- United States

- /

- Pharma

- /

- NasdaqCM:NKTR

Assessing Nektar Therapeutics (NKTR) Valuation After Recent Surge in Share Price

Reviewed by Simply Wall St

See our latest analysis for Nektar Therapeutics.

Momentum has picked up for Nektar Therapeutics after a strong 90-day share price return of 149%, bringing this year’s total share price gain to over 288%. While the latest move follows some short-term swings, the bigger picture is a remarkable turnaround. However, long-term total returns remain negative for now.

If you’re keeping an eye out for other innovative pharma stories or potential recovery plays, it makes sense to see what’s emerging by browsing our See the full list for free.

But after such dramatic gains, is Nektar’s current valuation justified by improving fundamentals or has the recent surge already accounted for future growth? This leaves investors to wonder if a true buying opportunity remains.

Most Popular Narrative: 40% Undervalued

With Nektar stock last closing at $55.97 and the most widely followed narrative putting fair value at $93.86, there is potential for a valuation reset as optimism builds around its upcoming milestones.

Strong initial Phase IIb and ongoing data for REZPEG in atopic dermatitis, combined with a large and growing addressable market (expected to reach nearly $30B by 2033), position Nektar to access significant new revenue streams and improve long-term earnings as the population ages and chronic inflammatory diseases rise globally.

Want to uncover how high earnings multiples and aggressive margin assumptions combine in analyst projections? There is a bold profitability leap in this narrative that changes typical biotech math. Find out what is fueling these forecasts and whether you agree with the numbers behind that 40% upside.

Result: Fair Value of $93.86 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent net losses and reliance on REZPEG's regulatory and commercial success could quickly shift sentiment if development or fundraising encounters setbacks.

Find out about the key risks to this Nektar Therapeutics narrative.

Another View: Market Comparisons Raise Questions

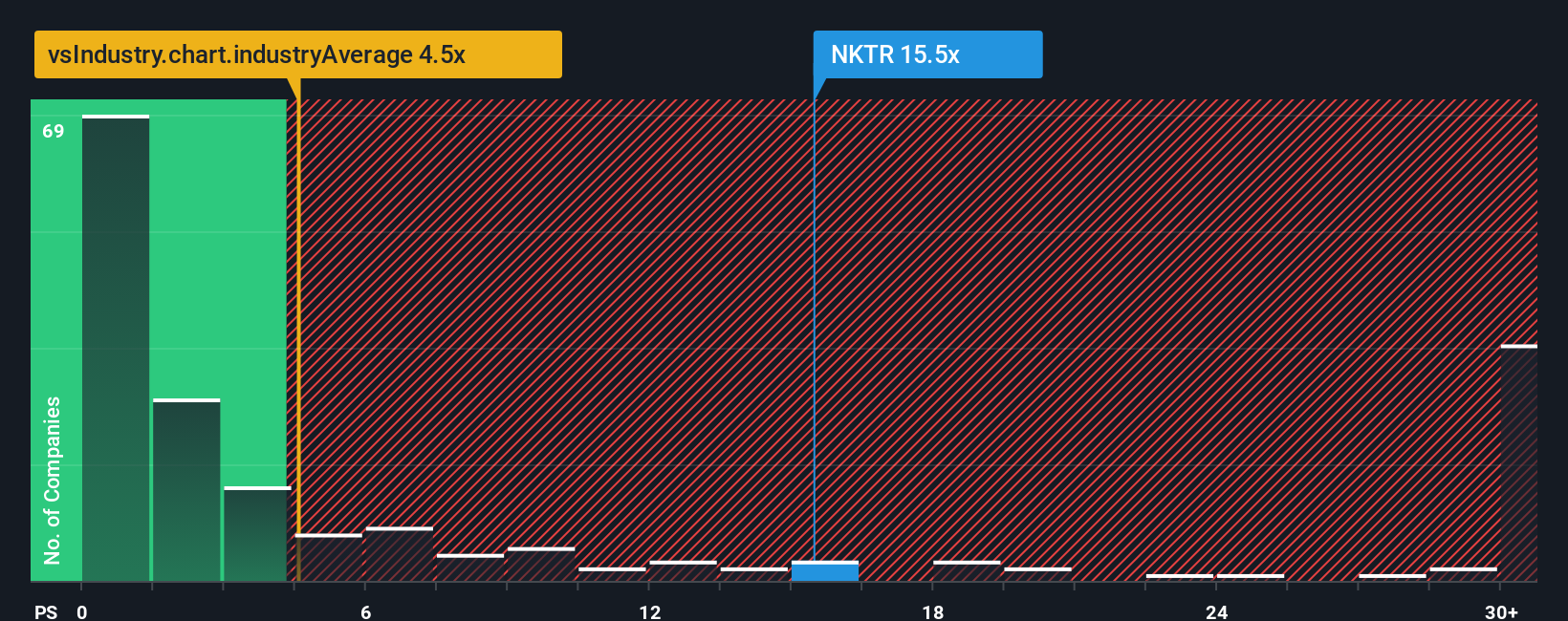

While analyst optimism paints Nektar as undervalued, a look at its current price-to-sales ratio tells a different story. At 17x, it far exceeds the US Pharmaceuticals industry average of 4x, its peer average of 10.4x, and even the fair ratio of 8.8x. This pricing gap signals that the market may have already priced in a lot of future hope. For new buyers, this could increase the risk if expectations fall short.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Nektar Therapeutics Narrative

If you see things differently or want to dig deeper into the numbers, you can easily build your own viewpoint in just a few minutes. Do it your way

A great starting point for your Nektar Therapeutics research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Every investor deserves an edge, and Simply Wall Street’s powerful screener gives you a shortcut to stocks with strong potential you might otherwise miss.

- Cement your portfolio’s cash flow with companies boasting reliable yield opportunities by checking out these 16 dividend stocks with yields > 3%.

- Tap into the hottest tech trend by focusing on growth potential from these 25 AI penny stocks that are fueling tomorrow’s automation and innovation.

- Spot undervalued gems before the crowd by searching through these 876 undervalued stocks based on cash flows and uncover opportunities most investors overlook.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nektar Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:NKTR

Nektar Therapeutics

A biopharmaceutical company, focuses on discovering and developing therapies that selectively modulate the immune system to treat autoimmune disorders in the United States and internationally.

Excellent balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives