- United States

- /

- Pharma

- /

- NasdaqGM:EYPT

EyePoint Pharmaceuticals (EYPT): Is the Stock Undervalued After Recent Volatility?

Reviewed by Simply Wall St

EyePoint Pharmaceuticals (EYPT) has recently caught investor attention as its shares moved slightly higher, following a period of noticeable volatility. The company’s performance has shifted over the past month, providing an interesting setup for those watching the healthcare space.

See our latest analysis for EyePoint Pharmaceuticals.

EyePoint’s shares have swung notably in recent weeks, and while the latest 1-day move was modest, momentum is still in play. The year-to-date share price return is nearly 38%, but the 1-year total shareholder return is in the red, reflecting both renewed interest and recent volatility. Over the longer term, gains for long-term holders have been significant. This suggests the market is alternating between optimism and caution as new developments unfold and growth potential gets reassessed.

If you want to see what other healthcare companies are gaining traction, discover new ideas with our curated See the full list for free..

With shares up nearly 38% year to date but still well below analyst targets, the question arises: Is EyePoint Pharmaceuticals trading at an attractive discount, or has the market already factored in its long-term growth potential?

Most Popular Narrative: 67.8% Undervalued

With the narrative fair value estimate eclipsing the last close by a wide margin, EyePoint Pharmaceuticals could be riding a wave of optimism from analysts. The stage is set for potential upside, but the numbers behind this view raise big questions.

Accelerated completion and strong execution of pivotal Phase III trials for DURAVYU in wet-AMD, targeting a large and expanding population of elderly patients with retinal disease, positions EyePoint for potential first-to-market advantage. This is expected to drive substantial topline revenue growth. Demonstrated robust efficacy, long-acting dosing (every 6 months), and a favorable safety profile of DURAVYU address the physician and patient demand for more durable ocular therapies. This supports physician adoption and expands the addressable market, with likely positive impact on revenue and margins post-approval.

Want to know the secret sauce behind that sky-high target? This narrative is built on daring growth projections, an aggressive market expansion plan, and margin transformation that would redefine EyePoint’s trajectory. Curious what makes this forecast so bullish? Unpack the bold assumptions that power this valuation.

Result: Fair Value of $34.42 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, significant delays in DURAVYU approvals or a prolonged lack of revenue could quickly undermine even the most optimistic forecasts for EyePoint Pharmaceuticals.

Find out about the key risks to this EyePoint Pharmaceuticals narrative.

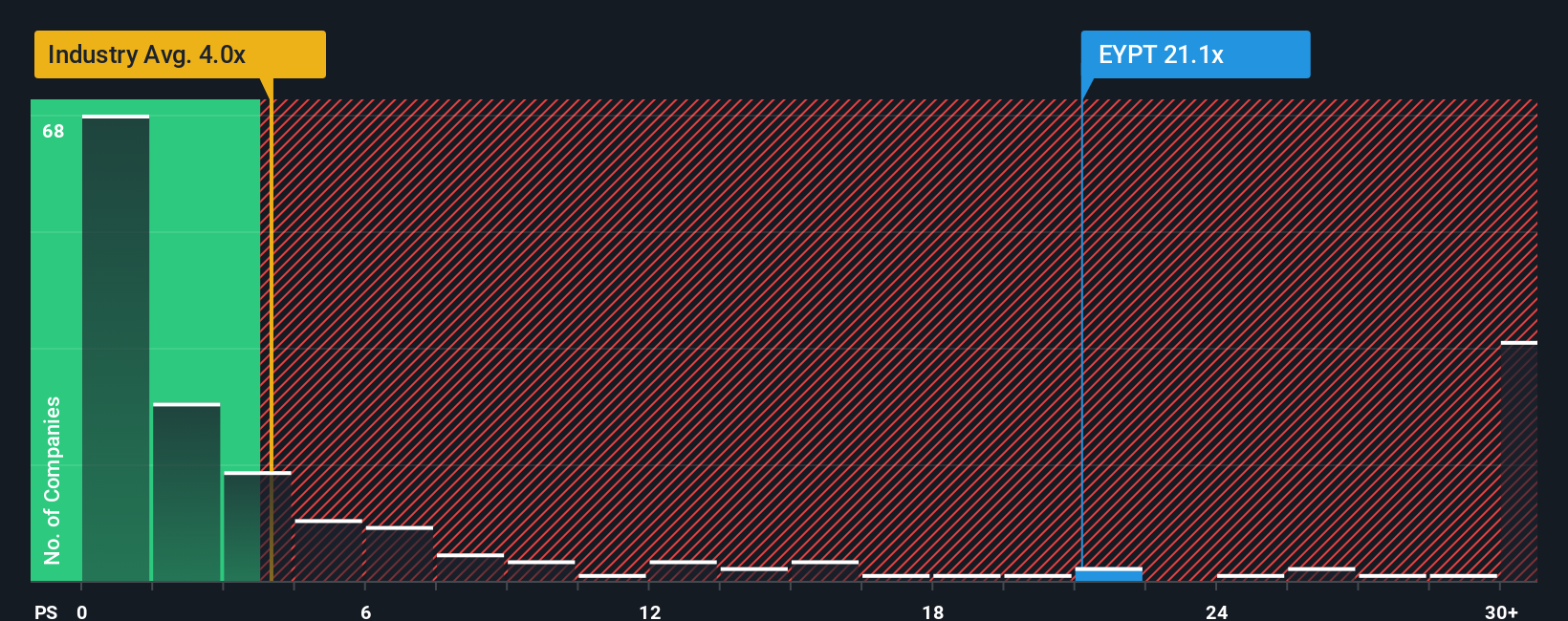

Another View: Multiples Point to Valuation Risk

Looking through the lens of the price-to-sales ratio, EyePoint Pharmaceuticals trades at 21.1 times sales. This is much higher than the US pharmaceuticals industry average of 4 times and its peers’ average of 2 times. Its fair ratio sits at 0, suggesting the market could eventually move lower. This raises real questions about whether optimism is already priced in or if a correction is on the horizon.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own EyePoint Pharmaceuticals Narrative

If you’re not fully on board with these narratives, or want to dig into the details yourself, you can craft an informed perspective in just a few minutes by using Do it your way.

A great starting point for your EyePoint Pharmaceuticals research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t wait to elevate your portfolio. Simply Wall Street’s unique screeners make it easy to spot standout opportunities beyond EyePoint Pharmaceuticals. Here’s where you might find your next winner:

- Capture big yields and steady returns when you review these 17 dividend stocks with yields > 3% boasting a proven income track record above 3%.

- Seize the upside potential in technology by tapping into these 25 AI penny stocks set to benefit from the explosive growth in artificial intelligence.

- Get ahead of the market shift with these 849 undervalued stocks based on cash flows that the data says are currently trading below their intrinsic worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EyePoint Pharmaceuticals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:EYPT

EyePoint Pharmaceuticals

Engages in developing and commercializing therapeutics to improve the lives of patients with serious retinal diseases.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives