- United States

- /

- Biotech

- /

- NasdaqGS:MLYS

Mineralys Therapeutics (MLYS): Assessing Valuation Following Positive Phase 3 Results for Lorundrostat and FDA Filing Plans

Reviewed by Simply Wall St

Mineralys Therapeutics (MLYS) shared key Phase 3 data for lorundrostat at ASN Kidney Week 2025. The results showed clear reductions in blood pressure and albuminuria in chronic kidney disease and hypertension patients.

See our latest analysis for Mineralys Therapeutics.

Mineralys Therapeutics’ strong Phase 3 results have powered remarkable momentum, with a 90-day share price return of 188.25% and a year-to-date share price surge of 210.37%. The excitement around lorundrostat and an upcoming FDA filing has clearly captured investors’ attention, especially as the company gears up for several high-profile healthcare conferences. Even with some short-term volatility, the one-year total shareholder return of 170.80% reinforces that optimism is building for both the product pipeline and the stock’s long-term prospects.

Curious which other healthcare innovators might be breaking out next? Now is a perfect time to see the full list with our See the full list for free.

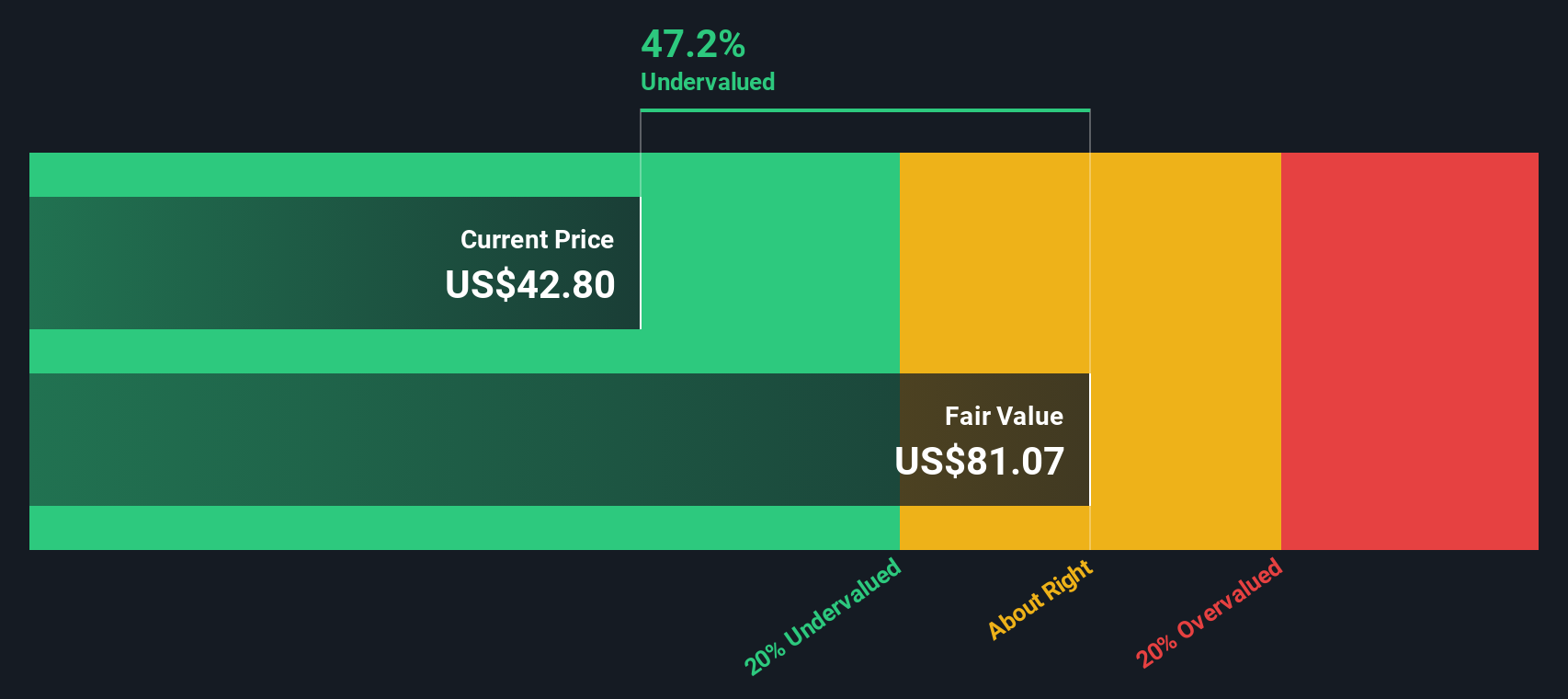

But with shares racing to new highs on Phase 3 excitement, the real question now is whether Mineralys Therapeutics is still undervalued or if the market has already priced in the potential for future growth.

Price-to-Book of 9.4x: Is it justified?

Mineralys Therapeutics is trading at a price-to-book ratio of 9.4x, significantly above both its peers and the broader biotech industry. The last close price of $38.02 reflects a valuation that has surged alongside excitement for its late-stage clinical data.

The price-to-book ratio measures how much investors are willing to pay for each dollar of a company’s net assets. For early-stage or loss-making biotech firms, a high price-to-book typically signals optimism about breakthrough potential compared to the current assets on the balance sheet.

Mineralys appears expensive compared to its peers, with industry comparables trading at just 6x and the wider US Biotechs industry averaging 2.5x. This significant divergence suggests the market is pricing in expectations of substantial pipeline progress, but it raises the bar for continued clinical and commercial achievements if the company is to justify such a premium.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 9.4x (OVERVALUED)

However, continued negative net income and zero reported revenue remain key risks. These factors could quickly dampen enthusiasm if clinical or regulatory progress stalls.

Find out about the key risks to this Mineralys Therapeutics narrative.

Another View: What About Discounted Cash Flow?

Looking from a different angle, our DCF model suggests Mineralys Therapeutics may actually be trading well below its estimated fair value. The DCF points to a price nearly four times higher than where the stock is today. This paints a very different picture from the price-to-book-based view. Might the market be missing something, or are investors simply pricing in the risks?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Mineralys Therapeutics for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 874 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Mineralys Therapeutics Narrative

If you see the story playing out differently or want to dig into the numbers yourself, you can quickly craft your own perspective in just a few minutes. Do it your way

A great starting point for your Mineralys Therapeutics research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Ready for Your Next Winning Idea?

Smart investing means never settling for just one story. Now is the time to seize opportunities in other fast-moving sectors that are brimming with potential and could power your next big breakthrough.

- Tap into the income potential of companies paying reliable cash returns by reviewing these 16 dividend stocks with yields > 3% that meet strict yield criteria and strong fundamentals.

- Fuel your fascination with the future by assessing emerging opportunities in AI through these 25 AI penny stocks and see which innovators are reshaping entire industries.

- Take control of market volatility by hunting for hidden gems among these 874 undervalued stocks based on cash flows and stay ahead as fresh ideas enter the spotlight.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MLYS

Mineralys Therapeutics

A clinical-stage biopharmaceutical company, develops medicines to target diseases driven by dysregulated aldosterone in the United States.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives