- United States

- /

- Biotech

- /

- NasdaqGM:NAMS

How Investors May Respond To NewAmsterdam Pharma (NAMS) Sharp Quarterly Revenue Drop and Widening Loss

Reviewed by Sasha Jovanovic

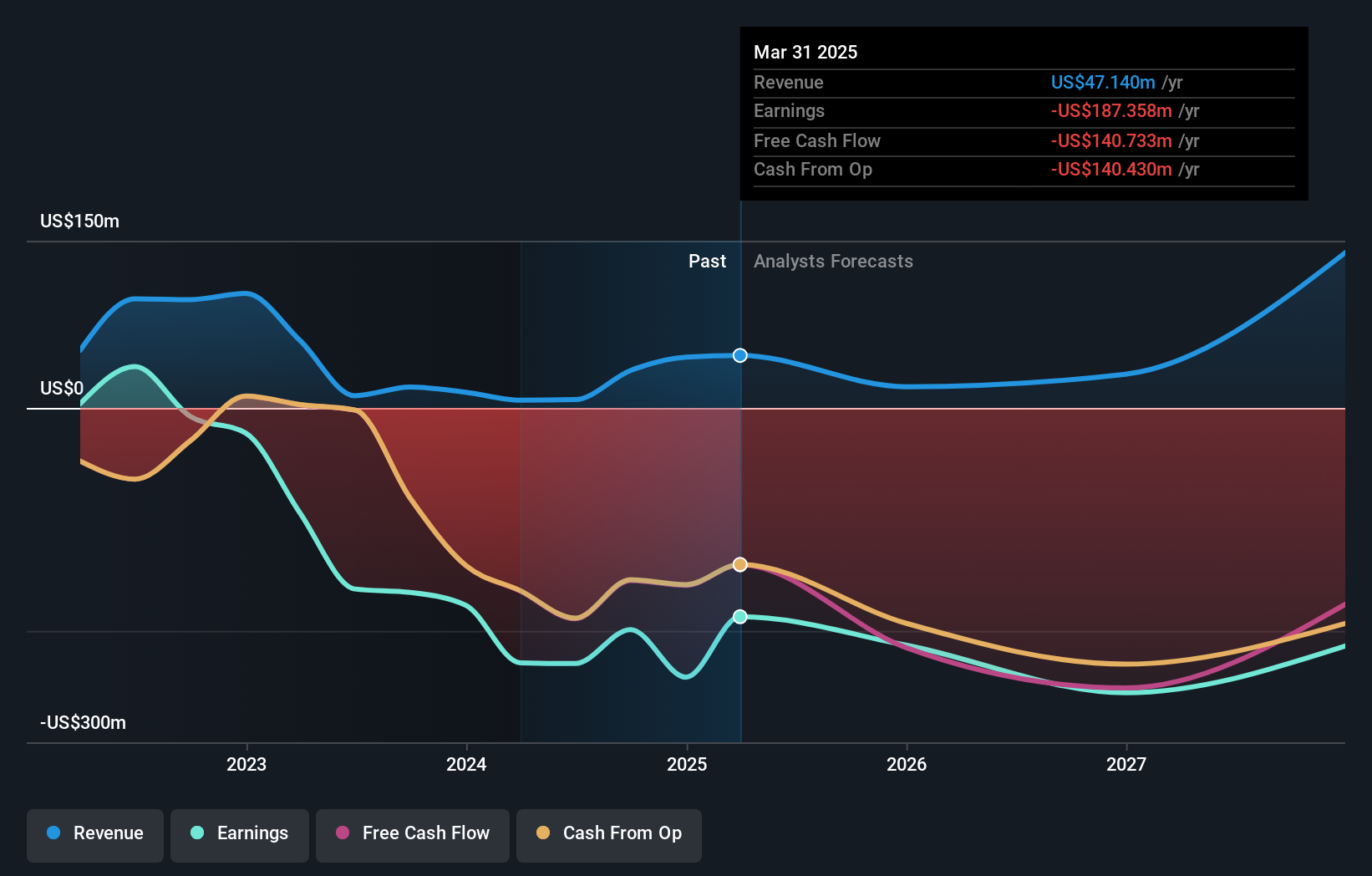

- NewAmsterdam Pharma reported third quarter earnings for 2025, revealing sales of US$348,000, a sharp decrease from US$29.11 million a year earlier, alongside net loss rising to US$72.01 million from US$16.65 million.

- A closer look shows that despite a very large year-over-year drop in quarterly revenue, the company’s net loss for the nine-month period actually narrowed compared to the previous year.

- We'll explore how the combination of steep quarterly sales decline and wider quarterly loss shapes the current investment narrative for NewAmsterdam Pharma.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is NewAmsterdam Pharma's Investment Narrative?

Owning NewAmsterdam Pharma today requires conviction in the long-term prospects for obicetrapib, the company's lead asset, and faith that upcoming regulatory events and commercial partnerships can drive meaningful future revenue. However, the recent earnings report changes the near-term picture: Q3 sales fell sharply to just US$348,000 and quarterly net loss widened, which may raise new doubts about revenue sustainability leading into regulatory review milestones. This drop in sales is abrupt compared to previous quarters, and could impact management’s ability to support critical short-term catalysts like the European Medicines Agency’s MAA review and any future commercial launches. At the same time, the report also showed that losses over the nine-month period actually narrowed, possibly easing longer-term concerns about cash burn, though ongoing dilution and board turnover remain. For investors, this means the latest numbers might shift the key risk focus toward near-term revenue uncertainty, while regulatory catalysts are still clearly front and center. On the flip side, shareholder dilution has become a more important issue to watch here.

Despite retreating, NewAmsterdam Pharma's shares might still be trading 47% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 2 other fair value estimates on NewAmsterdam Pharma - why the stock might be worth as much as 88% more than the current price!

Build Your Own NewAmsterdam Pharma Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NewAmsterdam Pharma research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free NewAmsterdam Pharma research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NewAmsterdam Pharma's overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NewAmsterdam Pharma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:NAMS

NewAmsterdam Pharma

A late-stage biopharmaceutical company, develops therapies to enhance patient care in populations with metabolic disease.

Excellent balance sheet with low risk.

Market Insights

Community Narratives