- United States

- /

- Pharma

- /

- NasdaqGM:HROW

A Fresh Look at Harrow (HROW) Valuation Following Strong Q3 Earnings and Growth Initiatives

Reviewed by Simply Wall St

Harrow (HROW) just released its third quarter earnings, catching the eye of investors with both impressive revenue growth and a shift from last year’s net loss to positive net income. The company’s results were supported by strong product performance and ongoing commercial expansion initiatives.

See our latest analysis for Harrow.

Harrow’s latest results come on the heels of significant commercial progress, yet the recent share price return shows a more cautious market mood, with a 1-year total shareholder return of -34.37%. Still, the bigger picture is impressive. Investors who stuck with the stock for the past three years have seen a total shareholder return of 194.31%, and a remarkable 401.32% over five years. This suggests that long-term momentum in the business remains strong even as near-term sentiment cools.

If strong growth stories get you curious, now could be the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With impressive long-term returns and accelerating earnings, Harrow’s fundamentals make a compelling case. However, with revenue growth already in the spotlight, should investors expect more upside? Or is all that future growth already priced in?

Most Popular Narrative: 49.9% Undervalued

Compared to Harrow’s last close of $34.14, the narrative puts fair value at $68.18, almost double the current share price. Let’s explore what’s driving this striking gap.

Operating leverage is set to improve meaningfully as Harrow's scalable commercial infrastructure, already built out and profitable, absorbs additional high-margin revenue from both organic growth (e.g., expanded refill rates, market share gains) and new product launches, likely driving further net margin expansion.

Wondering how this valuation leap is justified? Behind the headline is a narrative loaded with bold financial projections about revenue, profits, and margins. Unpack the exact blueprint powering this valuation. Are the analyst calculations conservative, aggressive, or just right? See what propels the most popular view.

Result: Fair Value of $68.18 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution risks remain. Slower uptake of new products or increased competition could quickly dent Harrow’s projected growth and profitability trajectory.

Find out about the key risks to this Harrow narrative.

Another View: How Do Valuation Ratios Stack Up?

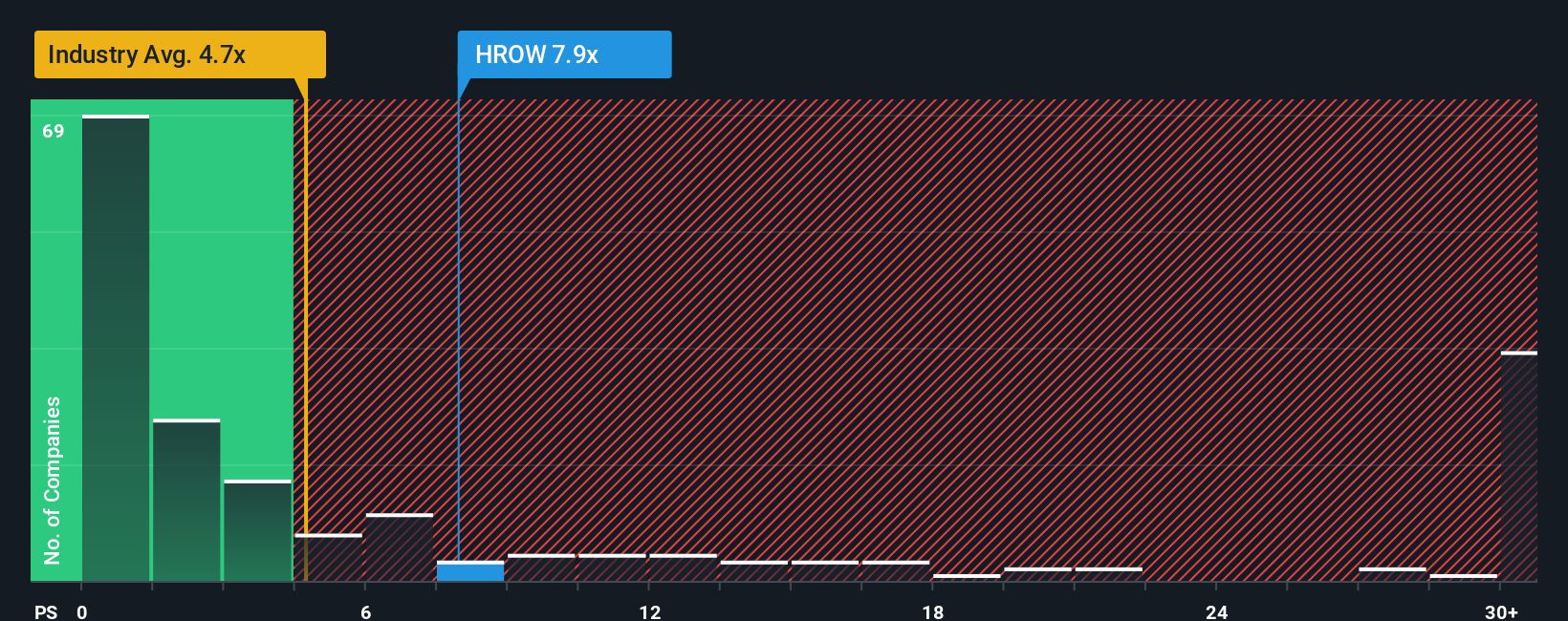

Looking at how the stock trades compared to revenue, Harrow stands out as a bit pricey right now. Its ratio is 5.5x, higher than both the US Pharmaceuticals industry average (4x) and its closest peers (5.2x). However, the market’s fair ratio could be 7.3x, pointing to potential room for future rerating. Does this premium signal confidence in Harrow’s growth, or could it leave investors exposed if expectations shift?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Harrow Narrative

Keep in mind, you can take a hands-on approach and build your own perspective from the data in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Harrow.

Looking for More Investment Opportunities?

Don’t watch from the sidelines. Expand your portfolio with proven strategies and fresh ideas chosen by savvy investors on Simply Wall St.

- Grow your income stream and spot stocks paying yields above 3% by checking out these 16 dividend stocks with yields > 3% right now.

- Ride the wave of tech innovation and access future market leaders through these 25 AI penny stocks before they become mainstream.

- Seize the chance to uncover potential bargains with these 864 undervalued stocks based on cash flows focused on companies trading below their intrinsic cash flow values.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Harrow might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:HROW

Harrow

An eyecare pharmaceutical company, engages in the discovery, development, and commercialization of ophthalmic pharmaceutical products.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives