- United States

- /

- Biotech

- /

- NasdaqGM:IRON

Disc Medicine (IRON): A Fresh Look at Valuation Following Key FDA Milestone and Pipeline Advances

Reviewed by Simply Wall St

Disc Medicine (IRON) has been in the spotlight after submitting a New Drug Application for bitopertin, earning an FDA National Priority Voucher, and unveiling early trial data in several blood disorders. These moves highlight growing pipeline momentum and increasing investor interest.

See our latest analysis for Disc Medicine.

Disc Medicine's momentum has translated into a remarkable 44.5% share price return over the last three months and a 19.3% gain for the past month, even with some short-term swings such as the recent dip to $83.85. The company’s total shareholder return of 29% for the last year underscores growing optimism as pipeline updates and regulatory milestones take center stage.

To discover what other innovative biotechs are gaining attention, this is a great opportunity to explore the broader sector with our See the full list for free.

Yet with the stock rallying sharply as pipeline news accelerates, investors face a key question: is Disc Medicine undervalued given ambitious growth plans, or is the market already anticipating the next wave of breakthroughs?

Price-to-Book Ratio of 5.1x: Is it justified?

Disc Medicine is trading at a price-to-book (P/B) ratio of 5.1x based on its latest closing price of $83.85, which is significantly higher than the US Biotechs industry average of 2.4x. This suggests the market is valuing the company at more than double the industry standard in terms of net assets.

The price-to-book ratio compares a company's market value to its book value. It serves as a traditional yardstick to assess whether a biotech stock is undervalued or overvalued on the basis of its net assets. For a high-growth biotech firm like Disc Medicine, a premium valuation can indicate strong expectations for future innovation or successful drug development, even if current profits are elusive.

Despite this, Disc Medicine’s P/B of 5.1x is actually lower than the average of its direct peers, who trade at 5.8x. While the valuation looks high against the industry, the company appears attractively valued compared to its closest competitors. There is no fair ratio available for additional context.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 5.1x (OVERVALUED compared to industry, ABOUT RIGHT compared to peers)

However, because Disc Medicine does not currently generate revenue and is experiencing ongoing net losses, its premium valuation could be challenged if pipeline progress or regulatory outcomes do not meet expectations.

Find out about the key risks to this Disc Medicine narrative.

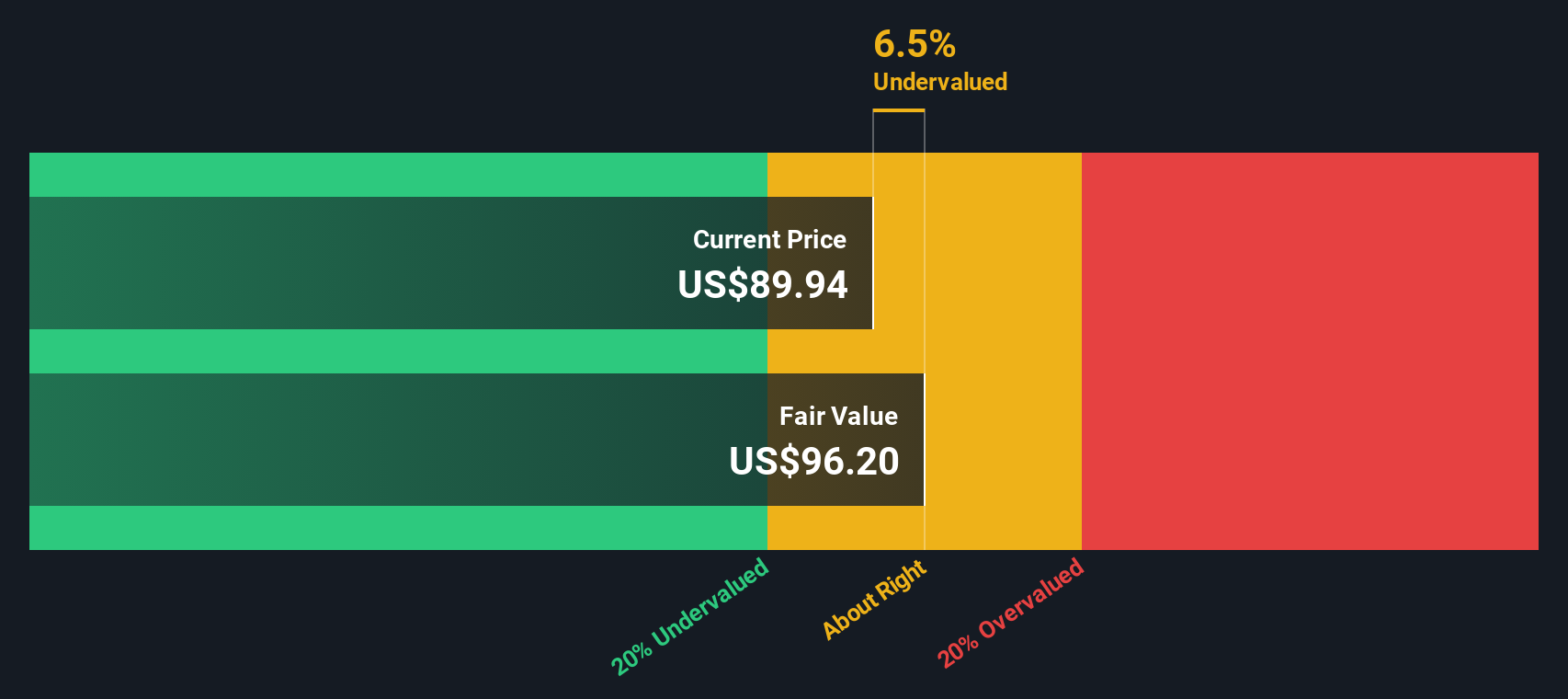

Another View: Discounted Cash Flow Says Undervalued

There is another way to value Disc Medicine, and our DCF model presents a very different perspective. At $83.85, the shares trade 68.4% below our estimated fair value of $265.53 using the SWS DCF model. This suggests the stock could be meaningfully undervalued if the company realizes its growth potential.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Disc Medicine for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Disc Medicine Narrative

If you have your own take on the numbers or want to see where your research leads, you can put together your own story in under three minutes. Do it your way

A great starting point for your Disc Medicine research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don't limit your potential by only watching the headlines. Seize fresh opportunities with targeted stock ideas. Your next winning pick could be just a click away.

- Capture consistent income streams when you review these 16 dividend stocks with yields > 3% boasting yields over 3% and strong financials for stability.

- Spot untapped growth by browsing these 870 undervalued stocks based on cash flows that have solid fundamentals but remain off most investors’ radar.

- Get ahead of the innovation curve and pinpoint promising breakthroughs with these 24 AI penny stocks built on transformational technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:IRON

Disc Medicine

A clinical-stage biopharmaceutical company, engages in the discovery, development, and commercialization of novel treatments for patients suffering from serious hematologic diseases in the United States.

Adequate balance sheet and fair value.

Market Insights

Community Narratives