- United States

- /

- Biotech

- /

- NasdaqGS:MDGL

Why Madrigal Pharmaceuticals (MDGL) Is Up 20.3% After Positive Two-Year Rezdiffra Data in MASH Cirrhosis

Reviewed by Sasha Jovanovic

- Madrigal Pharmaceuticals recently presented positive two-year data from the open-label compensated MASH cirrhosis arm of the Phase 3 MAESTRO-NAFLD-1 trial at the AASLD Liver Meeting, showing statistically significant improvements in multiple imaging and biomarker parameters for a challenging patient population with no approved therapies.

- These results add to Rezdiffra’s lead in the MASH market and highlight its potential to address a large segment of patients who currently lack effective treatments.

- We'll explore how the promising two-year Rezdiffra data for advanced MASH cirrhosis patients redefines Madrigal’s investment outlook and future opportunities.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Madrigal Pharmaceuticals Investment Narrative Recap

To be a shareholder in Madrigal Pharmaceuticals, one must be confident in Rezdiffra's continued growth as the company’s primary revenue driver and accept the risks linked to pipeline concentration, competition, and payor dynamics. The new two-year data for advanced MASH cirrhosis patients bolsters the case for Rezdiffra's efficacy and helps address near-term clinical uncertainty, but does not entirely resolve the overarching risk of future trial outcomes or potential setbacks in payer negotiations, both of which remain critical for Madrigal’s outlook.

Of the recent announcements, the company’s successful launch of Rezdiffra in Germany and the securing of extended U.S. patent protection until 2045 stand out. These milestones reinforce confidence in the business’s ability to establish durable global market opportunities, which remains highly relevant as continued trial results like the compensated MASH cirrhosis update may influence the reimbursement landscape and future patient access.

Yet, in contrast to this progress, investors should not overlook that reimbursement pressures from payers may intensify as access broadens and...

Read the full narrative on Madrigal Pharmaceuticals (it's free!)

Madrigal Pharmaceuticals is projected to reach $2.5 billion in revenue and $822.9 million in earnings by 2028. This outlook reflects a 68.6% annual revenue growth rate and an increase in earnings of $1.1 billion from the current -$281.9 million.

Uncover how Madrigal Pharmaceuticals' forecasts yield a $535.71 fair value, a 8% upside to its current price.

Exploring Other Perspectives

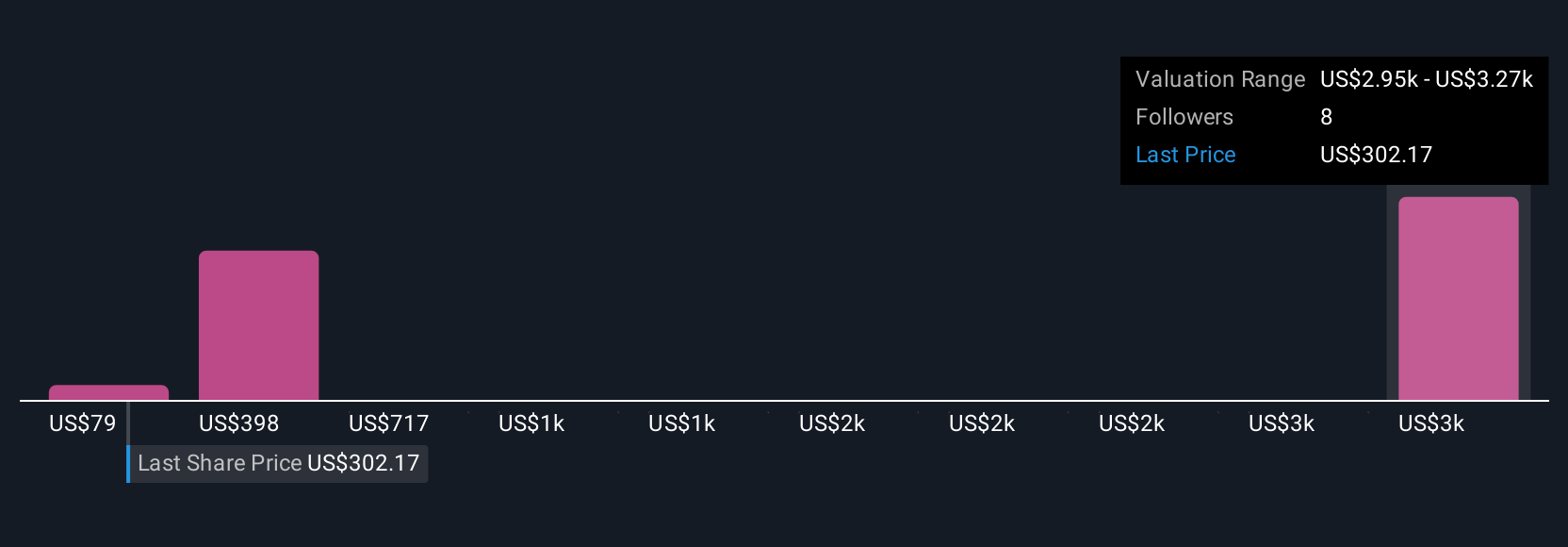

Four Simply Wall St Community fair value estimates for Madrigal Pharmaceuticals range from US$460 to US$2,575, reflecting strong differences in growth projections. With Rezdiffra’s recent trial results boosting optimism, remember that reimbursement risks could shape financial outcomes for years to come.

Explore 4 other fair value estimates on Madrigal Pharmaceuticals - why the stock might be worth 7% less than the current price!

Build Your Own Madrigal Pharmaceuticals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Madrigal Pharmaceuticals research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Madrigal Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Madrigal Pharmaceuticals' overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MDGL

Madrigal Pharmaceuticals

A biopharmaceutical company, focuses on delivering novel therapeutics for metabolic dysfunction-associated steatohepatitis (MASH) in the United States.

Exceptional growth potential and good value.

Market Insights

Community Narratives