- United States

- /

- Pharma

- /

- NasdaqCM:NKTR

Can Nektar Therapeutics’ (NKTR) Narrowed Loss Offset Concerns About Declining Revenue Momentum?

Reviewed by Sasha Jovanovic

- Nektar Therapeutics reported its third quarter 2025 earnings, posting revenue of US$11.79 million and a net loss of US$35.52 million, both declining compared to the previous year.

- While revenue has decreased significantly year-over-year, the company's net loss narrowed, indicating some improvement in expense management even amid ongoing challenges.

- We'll now consider how the sharp year-over-year drop in revenue may affect Nektar's overall investment narrative and future prospects.

Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

Nektar Therapeutics Investment Narrative Recap

To be a shareholder in Nektar Therapeutics, you need to have confidence in the long-term potential of its pipeline, especially the clinical and regulatory progress of REZPEG. The recent Q3 earnings showed a steep year-over-year drop in revenue but narrower net losses, and while these results highlight continued financial pressures, they don't materially change the immediate focus on data readouts and regulatory milestones as the key short-term catalyst. The biggest risk remains the company’s pre-commercial status and limited cash runway, which puts pressure on management to secure funding or strong clinical results soon.

Of the recent announcements, the late-breaking presentation of new REZOLVE-AD Phase 2b data at the ACAAI Annual Scientific Meeting stands out. This aligns directly with the company’s catalyst: strong clinical data could support regulatory progress and future commercial prospects for REZPEG in atopic dermatitis, which remains core to Nektar’s investment story.

Yet, despite positive clinical news, the risks linked to ongoing cash burn and the challenge of funding late-stage trials are details investors should be aware of…

Read the full narrative on Nektar Therapeutics (it's free!)

Nektar Therapeutics is projected to reach $40.9 million in revenue and $9.5 million in earnings by 2028. This forecast assumes an annual revenue decline of 18.3% and a $131.8 million increase in earnings from the current level of -$122.3 million.

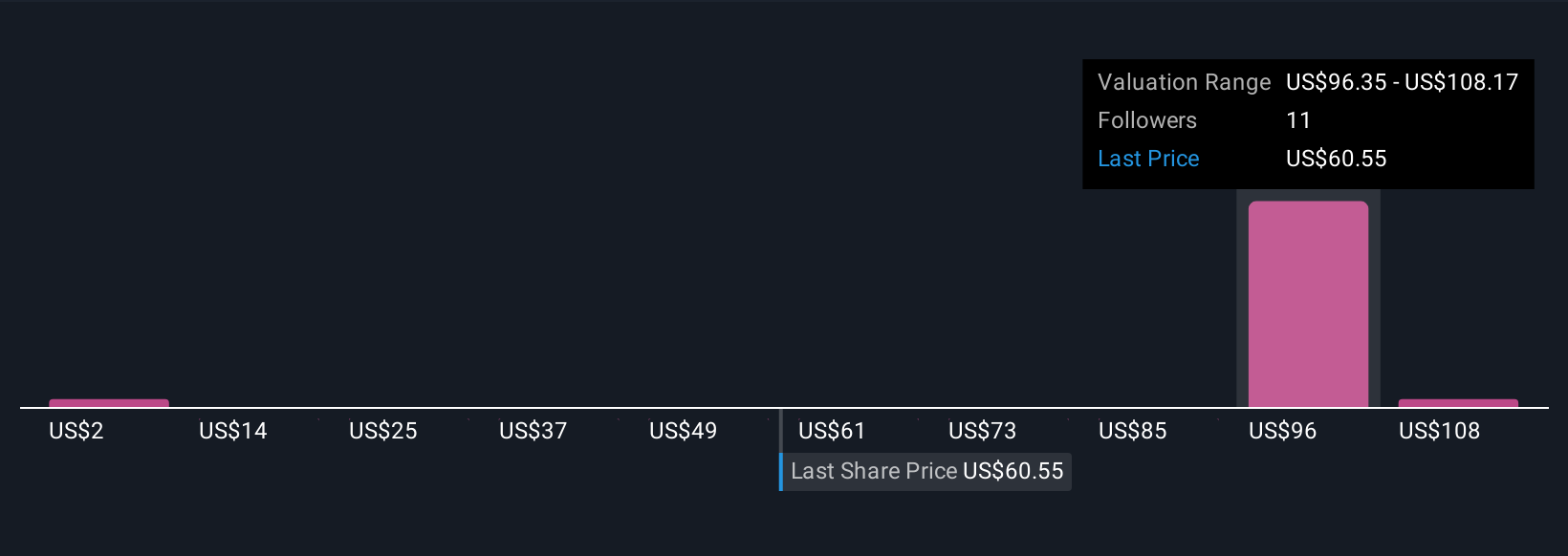

Uncover how Nektar Therapeutics' forecasts yield a $93.86 fair value, a 68% upside to its current price.

Exploring Other Perspectives

Four individual fair value estimates from the Simply Wall St Community span a wide range, from US$1.74 to US$120 per share. While some see high long-term promise, the company’s share price remains under pressure from extended unprofitability and a shrinking cash runway, so check several views as investors are weighing very different paths to success.

Explore 4 other fair value estimates on Nektar Therapeutics - why the stock might be worth less than half the current price!

Build Your Own Nektar Therapeutics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nektar Therapeutics research is our analysis highlighting 2 key rewards and 6 important warning signs that could impact your investment decision.

- Our free Nektar Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nektar Therapeutics' overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nektar Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:NKTR

Nektar Therapeutics

A biopharmaceutical company, focuses on discovering and developing therapies that selectively modulate the immune system to treat autoimmune disorders in the United States and internationally.

Medium-low risk with limited growth.

Similar Companies

Market Insights

Community Narratives