Stock Analysis

- United States

- /

- Biotech

- /

- NasdaqGS:GERN

High Growth Tech Stocks To Watch In September 2024

Reviewed by Simply Wall St

In the last week, the market has been flat, yet it is up 23% over the past year with earnings expected to grow by 15% per annum over the next few years. In this environment, identifying high-growth tech stocks that can capitalize on these favorable conditions becomes crucial for investors looking to maximize their returns.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| TG Therapeutics | 28.62% | 43.05% | ★★★★★★ |

| Sarepta Therapeutics | 24.22% | 44.94% | ★★★★★★ |

| Super Micro Computer | 20.62% | 27.13% | ★★★★★★ |

| Ardelyx | 27.44% | 65.50% | ★★★★★★ |

| G1 Therapeutics | 27.57% | 57.75% | ★★★★★★ |

| Invivyd | 42.91% | 70.39% | ★★★★★★ |

| Amicus Therapeutics | 20.45% | 61.85% | ★★★★★★ |

| Clene | 73.06% | 62.58% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 249 stocks from our US High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Geron (NasdaqGS:GERN)

Simply Wall St Growth Rating: ★★★★★☆

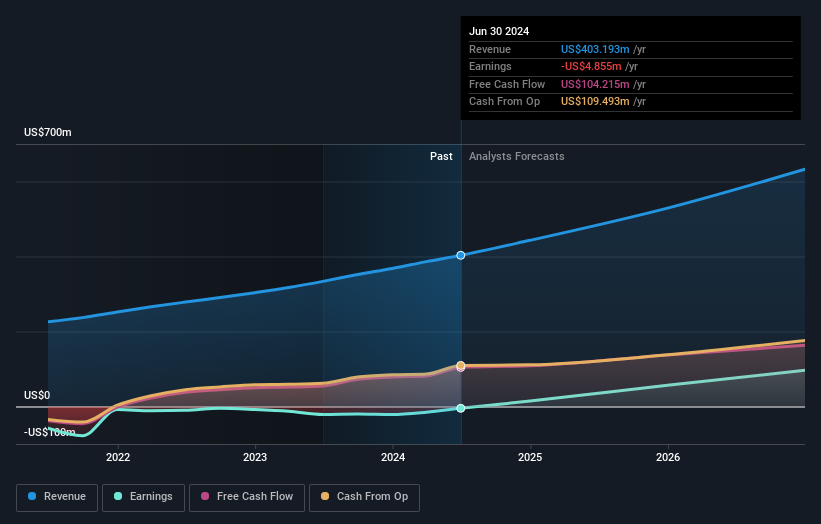

Overview: Geron Corporation is a late-stage clinical biopharmaceutical company that develops and commercializes therapeutics for myeloid hematologic malignancies, with a market cap of $2.86 billion.

Operations: Geron Corporation focuses on developing and commercializing therapeutics for myeloid hematologic malignancies, generating $1.37 million from its oncology therapeutic products. The company operates within the biopharmaceutical sector with a market cap of approximately $2.86 billion.

Geron's recent FDA approval of RYTELO™ for treating low- to intermediate-risk myelodysplastic syndromes marks a significant milestone, with the IMerge Phase 3 trial showing RBC transfusion independence rates of 39.8% and 28% for eight and twenty-four weeks, respectively. Despite a net loss of $67.38 million in Q2 2024, up from $49.23 million last year, revenue surged to $0.88 million from $0.03 million year-over-year, reflecting strong potential growth driven by innovative treatments in the biotech sector.

- Delve into the full analysis health report here for a deeper understanding of Geron.

Review our historical performance report to gain insights into Geron's's past performance.

monday.com (NasdaqGS:MNDY)

Simply Wall St Growth Rating: ★★★★★☆

Overview: monday.com Ltd., along with its subsidiaries, develops software applications across various regions including the United States, Europe, the Middle East, Africa, and the United Kingdom with a market cap of approximately $13.26 billion.

Operations: monday.com Ltd. generates revenue primarily from its Internet Software & Services segment, amounting to $844.78 million. The company operates across multiple regions, including the United States and Europe.

monday.com has demonstrated impressive growth, with Q2 2024 revenue hitting $236.11 million, up from $175.68 million a year ago, and net income reaching $14.32 million compared to a net loss of $7.04 million previously. The company forecasts full-year 2024 revenue between $956 million and $961 million, reflecting 31% to 32% growth year-over-year. With R&D expenses comprising a significant portion of their budget—$45.6 million in the latest quarter—the firm continues to innovate within its SaaS model, ensuring recurring subscription revenue while enhancing its enterprise offerings like the new Portfolio management solution.

- Take a closer look at monday.com's potential here in our health report.

Examine monday.com's past performance report to understand how it has performed in the past.

Clearwater Analytics Holdings (NYSE:CWAN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Clearwater Analytics Holdings, Inc. develops and provides a Software-as-a-Service (SaaS) solution for automated investment data aggregation, reconciliation, accounting, and reporting services to various clients including insurers and investment managers, with a market cap of approximately $6.10 billion.

Operations: Clearwater Analytics Holdings generates revenue primarily through its SaaS solution, which offers automated investment data aggregation, reconciliation, accounting, and reporting services. The company serves a diverse range of clients including insurers, investment managers, corporations, institutional investors, and government entities both in the United States and internationally.

Clearwater Analytics Holdings has been making significant strides in the tech sector, particularly with its innovative investment management solutions. The company's revenue grew by 18.1% year-over-year to $106.79 million in Q2 2024, while net loss narrowed substantially to $0.43 million from $10.92 million a year ago, showcasing improved operational efficiency and client acquisition strategies like onboarding La France Mutualiste and AXA XL. R&D expenses accounted for a notable portion of the budget, emphasizing their commitment to innovation with expenditures reaching $45 million last quarter, ensuring they stay ahead in the competitive SaaS market.

Key Takeaways

- Investigate our full lineup of 249 US High Growth Tech and AI Stocks right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GERN

Geron

A late-stage clinical biopharmaceutical company, focuses on the development and commercialization of therapeutics for myeloid hematologic malignancies.