- United States

- /

- Biotech

- /

- NasdaqGS:DVAX

Exploring Dynavax Technologies (DVAX) Valuation Following Q3 Earnings Growth and $100M Buyback Announcement

Reviewed by Simply Wall St

Dynavax Technologies (DVAX) just released its third-quarter earnings, showing increases in both revenue and net income compared to last year. The company also announced plans for a $100 million share buyback program.

See our latest analysis for Dynavax Technologies.

Following the upbeat earnings and buyback announcement, Dynavax Technologies has seen a wave of renewed investor interest in recent weeks. The company’s share price jumped 8% over the past week and is up nearly 11% in the last month. This signals building momentum as the market warms to its improved outlook. Even so, after a year-to-date share price return of -14% and a one-year total shareholder return of -19%, longer-term investors will be watching closely to see if this recent surge marks a real turning point or just short-term enthusiasm.

If positive earnings and share buybacks have you exploring fresh opportunities in the sector, now is a great time to discover See the full list for free.

With shares still down year-to-date despite a jump in recent weeks, investors are asking whether Dynavax Technologies is now trading at a discount or if the recent momentum has already priced in the company’s future growth potential.

Most Popular Narrative: 51.6% Undervalued

With Dynavax Technologies closing at $11.04, the most widely followed narrative assigns a fair value that is more than 50% higher. This striking gap raises immediate questions about what is driving such a bullish outlook and what assumptions sit beneath the target price.

Ongoing investment in the development pipeline (notably the shingles, pandemic influenza, and Lyme disease vaccine programs) positions Dynavax to benefit from heightened global government and public health focus on pandemic preparedness and preventative care, creating new long-term revenue streams and diversifying future earnings. Increased adoption and licensing of the proprietary CpG 1018 adjuvant platform, both internally and via external collaborations, leverages advances in immunotherapy and personalized medicine. This provides opportunities for higher-margin milestone and royalty income and improves overall net margins.

Want a peek at the scenario fueling that premium valuation? There is a juggernaut earnings turnaround forecast, bold margin expansion, and future market leadership factored into this price. Uncover which ambitious financial assumptions power this optimistic view; one number could change your perception of what is possible.

Result: Fair Value of $22.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on HEPLISAV-B, as well as any setbacks in Dynavax's clinical pipeline, could quickly derail these optimistic forecasts.

Find out about the key risks to this Dynavax Technologies narrative.

Another View: Checking the Market’s Multiples

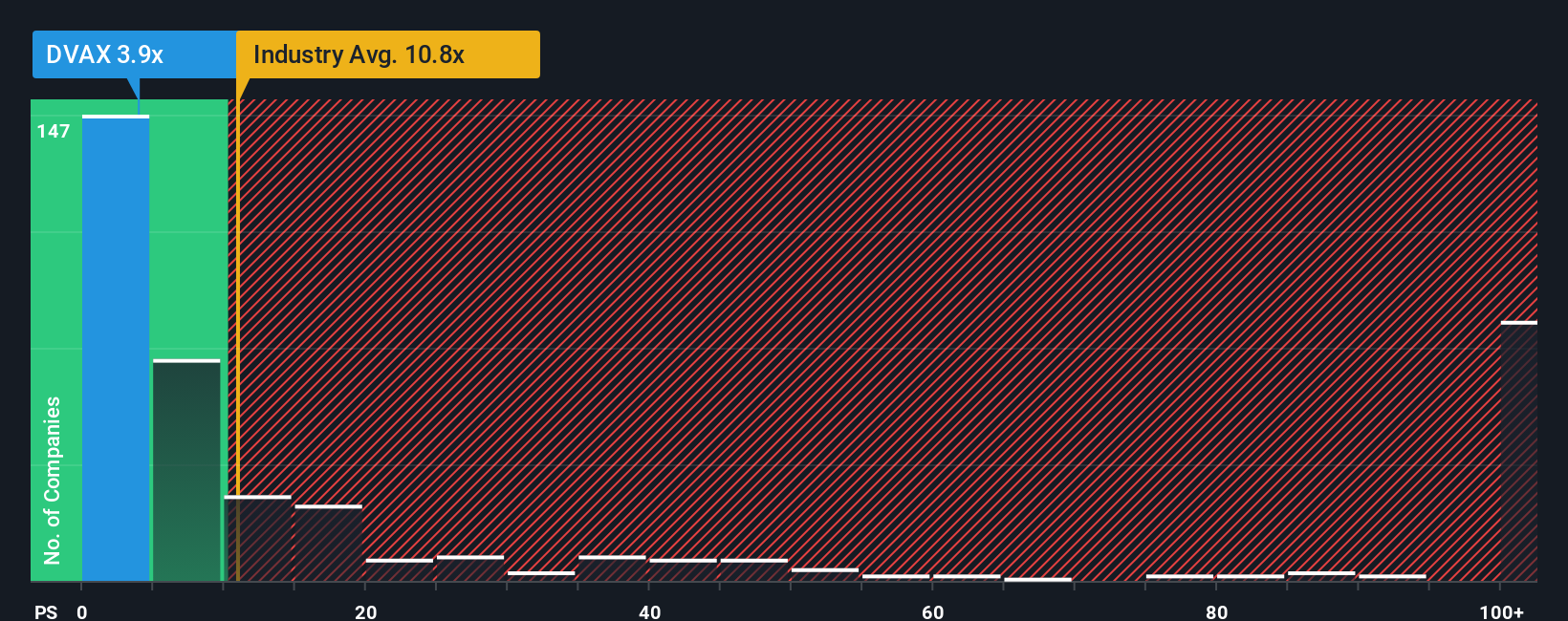

While some believe Dynavax Technologies is deeply undervalued, the current price-to-sales ratio of 3.9x is right in line with its fair ratio of 3.8x and dramatically cheaper than both the industry average (10.8x) and its peers (18.7x). This suggests that, by this measure, shares appear attractively priced versus the sector. However, does being cheaper than most rivals guarantee Dynavax has true value, or could risks justify this discount?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Dynavax Technologies Narrative

If you see things differently or want to dive deeper into the numbers yourself, you can build your own narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Dynavax Technologies.

Looking for More Smart Investment Ideas?

Unlock your next winning investment using Simply Wall Street’s free tools, hand-picked to help you seize promising opportunities before everyone else catches on.

- Tap into companies with strong financials by reviewing these 3575 penny stocks with strong financials, which stand out for resilience and growth potential.

- Find future leaders in AI innovation and access these 24 AI penny stocks that are reshaping industries with intelligent technology and automation.

- Boost your passive income strategy with these 16 dividend stocks with yields > 3% offering yields above 3 percent from financially healthy businesses.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DVAX

Dynavax Technologies

A commercial stage biopharmaceutical company, focuses on developing and commercializing vaccines in the United States and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives