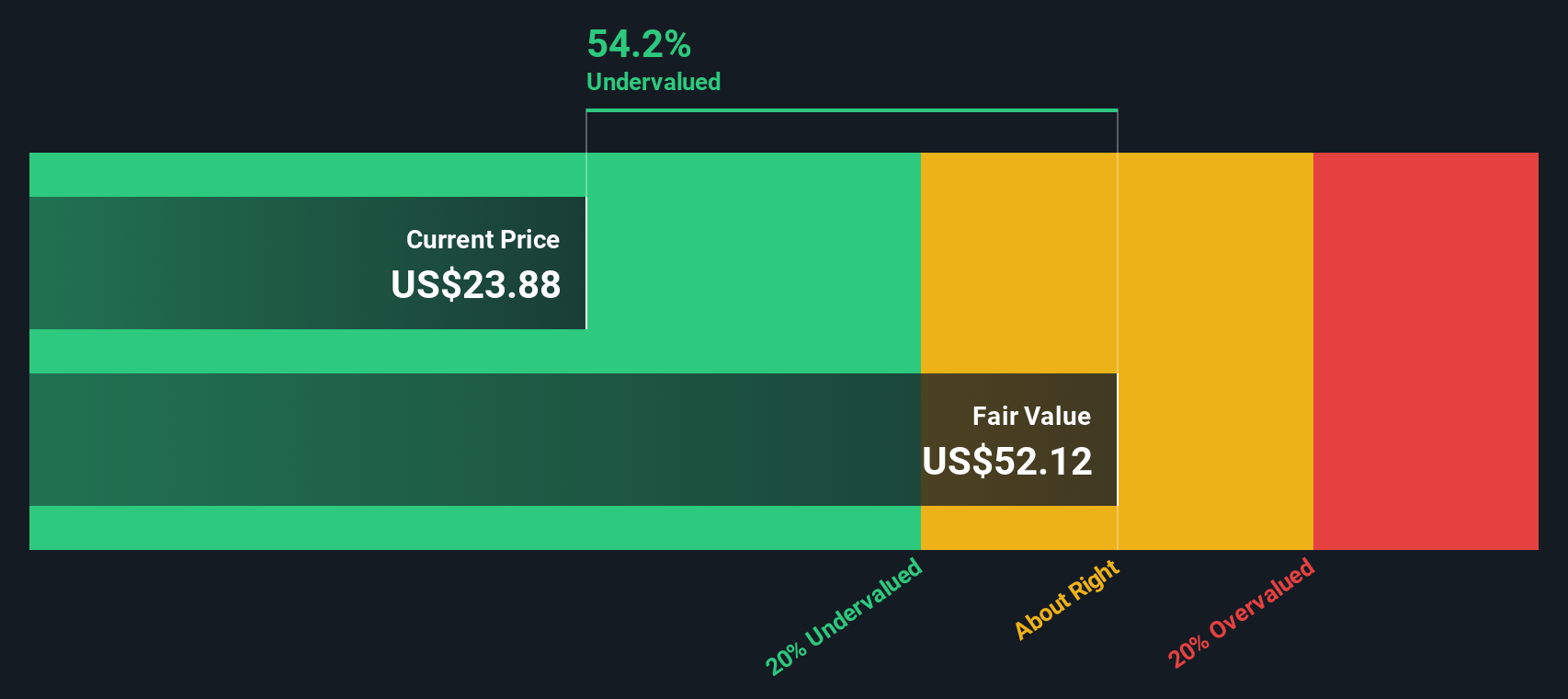

While the current market price and analyst narratives suggest Phibro Animal Health is overvalued, our SWS DCF model takes a much more optimistic stance. Based on this cash flow-driven approach, Phibro is actually trading about 50% below its fair value. With such a wide gap, could investors be overlooking a deeper opportunity? Or are expectations for future growth simply too high?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Phibro Animal Health for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 883 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Phibro Animal Health Narrative

If these perspectives do not fully fit your view or you want to dig into the numbers for yourself, you can easily build a custom narrative in just a few minutes. Do it your way

A great starting point for your Phibro Animal Health research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t let fresh opportunities slip by you. The Simply Wall Street Screener brings you powerful tools to spot market standouts and hidden gems that others might overlook.

- Tap into the explosive world of digital assets by reviewing these 82 cryptocurrency and blockchain stocks, which are poised to reshape payments, security, and online commerce.

- Boost your portfolio’s income stream with these 16 dividend stocks with yields > 3% that offer attractive yields above 3%, creating steady cash flow in any market climate.

- Ride the artificial intelligence wave and stay ahead of industry shifts with these 25 AI penny stocks, which are pushing the boundaries of what’s possible in tech.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:PAHC

Phibro Animal Health

Operates as an animal health and mineral nutrition company in the United States, Latin America and Canada, Europe, the Middle East, Africa, and the Asia Pacific.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives